The Finance Act, 2016 was assented to by the President Uhuru Kenyatta on 13th September 2016 after being passed by the Committee of the Whole House with some amendments made to the Finance Bill, 2016.

A number of changes not included in the Bill have now been introduced in the Act. Most of the amendments introduced by the Act came into force as of 9th June 2016 with a few exceptions which came into force on 1st July 2016. The remaining parts were to commence on 1st January 2017.

The 30% Branch ownership rule has also been done away with. The Companies Act 2015 had introduced a provision requiring all branches to demonstrate at least 30% local shareholding in the parent entity.

Below are the changes that will be effective from 1st January 2017:

Income Tax Amendments:

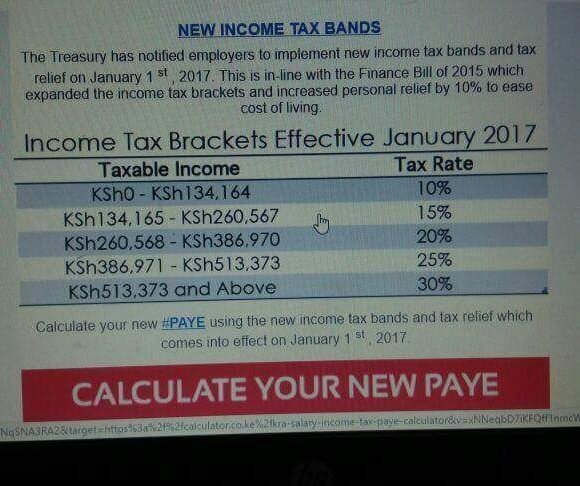

- The PAYE brackets have been expanded by 10% and the relief also increased by 10%. Annual Relief has been amended to KES 15,360.

- Expenses incurred in sponsoring sports by a company will now be tax allowed. However, a company interested in sports sponsorship should obtain prior approval from the Cabinet Secretary responsible for sports.

- Withholding tax on winnings from betting and gaming has now been abolished. The Lotteries, Betting and Gaming companies will no account for withholding tax on paid out winnings.

Value Added Tax updates:

- VAT on service charge has been removed, provided that:

- All the service charge is distributed directly to the employees in accordance with an agreement between employer and employees

- The service charge does not exceed 10% of the price of the service

Changes in the Tax Procedures Act

- Refund of overpaid tax – A tax payer can apply for a refund of overpaid tax within a period of 5 years from the date which the tax was paid. Any amount not refunded within 2 years will accrue interest rate of 1% per month.

- Waiver of interest – Tax payers will be able to apply waiver of interests on unpaid taxes or additional assessment. Remission of interest is only applicable where:

- There is uncertainty as to any question of low or fact

- The remission is in consideration of hardship or equity

- It will be impossible, difficult or expensive to recover the tax

Betting, Lotteries and Gaming Act:

- The below taxes will be applicable to the various revenue streams and are payable to KRA by the 20th of the following month:

- Betting tax of 7.5% on the gaming revenue

- Lottery tax at 5% on the lottery turnover

- Gaming tax at 12% on gaming revenue

- Prize competition tax at 15% on the cost of entry to a competition which is premium rated.

Analysis by Parag Shah

Partner – Advisory at Grant Thornton Kenya