Stanbic Bank Kenya, which once again maintained its tradition as the first bank to release earnings, reported a 16.6% drop in net profit for Q1 2025 to KSh 3.33 billion, down from KSh 3.99 billion a year earlier. The performance was impacted by reduced lending activity and lower foreign exchange income, though the lender retained robust capital and liquidity buffers.

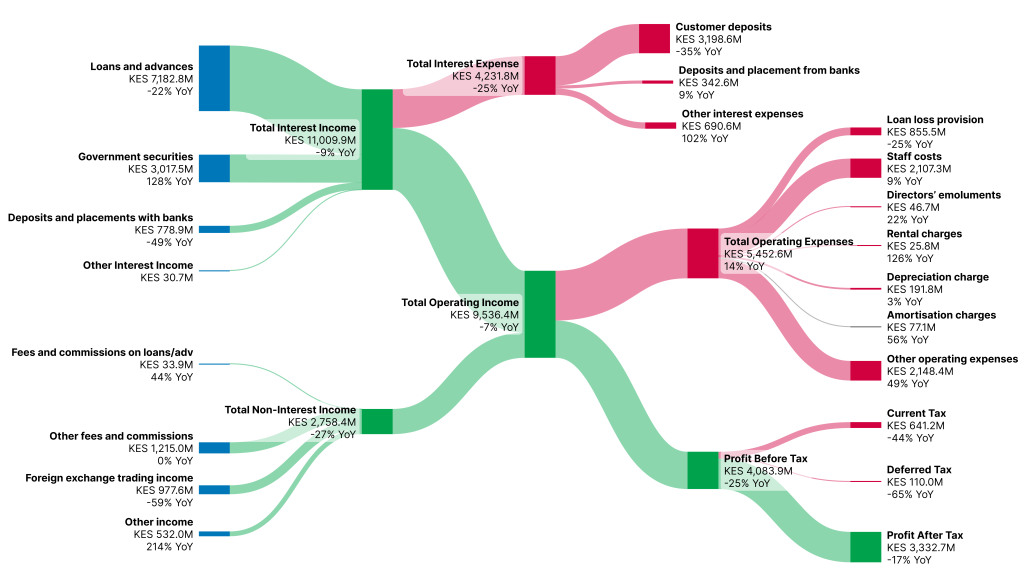

Total operating income fell 7% year-on-year to KSh 9.54 billion, weighed down by a sharp decline in non-interest income. This segment, which includes fees, commissions, and forex trading, dropped 27% to KSh 2.76 billion from KSh 3.79 billion, reflecting subdued market activity.

Meanwhile, net interest income remained stable at KSh 6.78 billion, supported by increased earnings from government securities which cushioned lower returns from loans and advances.

| Metric | Q1 2025 | Q1 2024 | YoY Change |

|---|---|---|---|

| Net Profit | KSh 3.33B | KSh 3.99B | ↓16.6% |

| Total Operating Income | KSh 9.54B | KSh 10.27B | ↓7.1% |

| Non-Interest Income | KSh 2.76B | KSh 3.79B | ↓27.2% |

| Net Loans and Advances | KSh 244.0B | KSh 255.8B | ↓4.6% |

| Customer Deposits | KSh 337.6B | KSh 355.5B | ↓5.0% |

| Gross NPLs | KSh 22.94B | KSh 24.21B | ↓5.2% |

| Capital Adequacy Ratio (Total) | 18.6% | 16.2% | ↑ |

| Liquidity Ratio | 48.3% | 51.2% | ↓ |

Solid Balance Sheet: Capital, Liquidity, Asset Quality and Lower Off-Balance Sheet Risks

Despite earnings pressure, Stanbic maintained a resilient balance sheet.

- •Total capital adequacy ratio stood at 18.6%, well above the regulatory minimum of 14.5%.

- •Liquidity ratio remained high at 48.3%, more than double the 20% statutory requirement.

“We remain focused on partnering with customers, strengthening stakeholder relationships, and delivering sustainable, long-term value.”

Dennis Musau, Chief Financial & Value Officer.

This highlights the bank’s ability to meet obligations and absorb shocks even under challenging conditions.

Gross non-performing loans (NPLs) declined to KSh 22.94 billion, with net NPLs after provisions improving to KSh 4.40 billion. This signals tighter risk controls and better recoveries.

Stanbic’s off-balance sheet exposures fell to KSh 146.6 billion, from KSh 189.5 billion last year. The sharp drop was largely due to lower derivatives and trade-related guarantees.

While Q1 2025 delivered a softer profit performance, Stanbic’s solid capital and liquidity levels offer stability going forward. The board is banking on prudent lending and diversified income streams to cushion the bank for the remainder of the year.

The bank is expected to focus on prudent lending and fee-based income to support performance.

Dr. Joshua Oigara, Chief Executive.

“We continue to assess market dynamics and remain flexible, positioning ourselves to navigate the year ahead and deliver sustainable value.”

Additionally, the bank reaffirmed its commitment to shareholder value, with a previously declared KSh 20.74 per share dividend (for FY2024) still on course.