First in line: Stanbic Holdings was the first bank to release their FY 2021 results in what is a month of bank earnings in Kenya.

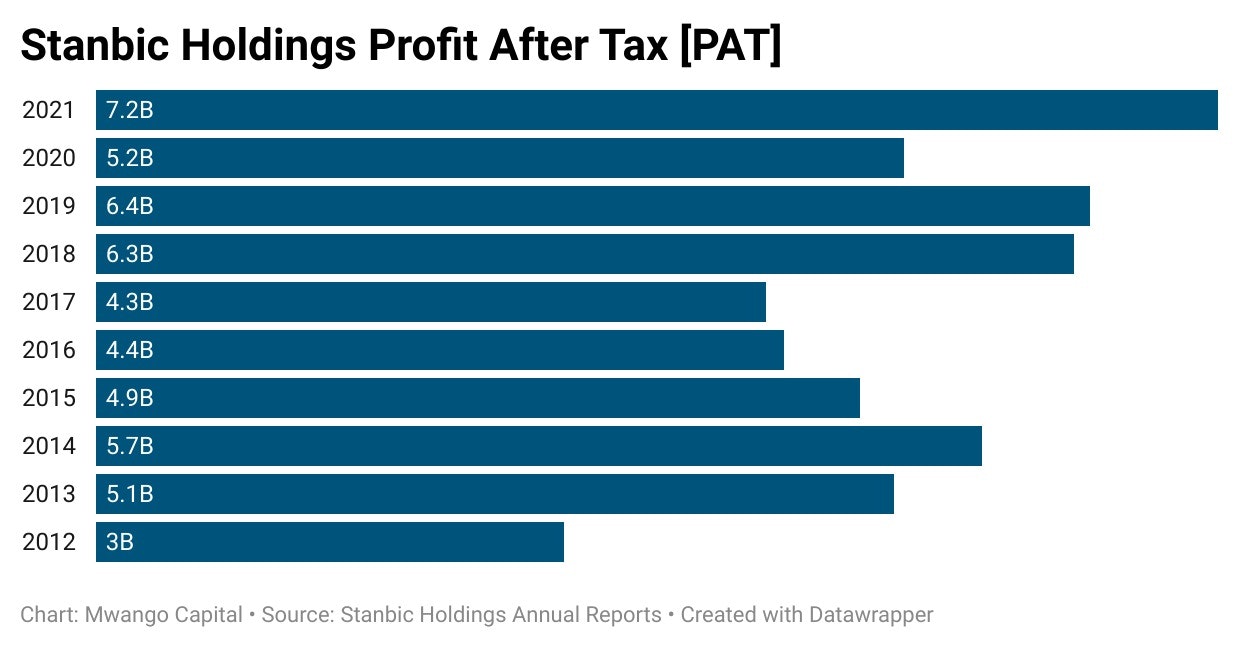

Performance: Balance sheet growth was mild as customer deposits shrunk 2.1% and total bank assets grew by 0.08%. Total income growth of 7.5% to KES 25B and a significant reduction in provisioning for probable losses by 48.2% saw profit before tax grew 56.7% to KES 9.8B. Net income grew 38.8% to KES 7.2B.

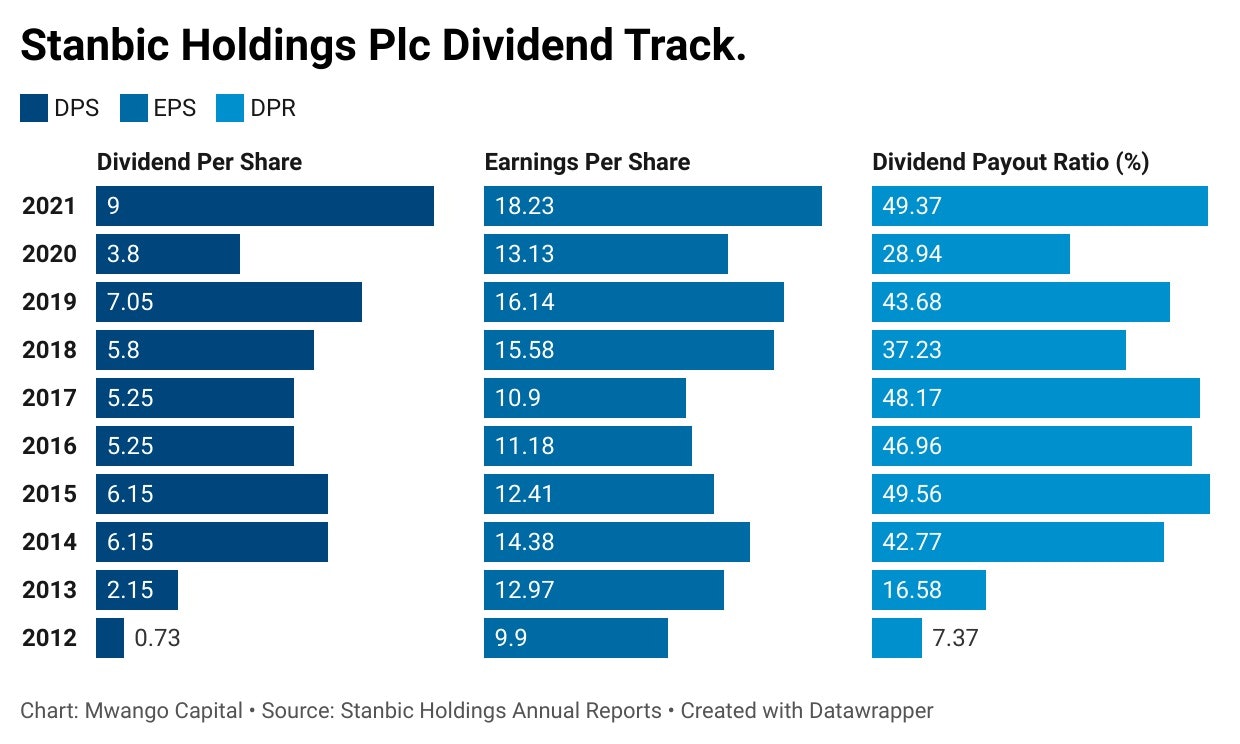

Record Dividend: Shareholders are set to rake in a final dividend of KES 9 [2020: KES 3.80, 2019: KES 7.05] on a KES 18.23 EPS – the highest EPS the bank has registered over the last decade. The dividend payment trend in the last 3 years shows that the bank is moving past the pandemic.

Safaricom Ethiopia’s Cloud Moves

Telco Cloud Platform: This week, Safaricom Ethiopia selected VMWare’s Telco Cloud Platform solution as it builds its network and IT infrastructure. The VMWare solution is inclusive of 5G standards and is oriented for a Telco or ISP environment – with Safaricom noting that the tech will be deployed to both its nascent IT and Telco environments – in what is technically known as a Greenfield Network Set Up.

“VMware Telco Cloud Platform will provide a robust platform for the deployment all network functions while also enabling flexibility as we scale and expand services.”

Pedro Rabacal, CTO Safaricom Ethiopia

“This project is unique as Safaricom Ethiopia does not need to contend with legacy technology and architectures. It has an opportunity to build something special from the ground up.”

Sanjay Uppal, SeniorVP and GM Service Provider & Edge, VMware

Infrastructure Sharing Deal: The current telecoms regulation framework by the Ethiopia Communications Authority provides for network sharing where foreign entrants share existing telecoms infrastructure. Network sharing encompasses sites, masts, and network roaming.

Termination Rates: In Kenya, Safaricom is in a tiff with competitors and the regulator, CAK, over the Mobile Termination Rates (MTRs) that took effect on Jan 1, 2022. The regulator slashed local MTs by 88% to KES 0.12 from the previous KES 0.99, resulting in cheaper calls outside a network (off-net calls).

What Else Happened This Week?

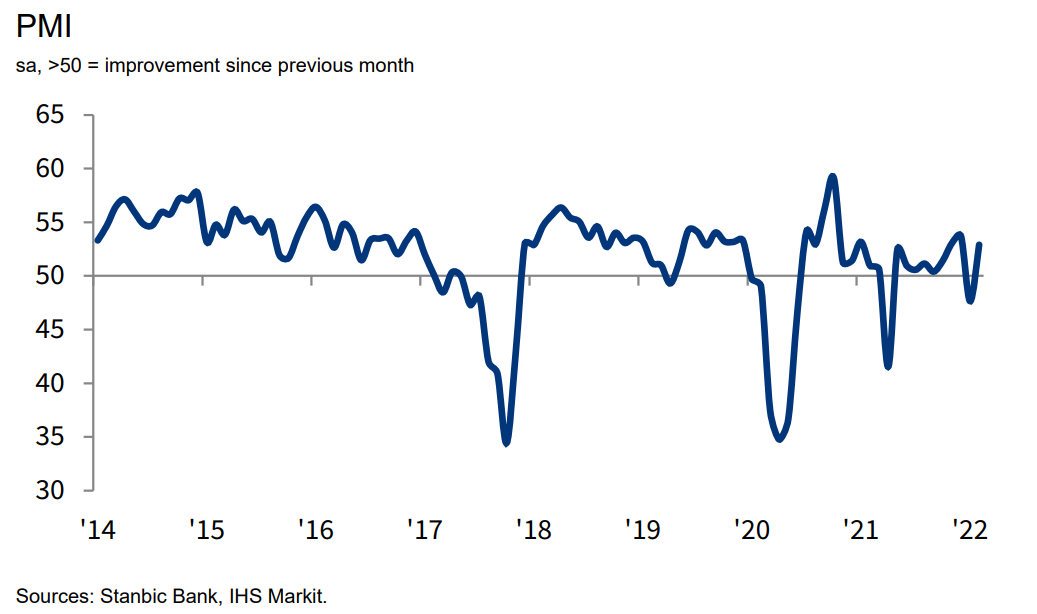

? Kenya PMI: Stanbic Kenya released their February Purchasing Managers’ Index (PMI). PMI came in at 52.9, an improvement from January’s 47.6, highlighting business recovery. [The Star]

? Kenya and Tanzania Borrowing Spree: To finance its KES 3.2T 2022/2023 budget, Kenya will have to plug a budget deficit of KES 846B. In Tanzania, the stock of national debt reached $37.57B by end of January 2022. Total external debt hit 75.4% of the country’s $28.17B budget. [The EastAfrican]

? Recovery in Uganda: Uganda PMI rose to 55.7 in February, up from 54.9 in January this year, after the country fully reopened on January 24 after two years of Covid-19 restrictions. [Xinhua]

? Power of social media: The Co-operative Bank of Kenya was this week forced to reverse a KES 42 charge it had been levying money transfers from M-Pesa to accounts after customers complained about it on social media. [Twitter]

African Markets this Week

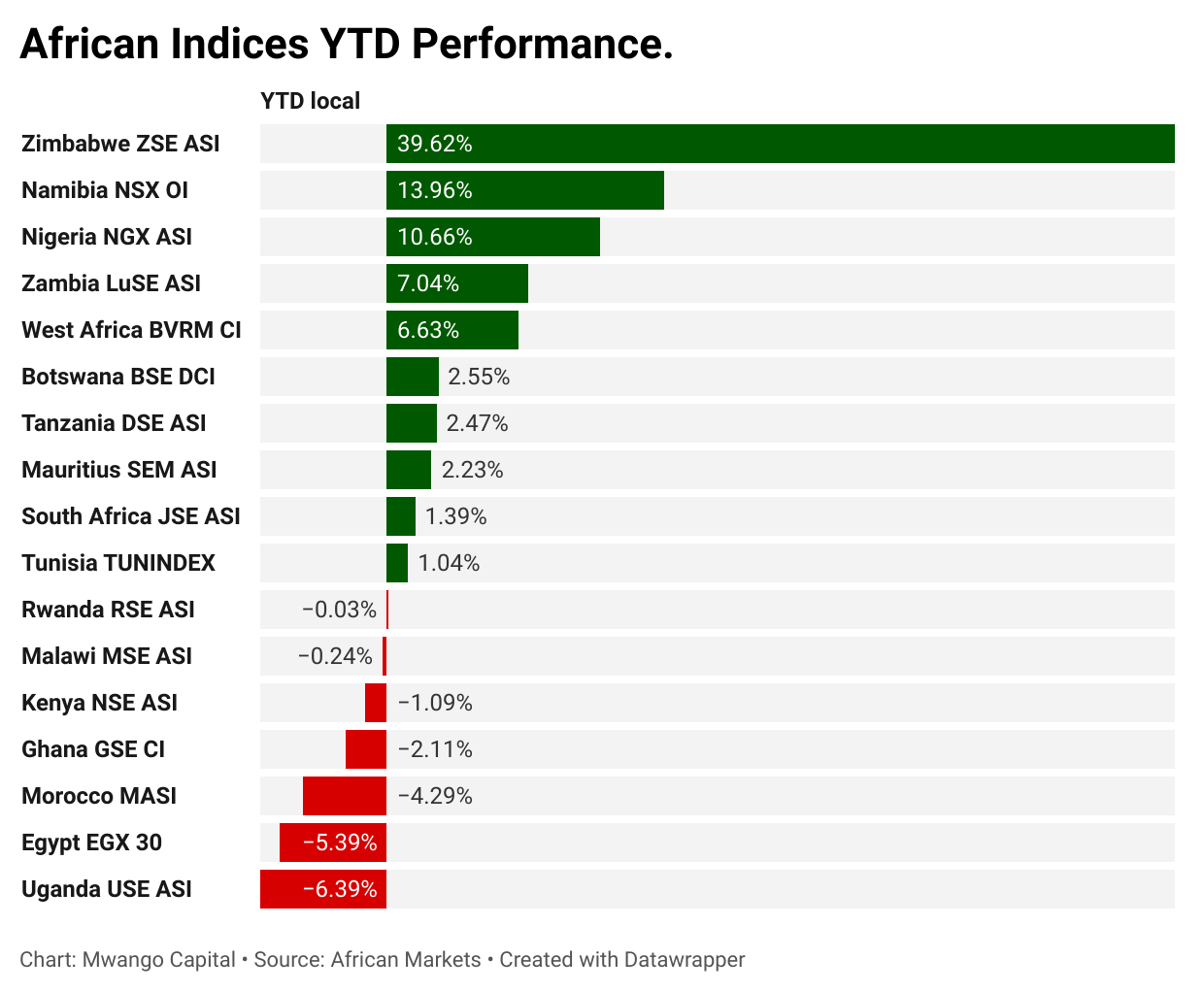

16 of the 17 indices we cover retreated this week. 7 markets posting negative returns YTD. Zimbabwe was the best performing market overall, registering 39.62% YTD returns followed by Namibia and Nigeria at 13.96% and 10.66%. The Ugandan Stock Exchange led the pack on a week-on-week basis with equities in Uganda rallying 0.8%. The Namibian Stock Exchange posted slouching performance shedding off 4.3% this week.