Standard Group PLC has released FY2024 financial results later than expected—on 5th June 2025 instead of the originally scheduled 9th May—highlighting the media company’s struggle to finalize its external audit on time.

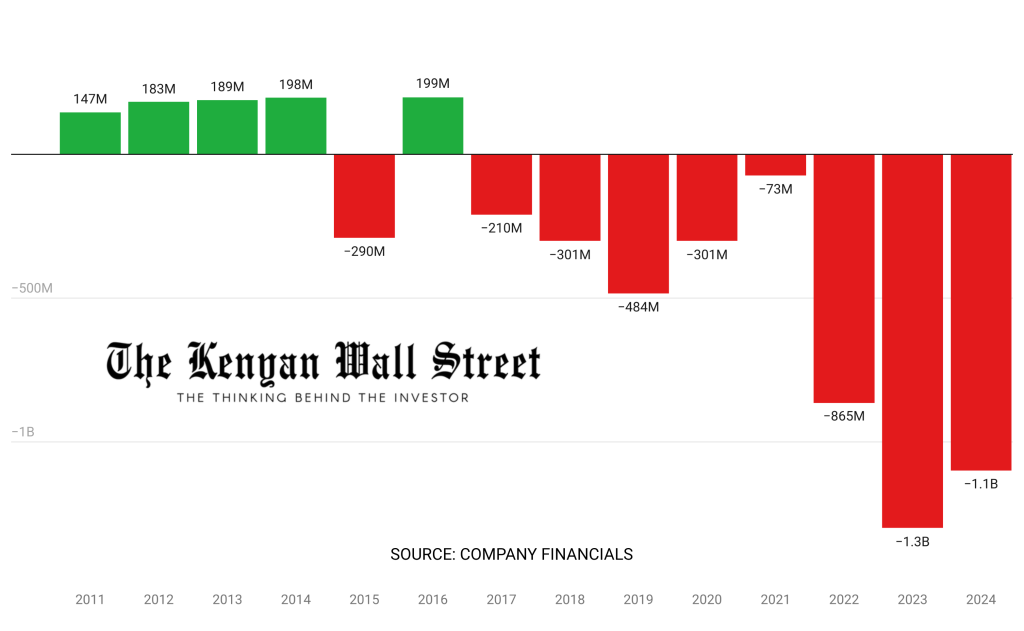

- •The results revealed a net loss before tax of KSh 1.1 billion for the year ended 31 December 2024.

- •This marks the fourth consecutive annual loss since 2019 and underscores persistent challenges in revenue generation, cost control, and market competitiveness.

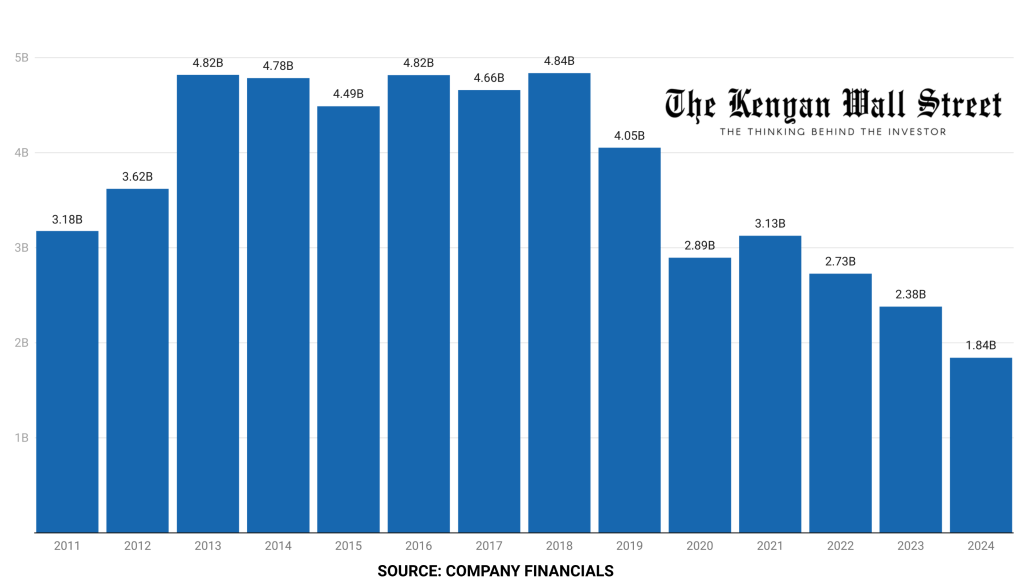

- •Since peaking at KSh 4.836 billion in 2018, the group’s revenue has steadily declined, reaching KSh 1.843 billion in 2024—a cumulative 62% decrease.

| Metric | 2024 (KES) | 2023 (KES) | YoY Change |

|---|---|---|---|

| Revenue | 1,843Mn | 2,381Mn | 🔻 -22.6% |

| Total Operating Costs | (2,910Mn) | (3,007Mn) | 🔻 -3.2% |

| Other Income | 78Mn | (8Mn) | 🔺 Turned positive |

| Finance Costs (Net) | (10Mn) | (89Mn) | 🔻 -88.7% |

| Loss Before Income Tax | (1.1Bn) | (723Mn) | 🔺 +52.1% |

| Total Comprehensive Loss | (1.1Bn) | (1.3Bn) | 🔻 -12.8% |

| Total Assets | 3.8Bn | 4.1Bn | 🔻 -6.4% |

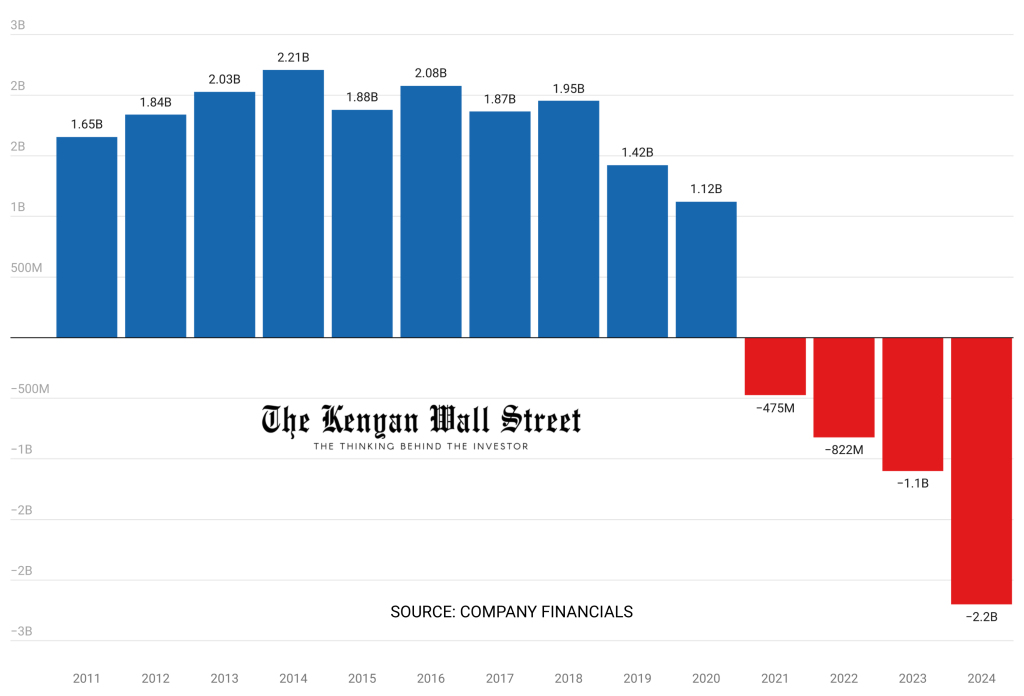

| Total Shareholders’ Equity | (2.2Bn) | (1.1Bn) | 🔺 Worsened (doubled) |

| Cash and Cash Equivalents | (28Mn) | (35Mn) | 🔺 Improved by 20% |

The sharp revenue drop reflects intensified competition from digital media platforms, reduced advertising spend across key segments, and a broader slowdown in Kenya’s economic environment that continues to strain traditional revenue streams.

Profitability Challenges

The group’s financial performance also mirrors a worrying trend in profitability. Losses before tax have worsened from KSh 684 million in 2019 to KSh 1.1 billion in 2024—a 61% increase—highlighting structural challenges in aligning costs with shrinking revenues.

Despite efforts to manage operational costs, which decreased marginally from KSh 3,007 million in 2023 to KSh 2,910 million in 2024, the group’s losses remain substantial.

Shareholders’ equity has also eroded sharply, turning negative in 2021 and deepening to KSh -2.2 billion by the close of 2024. The last time the group reported positive equity was in 2020, at KSh 1.12 billion, marking a staggering 296% swing over just four years.

This rapid deterioration in equity signals ongoing financial distress and highlights the need for a robust recapitalization strategy.

To address its financial challenges and position itself for sustainable growth, Standard Group PLC received approval from the Capital Markets Authority (CMA) on 22nd May 2025 to proceed with a rights issue.

The company plans to raise approximately KSh 1.5 billion by issuing 283,661,120 new shares at KSh 5.29 per share on a ratio of 11 new shares for every 3 held.

Proceeds from this rights issue will be directed toward settling existing liabilities, securing working capital, and supporting both organic and inorganic growth initiatives. The company also plans to accelerate its digital transformation strategy to align with market shifts and drive long-term profitability.