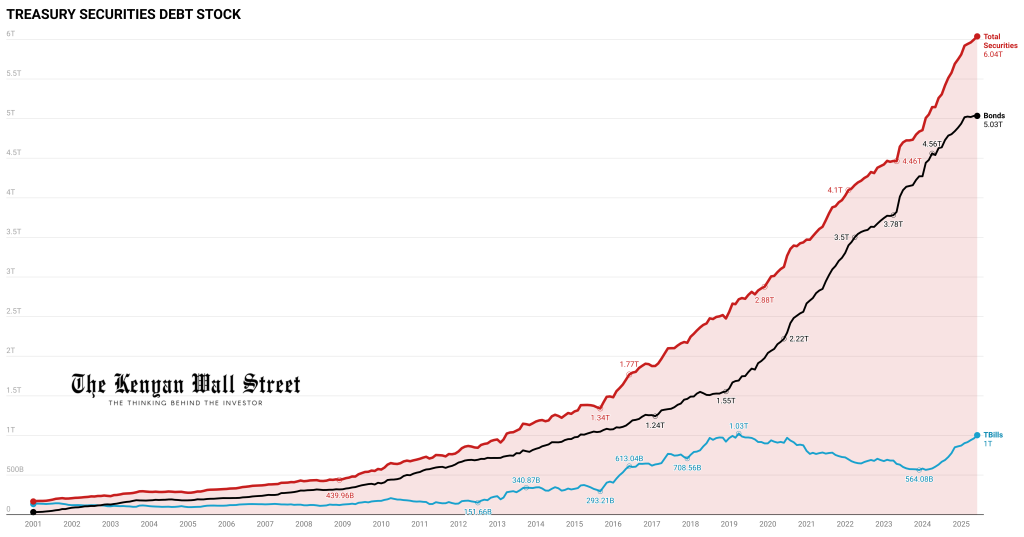

Kenya’s domestic debt market has hit two major milestones, signaling shifting government financing patterns and rising reliance on short-term instruments.

- •As of June 2025, the stock of Treasury Bills (T-Bills), short-term debt instruments maturing in under a year, crossed the KSh 1 trillion mark for the second time in history, closing at KSh 1.003 trillion on June 13th.

- •The last and only previous time this level was reached was in April 2019, when T-Bills stood at KSh 1.025 trillion before beginning a steady decline, bottoming out at KSh 564.1 billion in December 2023.

- •From December 2023 to June 2025, T-Bills expanded by KSh 439.6 billion, a 77.9% increase over 18 months.

On a year-on-year basis, the short-term paper stock rose +58.7% from KSh 632.5 billion in June 2024.

Domestic Securities Hit Record High

At the same time, Kenya’s total domestic debt securities, the sum of T-Bills and Treasury Bonds (T-Bonds), hit an all-time high of KSh 6.04 trillion in June 2025. This is the first time in Kenya’s history that outstanding domestic securities have exceeded the KSh 6 trillion threshold.

Compared to June 2024, when the total stood at KSh 5.26 trillion, this reflects a +14.8% year-on-year increase. Over the last decade, the total has surged more than fourfold, from KSh 1.38 trillion in 2015, representing a +337% growth.

While Treasury Bonds continue to account for the bulk of the total stock (over 83%), the proportion of T-Bills has been rising steadily in recent months—from 12% in June 2024 to 16.6% in June 2025.

According to the Treasury’s Exchequer Report for May 2025, total domestic borrowing stood at KSh 1.17 trillion, comprising KSh 597.15 billion in net new borrowing and KSh 569.89 billion in internal debt rollovers. Over the same period, the government spent KSh 1.448 trillion to service public debt, including both principal repayments and interest. Notably, interest payments alone are projected to exceed KSh 1 trillion in the current financial year.

Other Domestic Debt Components

In addition to T-Bills and Bonds, the stock of Other Domestic Debt—which includes advances from commercial banks, pre-1997 overdrafts, and clearing items in transit—stood at KSh 111.8 billion as of mid-June 2025, according to Central Bank data. Although it forms a small portion of gross domestic debt, this component has steadily increased from KSh 105.2 billion in December 2024, contributing to a gross domestic debt stock of KSh 6.22 trillion as of June 13, 2025.

These developments point to a rebalancing in the composition of domestic debt. The government is increasingly leaning on short-term instruments to meet its financing needs amid evolving fiscal pressures and market dynamics.