Kenya’s eighth largest bank by market share, Stanbic Kenya (NSE; CFC) has reported a drop 9.24 percent to Sh1.08 billion in net profit for the first quarter of 2017.

Stanbic is now the second listed lender to report its earnings for Q1 2017 after NIC Bank which reported a decline of 3.9 percent over the same period.

Despite increasing its loan book by 11.4 percent to Sh 115.37 billion, the bank’s net interest income fell by 12.23 per cent to Sh2.44 billion as customer deposits grew by 20 percent to Sh130.56 billion.

Bad loans over the period under review shot up by 30 percent to Sh5.76 billion while loan loss provisions increased by 32.8 percent to Sh1.66 billion.

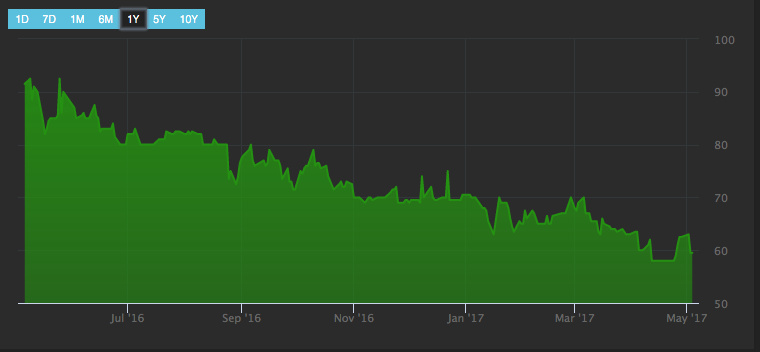

Share Price YoY

Over the last one year, the lender’s share price has fallen by nearly 32 percent from Sh 91.5 traded on 9th May compared to Sh 62.0 traded on Friday 5th May as shown in the chart below.

Related; NIC Bank Q1 2017 Earnings Plunge By 3.9%, Completes IBL Management