Updated on June 14th, 2022 for Sure Dividend

It is no secret that we recommend investors focus on the highest-quality dividend growth stocks. One of our favorite places to look for the best dividend stocks is the list of Dividend Aristocrats, an exclusive group of 65 stocks in the S&P 500 with at least 25 consecutive years of annual dividend increases.

You can download an Excel spreadsheet of all 65 Dividend Aristocrats, including important financial metrics such as P/E ratios and dividend yields, by clicking the link below:

Click here to download your Dividend Aristocrats Excel Spreadsheet List now.

But there are many high-quality dividend stocks to be found outside the Dividend Aristocrats. Investors can find strong investment opportunities in the U.S. and around the world, and in every market sector. What matters is that investors select companies with durable competitive advantages and future growth potential.

Related: Two’s Are Now Underestimated: The Mikan Drill for Stocks.

To help with the search, we reached out to several authors of popular investing websites as well as Sure Dividend writers for their individual recommendations. The following list represents these contributors’ favorite dividend stocks for the remainder of 2022, in no particular order.

Table Of Contents

You can jump instantly to any specific contributor by clicking on the links below:

- •Dividend Stocks Rock: Air Products & Chemicals (APD)

- •Retire Before Dad: Parker-Hannifin (PH)

- •Dividend Growth Investor: T. Rowe Price (TROW)

- •Prakash Kolli: T.Rowe Price (TROW)

- •Nikolaos Sismanis: American Water Works (AWK)

- •Nate Parsh: Qualcomm Inc. (QCOM)

- •Josh Arnold: Stanley Black & Decker (SWK)

- •Eli Inkrot: Stanley Black & Decker (SWK)

- •Bob Ciura: Texas Instruments (TXN)

- •Ben Reynolds: 3M Company (MMM)

The 8 Best Dividend Stocks Now

Best Dividend Stock #8 Air Products & Chemicals (APD)

This best dividend stock selection is from Mike with Dividend Stocks Rock

APD has a diverse way of positioning its business in a sector where most are stuck with commodity price fluctuations. As a provider of industrial gases, APD signs long-term contracts with its customers. Industrial customers are more concerned with stability and reliability than costs since gases make up a small part of their expenses but are vital to their business.

APD strategically acquired Shell’s and GE’s gasification businesses in 2018. The company became a leader in its industry and has opened doors to expand its business in China and India. APD has an impressive backlog of projects that we think will continue to improve its top-tier return on invested capital. APD’s ambitious growth plan, including $14.1B to be spent in its project backlog, has potential to continue improving ADP’s invested capital. Demand for hydrogen should continue to increase in 2022 and 2023 as demand for jet fuel recovers.

While the company’s core business is protected with long-term contracts, growth is still linked to the economic cycle. As an industrial gas supplier, APD’s sales are contingent on demand for gases. It seems that the company recovered from the current economic downturn, however demand remains cyclical.

Industry competitors also made valuable acquisitions recently: Air Liquide bought Airgas in 2016 (market cap of over $80B) and the Praxair-Linde merger in 2018 (market cap of over $170B) resulted in a second giant with whom APD must compete. The resulting competition for market share is fierce, with price wars leading to lower margins. Higher raw material input costs could also put pressure on ADP’s bottom line.

While APD has great prospects for expanding its business in emerging markets, other players also face the same opportunity.

Best Dividend Stock #7: Parker-Hannifin (PH)

This best dividend stock selection is from Craig with Retire Before Dad.

Parker Hannifin is a Cleveland-based diversified equipment and components company that manufactures a wide range of industrial motion and control technologies. The company claims the #1 position in the $135 billion motion and control industry with $16 billion in revenue, 11% of global market share, and more than 900,000 products sold.

Its specialties include engineered materials, hydraulics, process control, filtration, fluid connectors, instrumentation, motion systems, and aerospace technologies. Most of Parker Hannifin’s products are unfamiliar to consumers but widely used in engineering, improving our lives behind the scenes.

Parker Hannifin is sometimes overlooked as a stalwart dividend growth stock because it doesn’t qualify as a Dividend Aristocrat as determined by S&P Global Ratings. Parker Hannifin’s dividend increase streak is based on its fiscal year (ending June 30th) rather than the calendar year.

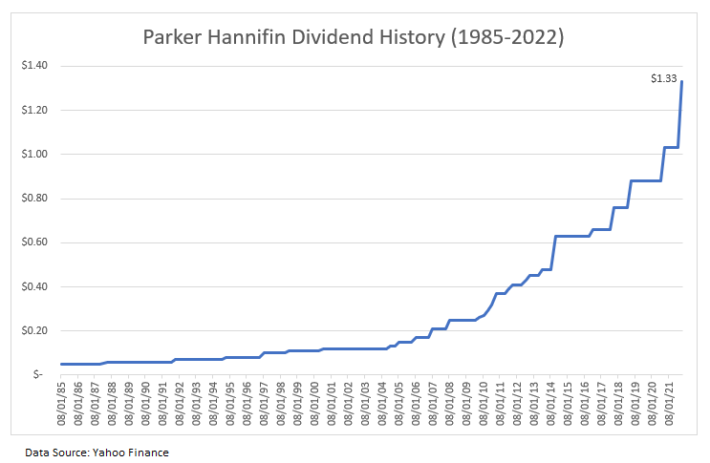

The company has increased its dividend for 66 years, including the most recent increase of 29% in April 2022. This streak puts it among an elite group of companies, the Dividend Kings, that have increased their dividends for 50 years or more. Parker Hannifin’s 10-year dividend growth rate is about 10%.

Management aims to maintain a target 5-year average payout ratio of 30%-35% of net income. This subdues the 5-year average dividend yield (about 1.6%). But healthy dividend growth and price appreciation have rewarded patient shareholders in the past. The stock is currently trading at about 14 times next year’s estimated earnings.

The 1.92% current dividend yield and valuation make this an attractive stock for long-term income investors to consider.

Best Dividend Stock #6: T.Rowe Price (TROW)

This best dividend stock selection is from Dividend Growth Investor.

T. Rowe Price Group, Inc. (TROW) is a publicly owned investment manager. T.Rowe Price is a dividend champion with a 36 year streak of consecutive annual dividend increases. The last increase occurred in February 2022, when the Board of Directors hiked distributions by 11.11% to $1.20/share.

In the past decade, the company has managed to increase dividends at an annual rate of 13.30%/year. Dividends went up faster than earnings per share over the past decade, thanks to a growing payout ratio. I would expect future dividends growth in the range of 7% – 8%/year over the next decade.

T.Rowe Price has managed to increase earnings per share at an annual rate of 12.90%/annum since 2007. Earnings rose from $2.40/share in 2007 to $13.12/share in 2021.

The main drivers behind future earnings growth will come from organic growth in assets under management, long-term growth in equity markets, and new product introductions. As assets under management increase from inflows and rising prices over time, the company achieves greater scale, which reduces per unit cost and increases overall profits.

Two-thirds of assets under management are in retirement accounts, which tend to be stickier. Inertia is a powerful force in the mutual fund business – once most ordinary investors make an investment, they are more likely to stick to it and maintain the status quo. This is great news for companies like T.Rowe Price, since it can collect fees for decades down the road on those investments.

Currently the stock is attractively valued at 12 times forward earnings and yields 3.84%.

About this best dividend stock selection’s author: Dividend Growth Investor is a private investor who has been covering dividend growth stocks since 2008.

Best Dividend Stock #6: T.Rowe Price (TROW)

This best dividend stock selection is from Prakash Kolli of Dividend Power.

T. Rowe Price (TROW) has struggled in 2022 because of the broader market decline. TROW derives its revenue primarily from fees from assets under management (AUM) as an investment manager. Consequently, market action and net outflows lowering AUM affect fee income. As a result, the market has punished TROW, and the stock price is down nearly 36% year-to-date.

However, TROW is a successful asset manager growing AUM over time because of its retirement plans. Furthermore, the firm’s funds tend to beat their peers and benchmarks over extended periods. As a result, TROW’s AUM has increased to over $1.5 trillion at the end of the first quarter.

The main attraction for dividend growth investors is the 36-years of annual dividend increases making the stock a Dividend Aristocrat. The firm has a solid record of double-digit increases for 5-years at approximately 14.9% and 10-years at ~13.3%. Moreover, the conservative payout ratio of ~34% suggests more gains in the future.

Source: Portfolio Insight

The decline in stock price has simultaneously increased the dividend yield. As a result, investors are getting a 3.83% yield, more than the 5-year average of 2.62%. The dividend yield is also more than double the average of the S&P 500 Index. Besides the low payout ratio, the dividend is supported by a net cash position on the balance sheet.

From a valuation perspective, TROW is trading at a forward price-to-earnings (P/E) ratio of approximately 12X, less than the range in the past 5-years and 10-years. Dividend investors can purchase an undervalued Dividend Aristocrat with a history of double-digit dividend increases yielding almost 4%. In my opinion, TROW is a long-term buy.

Disclosure: Long TROW

Author Bio: Prakash Kolli is the founder of the Dividend Power site. He is a self-taught investor and blogger on dividend growth stocks and financial independence. Some of his writings can be found on Seeking Alpha, InvestorPlace, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, FXMag, and leading financial blogs. He also works as a part-time freelance equity analyst with a leading newsletter on dividend stocks. He was recently in the top 100 and 1.0% (81st out of over 9,459) of financial bloggers as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.

Disclaimer: The author is not a licensed or registered investment adviser or broker/dealer. He is not providing you with individual investment advice. Please consult with a licensed investment professional before you invest your money.

Best Dividend Stock #5: American Water Works (AWK)

This best dividend stock selection is from Nikolaos Sismanis.

American Water Works is the largest and most geographically diverse, publicly traded water and wastewater utility company in the United States, as measured by both operating revenues and population served. The company serves over 15 million people in 46 states.

Besides its tremendously diversified operations, there are multiple elements to like about American Water Works as a dividend stock, including a highly resilient business model. This is due to water being a necessity both for residential and industrial usage, as well as a mission-critical asset for the military.

With the 1.77%-yielding company experiencing predictable cash flows as a result of limited volatility in water consumption levels, it has been able to grow its network and operations with limited risks. Besides gradually unlocking economies of scale amid expanding its network and acquiring smaller competitors, the company is able to grow its earnings by requesting regulators for occasional rate increases.

By combining exceptional cash flow visibility, and a predictable earnings growth pathway, management has provided one of the most precise medium-term outlooks we have encountered.

Specifically, the company expects its earnings per share to grow by approximately 7%-9% annually through 2026. This includes rate base increases, which the company estimates to grow by a CAGR of 8%-9% through 2031. Accordingly, management expects to grow the dividend by a CAGR between 7%-10% over the same period. Thus, investors face reduced risk when assessing the company’s investment case.

Shares of American Water Works are currently trading at around 33 times this year’s expected net income, which is admittedly a rich multiple. The market may continue attaching a premium to the stock due to its robust qualities and reassuring investment case. Valuation compression risks should be considered by prospective investors, nonetheless.

Best Dividend Stock #4: Qualcomm Inc. (QCOM)

This best dividend stock selection is from Nate Parsh.

In choosing a dividend growth name that can outperform going forward, an investor needs to identify a company that has positives working in its favor.

Qualcomm Inc. (QCOM) has multiple tailwinds that should set the stock up to be one of the best dividend growth names for the remainder of 2022. The company reported earnings results at the end of April, with revenue surging 41% to $11.2 billion and produced adjusted earnings-per-share of $3.21, which compared favorably to $1.90 in the prior year.

Qualcomm Technology Licensing did decline 2%, but this is the much smaller of the two segments that make up the company. Qualcomm CDMA Technologies, which accounted for 85% of quarterly revenue, was higher by 52% year-over-year. Each business within the segment saw double-digit revenue growth. Internet of Things, Handsets, Automotive, and RF front-end grew 61%, 56%, 41%, and 28%, respectively.

While all businesses are performing at a high level, Handsets are likely to be a major contributor to results in the coming quarters as the ramp up and deployment of 5G service continues. As the rollout of 5G continues, customers are likely to upgrade their devices, requiring the purchase of a new phone. As a major supplier of the components found in handsets, Qualcomm’s largest contributor to revenue is likely to continue to post impressive growth rates.

With the majority of the company showing strong results, shareholders are likely to see continued dividend increases. Qualcomm has raised its dividend for 20 consecutive years, including a 10.3% increase for the upcoming June 23rd payment date. Shares yield 2.3% today, above the 1.7% average yield for the S&P 500 Index.

Editor’s Note: The next two analysts independently picked the same stock.

Best Dividend Stock #3: Stanley Black & Decker (SWK)

This best dividend stock selection is from Josh Arnold.

Stanley Black & Decker is a manufacturer and distributor of storage and tool brands in the US primarily, but operates globally. The company’s brands include very popular consumer and professional lines such as BLACK+DECKER, Stanley, Craftsman, DeWalt, Porter Cable and more. The company’s dominance stems from its wide range of brands that serve every price point, and just about any use case for tools. This has afforded Stanley outstanding long-term earnings growth over time.

Despite what could be lower earnings year-over-year for 2022, we believe the company can grow at 8% annually, on average, in the years to come. Record earnings from 2021 should be eclipsed in the relatively near future, following temporary supply chain challenges in 2022. We see share repurchases as contributing slightly to growth, but most of it accruing from revenue gains, as has been the case historically.

Shares yield 3% today, roughly twice that of the S&P 500. In addition, Stanley is a Dividend King, having boosted its payout for 54 consecutive years. This combination of a relatively high yield and exemplary dividend longevity is a big reason why this is one of the best dividend stocks in the market.

What makes it rise to the top is that the selling pressure this year has decimated the valuation, as shares trade for about 12 times this year’s earnings, which could drive a ~7% annual tailwind to total returns.

Combining these factors, we have a stock with double the market’s yield, 8% estimated earnings growth, and a 7% estimated tailwind from a trough valuation. This means Stanley Black & Decker could provide upper-teens total returns, in addition to being a world-class dividend stock.

About this best dividend stock selection’s author: Josh Arnold is an independent equity analyst and a prolific writer on the subject of dividend stocks. His work can be seen here on Sure Dividend, as well as other financial sites such as Seeking Alpha.

Best Dividend Stock #3: Stanley Black & Decker (SWK)

This best dividend stock selection is from Eli Inkrot of Sure Dividend.

Tracing its roots to 1843, Stanley Black & Decker is the world’s largest tool company with iconic brands including Stanley, Black + Decker, DeWalt, Craftsman, Cub Cadet and Troy-Bilt. The $19 billion company employs over 60,000 people and generated $17 billion in sales last year.

Stanley Black & Decker has stood the test of time and has proven itself to be a quality business. Its dividend record is also notable, having paid a dividend for nearly 150 years and having increased this payout for over five decades.

In the 2011 through 2021 period, Stanley Black & Decker increased its dividend each year between 3.0% and 10.0% annually. For the entire period, the dividend grew at an average compound growth rate of 6.2% per year.

This dividend growth was supported by earnings-per-share growth. In the same stretch, Stanley Black & Decker’s earnings-per-share increased 9 out of 10 years, growing by an average compound growth rate of 7.5% per year. Incidentally, because earnings-per-share growth outpaced dividend growth, this means the payout ratio declined over the last decade – from ~40% in 2011 down to under 30% in 2021.

Finally, the share price grew by a compound average growth rate of 10.6% per year over this period. The reason the share price outpaced earnings-per-share growth was due to an expanding P/E ratio. The security’s valuation went from under 13 times earnings to over 17 times earnings during this time.

These factors are interesting to note about the past, but also helpful in thinking about the future. There are moments when an investment can outperform the business results. Today could once again be one of those moments.

Since the end of 2021, Stanley Black & Decker’s share price is down -35%. It should be noted that the company’s earnings-per-share guidance is down as well (from $12.00 – $12.50 to $9.50 – $10.50), but these are the sorts of things that allow for outsized gains. Shares are now back down to ~12 times expected earnings.

In the Sure Analysis Research Database, we are forecasting the potential for 16.9% annualized total returns over the next five years. This is driven by the 2.6% starting yield, 8% expected growth rate and an ending P/E ratio of 16.5.

Of course, all sorts of things can happen in the investing world. However, even with a 4% growth rate and an ending P/E ratio of 14, this still equates to the potential for 9.4% annualized gains. Good things happen you pair a high-quality business with a margin of safety.

Disclosure: I am long SWK.

About this best dividend stock selection’s author: Eli Inkrot is President of Premium Services at Sure Dividend, overseeing the Sure Analysis Research Database, Newsletters and Special Reports. Previously, Eli was an analyst in private real estate, VP and Portfolio Manager for a money management firm, VP for a financial software company and an independent equity analyst. Eli received a degree in Business and Economics from Otterbein University and a Master’s in Finance from the University of Tampa, where he was named the “most outstanding graduate student.”

Best Dividend Stock #2: Texas Instruments (TXN)

This best dividend stock selection is from Bob Ciura of Sure Dividend.

The best dividend stocks often have a combination of a market-beating dividend yield, solid growth prospects, and a reasonable valuation. It appears Texas Instruments (TXN) stock has all three of these qualities, which is why it is my top pick for the remainder of 2022.

Texas Instruments is a semiconductor company that operates two business units: Analog and Embedded Processing. Its products include semiconductors that measure sound, temperature and other physical data and convert them to digital signals, as well as semiconductors that are designed to handle specific tasks and applications.

This has been a challenging year for tech stocks, as rising interest rates and the threat of a global recession have caused share prices across the tech sector to fall. But this only makes TXN stock even more appealing for bargain-hunters.

The stock has a current yield of 3.0%, which beats the S&P 500’s average yield of ~1.5%. And, Texas Instruments is a fantastic dividend growth company. It generates a level of free cash flow, a significant portion of which is returned to investors through cash returns.

According to the company, Texas Instruments generated 12% annual growth in free cash flow per share from 2004-2021. In this period, Texas Instruments has increased its dividend every year, at an average growth rate of 25% per year. The company has also reduced its outstanding share count by 46% since 2004, proving that Texas Instruments is a shareholder-friendly company.

Plus, the company has performed extremely well this year, even with the aforementioned headwinds.

In the most recent quarter, Texas Instruments grew revenue by 15% versus the previous year’s quarter. This was the result of a revenue increase of 16% in the Analog business, while revenues in the Processing segment grew by 2% year-over-year. Perhaps more impressively, Texas Instruments managed to grow its gross profit margin to an attractive level of 70%.

TXN currently trades for a 2022 P/E of 16.9. We believe this is too low for such a quality company, as our fair value P/E estimate is 20. The combination of earnings growth, dividends and multiple expansion could result in annual returns of nearly 14% per year.

Therefore, TXN is an undervalued stock with strong growth, a 3% dividend yield, and a high level of expected returns. This makes TXN my top pick for the remainder of 2022.

About this best dividend stock selection’s author: Bob Ciura is President of Content at Sure Dividend. He has worked at Sure Dividend since October 2016. He oversees all content for Sure Dividend and its partner sites. Prior to joining Sure Dividend, Bob was an independent equity analyst publishing his research with various outlets including The Motley Fool and Seeking Alpha. Bob received a Bachelor’s degree in Finance from DePaul University, and an MBA with a concentration in Investments from the University of Notre Dame.

Best Dividend Stock #1: 3M Company (MMM)

This best dividend stock selection is from Ben Reynolds of Sure Dividend.

3M (MMM) is a blue-chip dividend stock with an impressive history. The company was founded in 1902, 120 years ago. And 3M has paid rising dividends for an incredible 64 consecutive years.

With a dividend streak of 50+ years, 3M is a member of the exclusive Dividend Kings list. The Dividend Kings are the gold standard in dividend longevity.

3M is a manufacturer with a focus on research and development. The company’s long history of innovation has spurred its growth over the last 12 decades. The company currently spends 6% of sales – around $2 billion annually – on research and development.

3M is clearly a high-quality business with a strong and durable competitive advantage. But a great business purchased at too high of a price doesn’t make a compelling investment.

Fortunately for dividend growth investors looking to buy now, 3M is trading for a dividend yield of more than 4%. This is a rare opportunity to lock in a high starting year for this quality dividend growth stock.

Source: Ycharts

The only other times since 1990 that 3M was trading for a dividend yield of 4% or greater was during the Great Recession and during the COVID-19 crash in 2020.

3M is inexpensive right now because it is facing nearly 300,000 lawsuits surrounding claims that its earplugs used by combat troops were defective. We don’t believe this significantly impacts the companies long-term prospects.

Additionally, 3M has not performed up to its usual standards over the last few years. In fiscal 2018, the company generated earnings-per-share of $10.46. We are expecting earnings-per-share of $11.00 in fiscal 2022, for only marginal growth over 4 years.

Despite this, there’s much to like about 3M as an investment right now. First, the 4%+ dividend yield immediately stands out. We expect moderate growth of around 5% a year going forward. And with a price-to-earnings ratio of only 13.3, we expect significant valuation multiple expansion to our fair value price-to-earnings ratio estimate of 19.0.

3M is a proven business that rewards shareholders with rising dividends over the long run. The company has not performed up to its usual standards over the last several years, but it still has a durable competitive advantage and ample cash flow generating ability. Near-term headwinds have created a buying opportunity at 3M.

About this best dividend stock selection’s author: Ben Reynolds founded Sure Dividend in 2014. Reynolds has long held a passion for business in general and investing in particular. He graduated Summa Cum Laude with a bachelor’s degree in Finance and a minor in Chinese studies from The University of Houston. Today, Reynolds enjoys watching movies, reading, and exercising (not at the same time) in his spare time.

Other Dividend Lists

The Dividend Aristocrats list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- •The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- •The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- •The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 38 stocks with 50+ years of consecutive dividend increases.

- •The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- •The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- •The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- •The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- •The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - •The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- •The Dividend Challengers List: 5-9 consecutive years of dividend increases.

This article was first published by Bob Ciura for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

5 Rules For Building a Dividend Portfolio You Can Live On

These 2 Dividend Stocks Will Work During Inflation Or Recession

Bill Gates Portfolio List | All 18 Stock Investments Now

2022 High ROIC Stocks List | Top 10 Highest Return On Invested Capital Stocks

2022 Best Monthly Dividend Stocks List | See All 49 Now | Yields Up To 19.0%