By Stephen Mutoro, Chairman, Stop Crime Kenya (StoCK)

Hard-pressed consumers fear they’re the ones who must tighten their belts yet again following President William Ruto’s declared intention to increase tax revenues by Sh500 billion by June this year.

It is a stern tax challenge for the Kenya Revenue Authority, considering it collected Sh2.03 trillion in the 2021/22 financial year. That was the first time in history that KRA passed the Sh2 trillion mark as a series of tax increases began to bite.

The President, however, sees scope for yet more growth in state coffers. He said most of the increases can come from VAT taxes that are never submitted, adding that only 60 per cent of collectible VAT is currently paid to KRA.

Yet the illegal trade of counterfeit and smuggled goods in Kenya deprives the fiscus of more than Sh150 billion tax revenue a year and must be addressed as a top priority. An estimated one in every five products sold in Kenya is counterfeit and almost four million Kenyans are using counterfeit goods that include sugar, cigarettes, alcohol, bottled water, pharmaceutical products and cooking oil, posing a serious threat to health and security and depriving our economy of vital revenue.

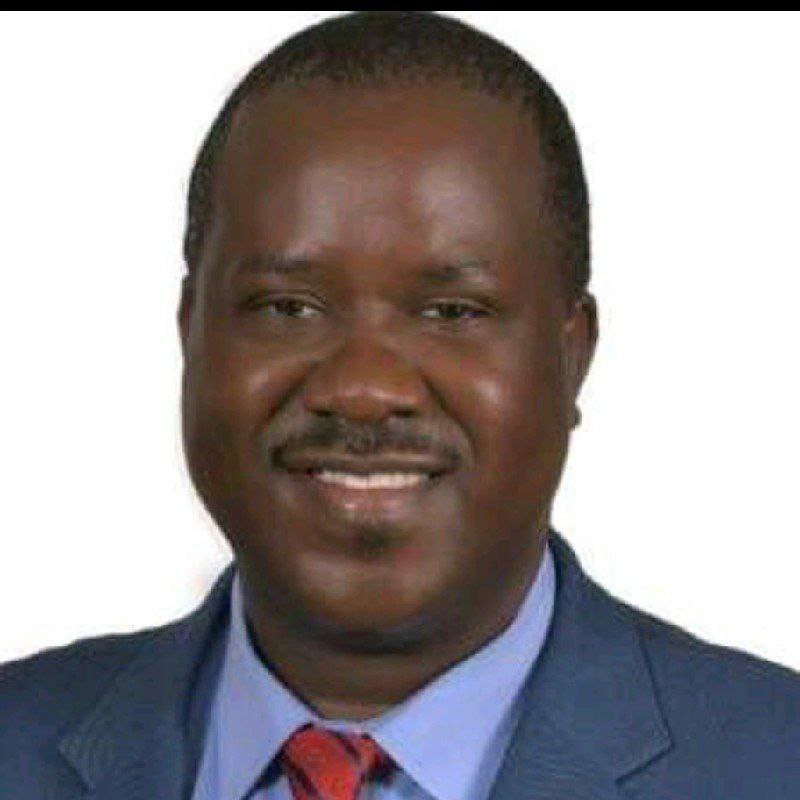

New KRA chairman Anthony Mwaura has, so far, been very positive in his approach. He told the Star newspaper that, under his watch, there will be no leniency for those who try to avoid paying their taxes, stating that there will be no “untouchables” or “sacred cows” exempt from meeting their fiscal responsibilities.

“My immediate assignment is to seal all revenue leakages, which I have already identified,” he said. “I know where we have been losing money, where we have not been doing very well, and where we need to pull up our socks and change the environment of both the taxpayers and our tax collectors.”

Such an attitude is welcome and we must hope that it’s not too late to properly combat sophisticated networks that are facilitating a proliferation of contraband in our economic eco-system.

An investigation last year revealed the deep-rooted involvement of law enforcement officers in the smuggling of illicit goods, ranging from cigarettes to sugar.

Insiders, filmed speaking on condition of anonymity, told of high-ranking officers running illicit trade cartels, the bribery of police and border officials and the deadly consequences for anyone who tried to blow the whistle on these destructive activities.

The Anti-Counterfeit Authority (ACA) says the trade in counterfeit or smuggled goods has reached unprecedented levels. It was worth more than Sh800 billion in 2018 and ACA fears that number has hit Sh1 trillion this past year.

The scale of the problem should prompt Government to consider amalgamating all state agencies handling various aspects of illicit trade into a one-stop oversight and regulatory authority.

And the devastating impact of illicit trade on the fiscus should also be top of their minds as they plan the next financial year and the Medium-Term Budget.

Developing a national policy and legislation around beating illicit trade would go a long in easing the impending heavy tax pressure on ordinary Kenyans already caught up by the retiring of all subsidies on electricity, fuel and other key services.

Government should beware that yet more tax increases will simply drive more shoppers to seek supposed bargains in the black market, thereby boosting the profits of criminals involved in illicit trade.

Instead of hiking prices for honest, hard-working citizens, Government should be cracking down on illicit trade, strengthening enforcement at our porous borders and ensuring that tax-evading crooks feel the full force of the law.

That will be the fairest and most efficient method of filling state coffers and will go a long way to meeting President Ruto’s tax challenge.

Related:

KRA Earns KES 9.07 Billion from Tax Amnesty Program

Treasury Sets Ruto’s First Budget at KES 3.6 Trillion as Govt Looks into Higher Tax Collections