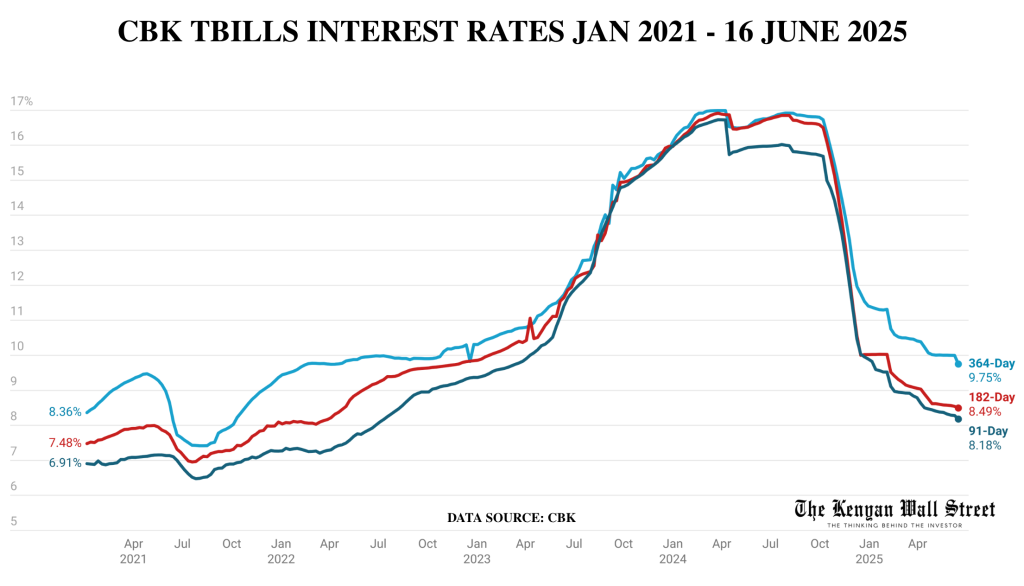

Treasury Bill (T-bill) yields have accelerated their drop in the latest Central Bank of Kenya auction, sinking to their lowest levels since June 2022.

- •The 364-day bill saw its yield fall by 25 basis points to 9.75%, matching the CBK’s recently lowered policy rate.

- •The 91-day and 182-day T-bills also dropped, settling at 8.18% and 8.49% respectively.

- •Large institutional investors have begun redirecting funds toward higher-yield, longer-term government bonds such as the reopened Savings Development Bond (SDB) 30-year and Fixed Coupon Treasury Bond (FXD) 15-year.

Investor behavior in the most recent auction tells the story. The 91-day bill attracted massive demand, recording a 364.9% subscription rate as many retail investors continue to chase short-term liquidity. However, competitive bids for the 182-day and especially the 364-day T-bills remained weak. The government only secured KSh 2.57 billion on the 182-day paper and KSh 2.99 billion on the 364-day paper, despite advertising KSh 10 billion for each.

Of the KSh 24 billion total offered across all T-bills, the government accepted KSh 17.2 billion. Out of these proceeds, KSh 10.86 billion went toward rolling over maturing securities, while net new borrowing amounted to just KSh 6.61 billion from the 91-day bill, KSh 622 million from the 182-day, and only KSh 347 million from the 364-day paper.

The SDB and FXD reopened papers offer attractive returnS:

- •FXD1/2020/015: 9.7 years to maturity, 12.756% coupon

- •SDB1/2011/030: 15.7 years to maturity, 12.0% coupon

With T-bill rates sliding below 10%, these bonds now stand out for investors seeking higher yields and potential capital gains, especially as the rate-cutting cycle continues.