The Nairobi Stock Exchange (NSE) has seen a surge in trading activity as the Kenyan shilling appreciates, leading to an increase in investor wealth by KSh 351 billion in just seven weeks, from February 15th to April 4th 2024.

- •Market capitalization, a measure of investors’ wealth, closed at Ksh 1.772 trillion on, April 4th, 2024, compared to Ksh 1.421 trillion recorded on February 15th, 2024.

- •The surge follows the Kenya shilling’s record appreciation against the USD, driven by positive news including Kenya’s successful US$ 1.5 billion Eurobond and the oversubscribed KSh 75 billion infrastructure bond, which alleviated fears of a dollar shortage.

- •In the last 7 weeks of Kenya shilling appreciation against the US dollar, trading on the Exchange has notably increased. Equity turnover during this period totaled KSh 15.8 billion with a volume of 867.63 million shares exchanging hands.

The Nairobi All-share stock index, a market cap-weighted index consisting of all securities on the NSE, has surged by an impressive 49% when measured in dollars since the beginning of the year, rebounding from a drastic 43% decline in 2023.

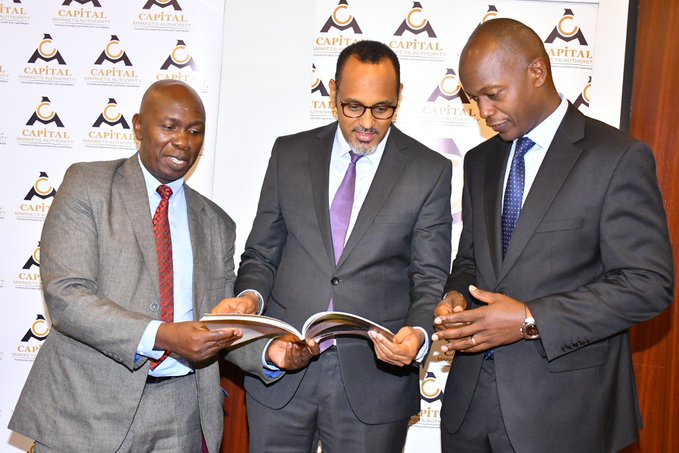

The Capital Markets Authority (CMA) recently unveiled its strategic plan aimed at enhancing market performance, investor wealth, and overall market stability. The regulator says the plan aligns with national and regional development agendas, while emphasizing stock market growth and resilience.

Key focus areas of the CMA’s strategic plan include customer base growth, financial sustainability, performance and risk management, human resource capacity enhancement, and environmental, social, and governance practices. The plan also looks at the importance of financial inclusion, digital assets, and regulatory reforms to drive market efficiency and transparency.

BlackRock Inc., the world’s largest asset manager, perceives a significant investment opportunity in Kenyan stocks, citing a stable political backdrop, improving macroeconomic outlook, and attractive valuation with a stock market trading on five times PE.

See Also: