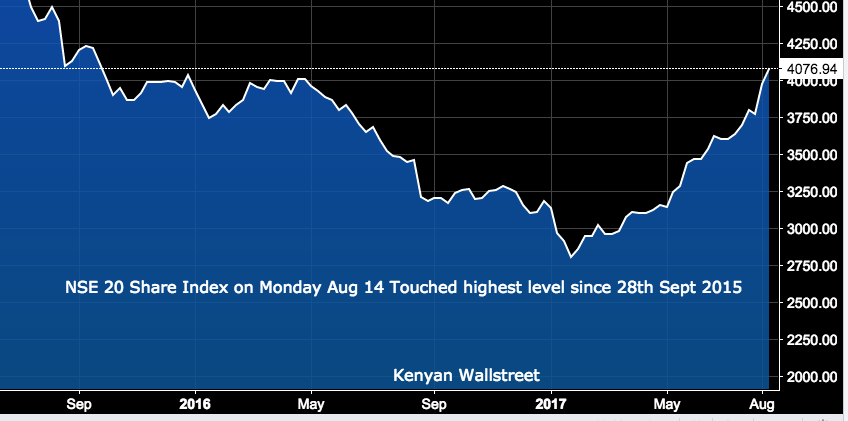

Increasing investor interest seen in banking stocks over the last one week has pushed the Benchmark NSE 20 Share Index to its highest level since October 2015.

On Monday Aug 14th, Banking sector index registered a massive 3.98% gain as Barclays, Cooperative, KCB and Equity bank advancing to close the day at average prices of; Sh 11.55 (+8.96%), Sh 16.95 (+4.95%), Sh 45.25 (+4.02%) and Sh 44.00 (2.92%) respectively according to data from Sterling Capital.

The rally saw the NSE 20 Share Index gain by 2.52% or 99.96 points, one of the biggest single day gain since the start of the year and crossed the 4000 mark to close at 4,076.9 4 points. Investor sentiment improved as 41 stocks advanced against 3 declining stocks with a foreign activity of 77.58%.

Insurance stocks were up by 2.29% as Sanlam and CIC Insurance emerged as the best performers gaining by 9.91% and 9.82% respectively.

On a returns perspective, the NSE 20 Share Index has returned approximately 30% on a YTD basis, 45% since 23rd of January and 17.98% over the 52 week period.

Conclusion

Banking stocks are witnessing an uptrend thanks to the re-election of Uhuru Kenyatta’s administration as investors remain optimistic that he could repeal the rate cap law which came into effect in August 2016. The law has led to a number of underlying structural issues which include the increase of bad debts.