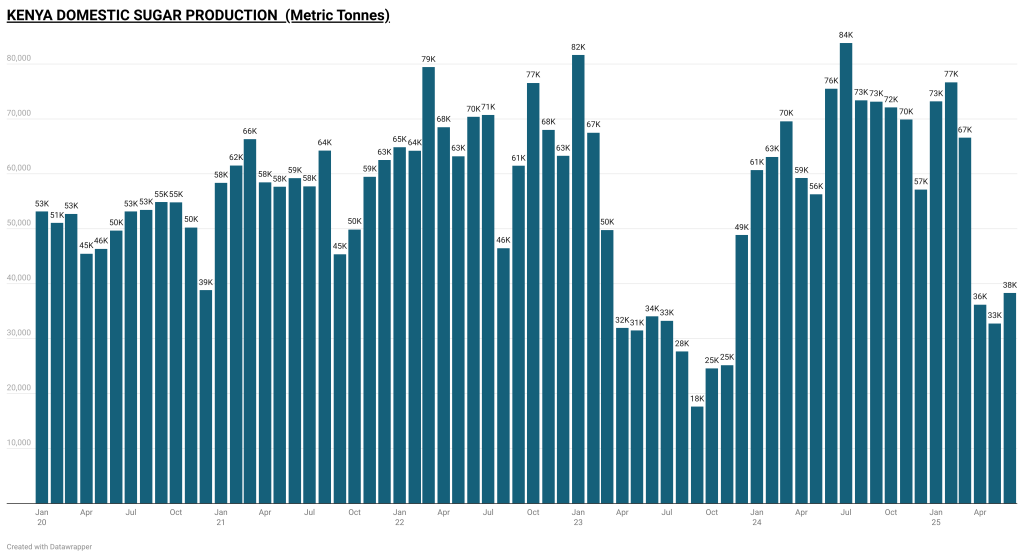

Kenya’s sugar industry has come under renewed pressure in 2025, with official data showing a 15.8% drop decline in domestic sugar production from 384,356 tonnes in the first six months of 2024 to 323,752 metric tonnes in the same period this year.

- •The fall in production was evident across most months in the first half of the year with June’s output at 38,339 tonnes, down by nearly half from 75,500 tonnes in June 2024.

- •April and May also recorded significant declines, with production at 36,194 tonnes and 32,760 tonnes respectively, compared to 59,263 tonnes and 56,271 tonnes in 2024.

- •Industry analysts expect a wider reliance on imports in the second half of the year, with a shortfall of nearly 400,000 tonnes projected for 2025/26.

- •While January and February showed stronger year-on-year gains, these were not enough to offset the steep drops in subsequent months.

The production slump reflects challenges in cane supply, stemming from overharvesting in prior cycles and reduced cane acreage. The Kenya Sugar Board had already warned of shortages in mature cane, leading to milling disruptions in the Western sugar belt.

Sector Interventions

Amid declining output, the government has introduced policy measures to stabilize the industry. A 4% Sugar Development Levy (SDL) came into effect on July 1, 2025, applying to both locally produced and imported sugar. Proceeds from the levy are earmarked for cane productivity (40%), infrastructure and factory development (30%), research (15%), and farmer support through cooperatives (5%).

The levy aims to inject funds into sector rehabilitation but has raised concerns about higher consumer prices and compliance risks. Ex-factory and retail sugar prices had already shown volatility in early 2025, prompting fears that additional levies could push prices further up.

Imports and Market Adjustments

Kenya has leaned on imports to bridge the supply gap. In June 2025, sugar imports dropped to 38,371 tonnes from 53,447 tonnes in May, as stocks rose to 19,078 tonnes, offering some cushion against the shortage. However,

To sustain industrial processing, the government recently approved a special import window for raw sugar. This is expected to keep refineries and industrial users in operation while cane development programs attempt to rebuild supply locally.