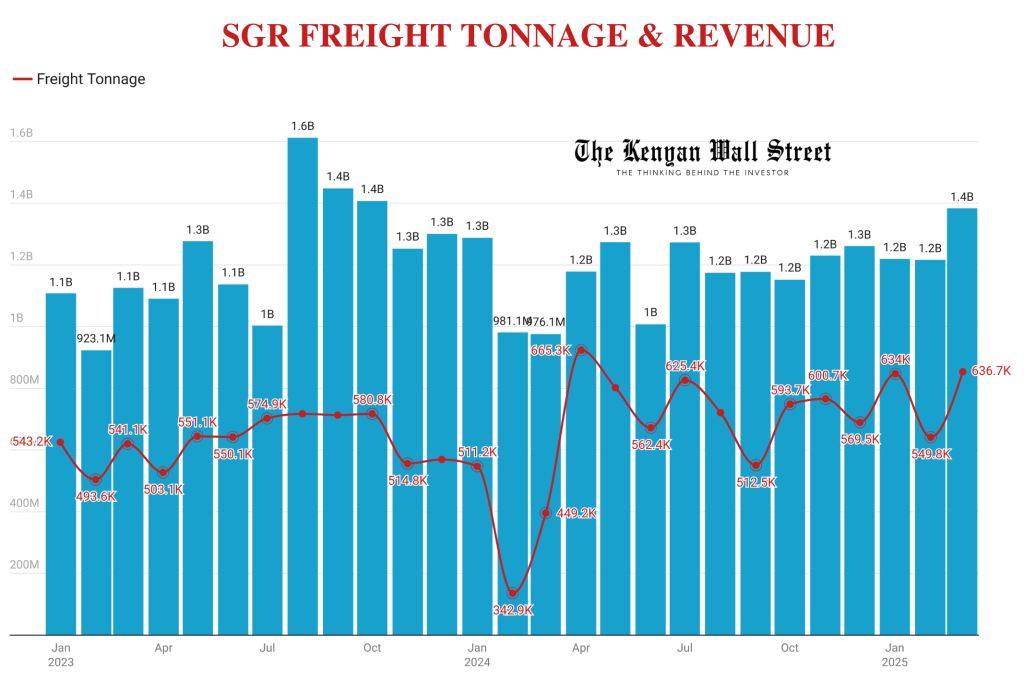

Kenya’s Standard Gauge Railway (SGR) recorded a significant surge in cargo transport in March 2025, with freight volumes reaching their highest levels since August 2023, even as passenger numbers experienced a notable decline.

- •In March 2025, SGR transported 636,724 tonnes of cargo, marking a +41.74% year-on-year (YoY) increase from 449,200 tonnes in March 2024 and a +15.81% rise month-on-month (MoM) from 549,818 tonnes in February 2025.

- •This figure stands as the highest monthly freight tonnage since August 2023’s 580,882 tonnes, reflecting a robust rebound in cargo movement.

- •Freight revenue soared to KSh 1.383 billion, a +41.77% YoY increase from KSh 976.099 million in March 2024 and a +13.80% MoM rise from KSh 1.216 billion in February 2025, underscoring strong demand for rail logistics and potentially higher-value cargo or improved pricing.

Kenya Railways Managing Director Philip Mainga attributed the record freight haul in March 2025 to improved last-mile connectivity, automation at freight yards, and government support for routing bulk cargo via rail.

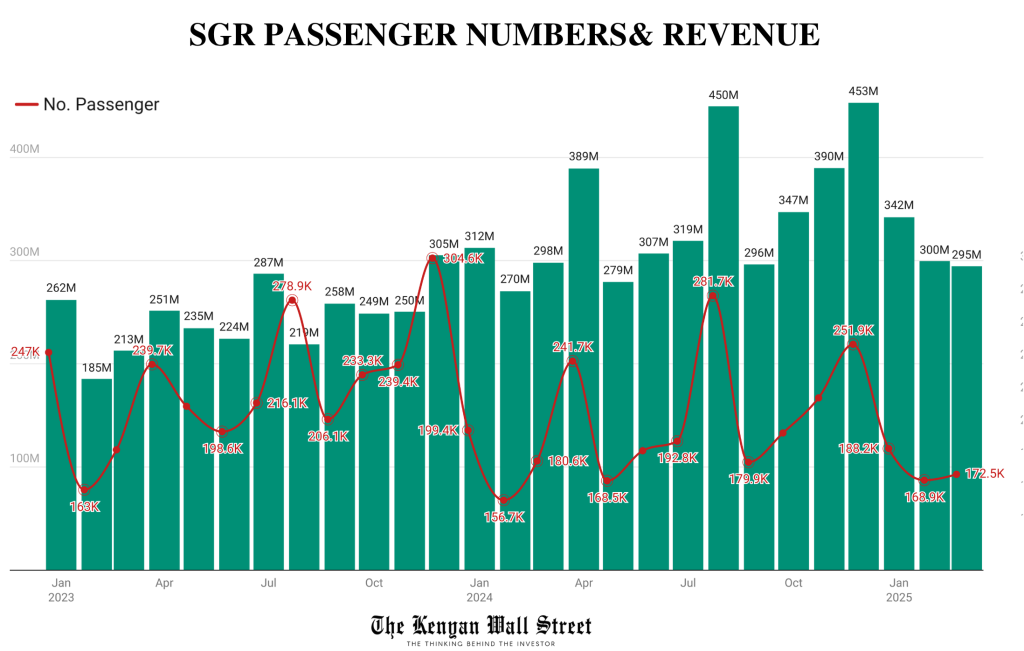

Conversely, passenger numbers dropped to 172,456 in March 2025, a 4.53% decline from 180,645 in March 2024, and the lowest March ridership since 156,653 in March 2021.

However, there was a slight 2.11% MoM uptick from 168,897 in February 2025. Passenger revenue fell 1.13% YoY to KSh 294.602 million from KSh 297.979 million in March 2024 and 1.66% MoM from KSh 299.566 million in February 2025, marking the lowest monthly revenue since January 2024’s KSh 312.443 million, despite efforts to stabilize commuter demand.

Strong Q1 2025 Freight Momentum

In the first quarter of 2025 (January to March), SGR moved a record 1.820 million tonnes of cargo, the highest Q1 tally since 2021, representing a +39.68% YoY increase from 1.303 million tonnes in Q1 2024.

Corresponding freight revenue reached KSh 3.819 billion, up +17.71% YoY from KSh 3.245 billion in Q1 2024, driven by the surge in tonnage.

Despite a 1.32% YoY drop in passenger numbers to 529,591 from 536,673 in Q1 2024, SGR collected KSh 936.300 million in passenger revenue, the highest Q1 figure on record since 2021, surpassing Q1 2024’s KSh 881.819 million by 6.18%. This revenue growth highlights effective fare strategies amid declining ridership.

Upgrades and Connectivity Plans

The surge in freight volumes aligns with renewed government efforts to expand and integrate the SGR network. In March 2025, the Ministry of Transport confirmed ongoing feasibility studies for extending the SGR line from Naivasha to Malaba, aimed at enhancing regional trade by facilitating seamless cargo flow into Uganda and beyond.

Additionally, Kenya Railways has upgraded container handling capacity at the Nairobi Inland Container Depot (ICD) and Mombasa port terminals, reducing turnaround times and encouraging more importers to opt for rail transport. These improvements are contributing to the freight growth.