Small and Growing businesses (SGBs) are increasingly taking insurance against political and economic risks as a hedge against loss of revenue and property, a new survey by WYLDE International and AAR has found.

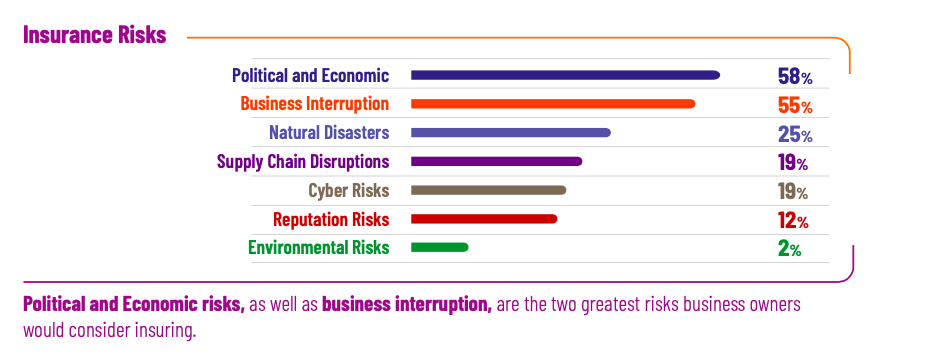

- •Political and economic risks as well as business interruption are emerging as the two greatest risks small and growing business owners consider purchasing insurance policy against.

- •During protests by the opposition in 2023, Kenya Association of Manufacturers (KAM) estimated daily Ksh2.86 billion losses while the losses incurred during the anti-Finance Bill protests in 2024 have also been estimated in billions.

- •The survey however still points to more work to improve insurance penetration in the country with 58% of small and growing business owners not considering taking insurance in the future, 24% not sure while a paltry 16% are sure of taking insurance in the future.

“Key findings on insurance uptake indicates less than 50 per cent of small and growing businesses currently have active insurance policies with property and motor insurance being the most popular,” the study, which targeted small and growing businesses within Nairobi’s metropolitan area, found.

“The businesses cite cost as the biggest challenge with a significant number also considering claim process, appropriate coverage, policy complexity and customised services before signing for a package.”

Risk management emerged as the leading motivation for insurance uptake, with 67% of business owners citing it as their primary reason for purchasing coverage. 16.7% of respondents said they were compelled by legal requirements, and 14.3% indicated they sought insurance for peace of mind.

Natural disasters, supply chain disruptions, cyber risks, registration and environmental risks are also cited by Small and Growing Business owners for consideration in the future.

According to the survey, of the firms that have taken up insurance, 52% of businesses rely on a single insurance provider, while 43% engage 2-3 providers.