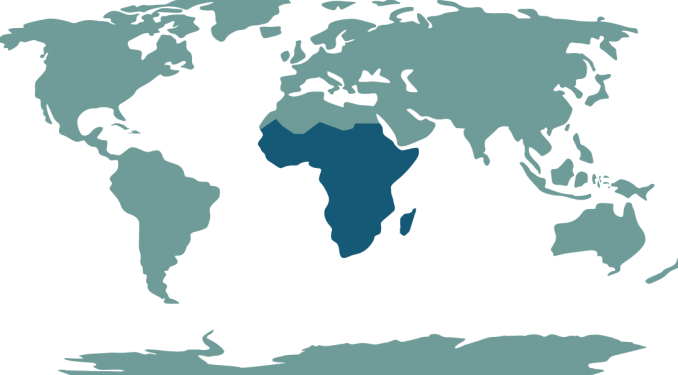

Citi analysts in their Africa Economics and Strategy Weekly say that Sub Saharan Africa (SSA) faces an uphill task in fiscal consolidation post 2020. While COVID19 pandemic and the economic slowdown in the region has been a significant blow to revenue collection in 2020, this compounds a range of other factors; fall in oil price since late 2014, poor tax policies, weak collection infrastructure, and GDP rebasing.

Citi analysts opine that SSA does not have a debt problem but a government revenue collection problem.

Zambia is on the verge of potentially defaulting on its Eurobond payments before the end of the year. There is a growing worry among Citi analysts that more countries in the SSA region are on the same trajectory and may face similar debt crisis. They note that 2020 is quite exceptional with respect to the rise in debt levels, while from 2021 debt levels will return to rising more steadily over a number of years.

The IMF in its SSA Regional Economic Outlook forecasts that new gross government debt will rise from 50.4% of GDP in 2019 to 56.6% of GDP in 2020. However, Citi analysts say that his rises to 60.4% when you exclude Nigeria and South Africa, SSA’s two largest economies.

Zambia leads the pack of countries whose ratio of debt to GDP surpasses 100% in 2020 including Angola, Cape Verde, Republic of Congo, Eritrea, and Mozambique. Research indicates that a rise in government debt above 90% of GDP is associated with dramatically worse growth outcomes. All the six countries with a government debt stock of over 100% of GDP have had to or are seeking debt restructuring with the exception of Cape Verde.

Citi analysts expect many of the countries with elevated debt stocks to continue to have access to not only Eurobond funding in the coming years, but also from commercial banks via syndicated loans, from multilateral and bilateral lenders and even from inflows into their domestic debt market.

For many governments across Africa external borrowing seems cheaper than domestic borrowing because interest rates seem lower than high domestic interest rates. Citi analysts fault this headline calculation as it fails to take into account the impact of currency depreciation on debt service costs if you raise revenue in domestic currency, but have to pay debt service largely in US dollars.

Citi recommends that from 2021 onwards, governments in SSA should seek to bring fiscal deficits under control on a revenue-based consolidation. In this respect, governments should start to set out clear government revenue collection targets with Eurobond issuing governments in SSA aiming to collect a minimum of 20% of GDP in tax revenue.

Governments could also think more proactively about approaching the Chinese government to agree a debt re-profiling for many projects which are clearly only commercially semi-viable in the short to medium term.

Although the analysts are optimistic that GDP growth will rebound relatively robustly in SSA in 2021-22, they are less optimistic about the potential recovery of government revenue.

RELATED

G20 Extends Debt Repayment Suspension for Another 6 Months

Kenya’s Huge Public Debt Bill raises Red flags