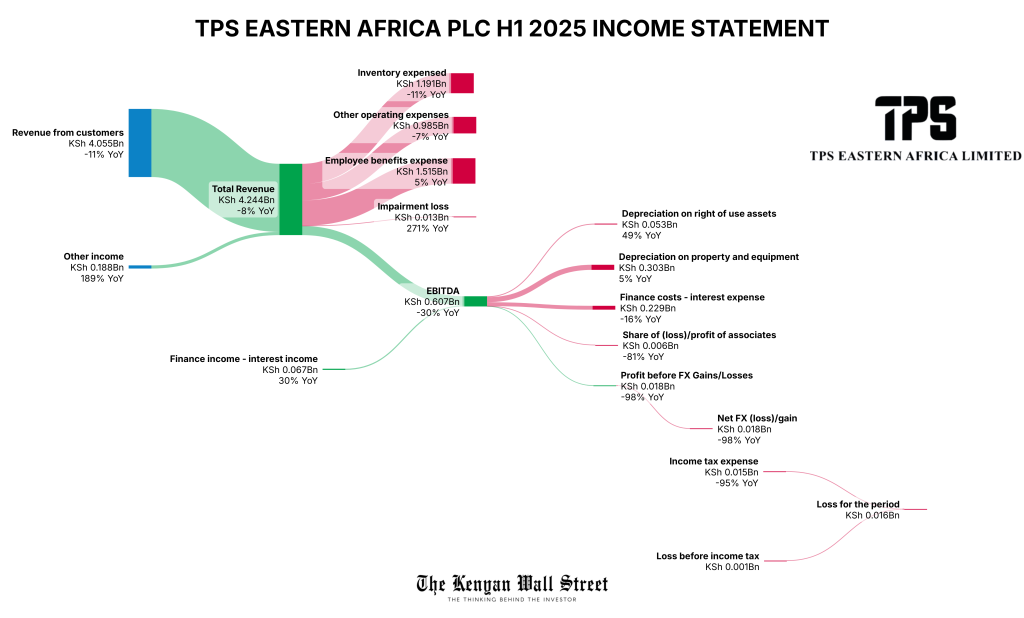

TPS Eastern Africa Plc, the parent of Serena Hotels, has reported a KSh 16 million loss after tax for the six months ended June 30, 2025, reversing a KSh 696 million profit a year earlier.

- •The downturn reflects a 10.5% drop in revenue to 4.055 billion and the absence of substantial foreign exchange gains seen in 2024.

- •Operating EBITDA fell 28.5% to KSh 539.9 million, impacted by weaker margins.

- •Depreciation on property, plant, and equipment rose 5.2% to KSh 303.0 million, while right-of-use asset depreciation jumped 48.7% to KSh 52.8 million.

Finance income increased 29.6% to KSh 67.0 million, but the net forex result swung from a KSh 762.3 million gain to a KSh 17.7 million loss. Share of profit from associates turned into a KSh 5.6 million loss from a KSh 29.5 million gain.

- •Finance costs declined 16.2% to KSh 229.0 million, easing some pressure on the bottom line.

Balance Sheet and Liquidity

Total assets decreased 1.3% year-on-year to KSh 19.923 billion, while equity fell 1.9% to KSh 11.320 billion. Cash and cash equivalents surged 129.9% to KSh 579.7 million, supported by positive operating cash flow of KSh 598.7 million. Capital expenditure totaled KSh 500 million, directed toward property refurbishments, sustainability initiatives, and guest experience upgrades.

| Metric | Jun 30 2025 | Jun 30 2024 | YoY % / Change |

|---|---|---|---|

| Revenue | 4.055Bn | 4.531Bn | -10.5% |

| Other Income | 187.9Mn | 65.3Mn | +187.7% |

| Operating EBITDA | 539.9Mn | 755.6Mn | -28.5% |

| Depreciation – PPE | 303.0Mn | 288.1Mn | +5.2% |

| Depreciation – ROU Assets | 52.8Mn | 35.5Mn | +48.7% |

| Finance Income | 67.0Mn | 51.7Mn | +29.6% |

| Finance Costs | 229.0Mn | 273.3Mn | -16.2% |

| Share of Associate Results | -5.6Mn | 29.5Mn | Worsened |

| Net Forex (Loss)/Gain | -17.7Mn | 762.3Mn | Worsened |

| Profit Before Tax | -1.2Mn | 1.002Bn | Worsened |

| Profit After Tax | -16.0Mn | 696.0Mn | Worsened |

| Earnings Per Share | -0.05 | 2.34 | Worsened |

| Total Assets | 19.923Bn | 20.190Bn | -1.3% |

| Total Equity | 11.320Bn | 11.535Bn | -1.9% |

| Cash & Cash Equivalents | 579.7Mn | 252.2Mn | +129.9% |

Despite these headwinds, the company expects a stronger second half on the back of peak tourism season and market recovery.

On August 6, Serena relaunched its Prestige Club loyalty programme and app, adding enhanced benefits for members across its portfolio. No interim dividend was declared.

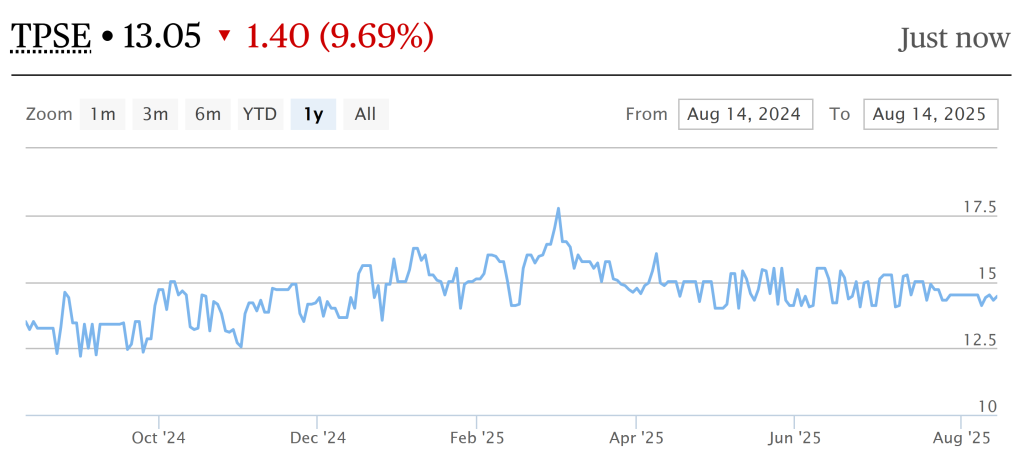

The market reacted negatively to the results. One hour into trading, TPS Eastern Africa shares fell 9.69% to KSh 13.05, down KSh 1.40 from the previous close, reflecting investor concern over the swing to a loss, revenue contraction, and loss of FX gains. Improved cash reserves provided some reassurance but sentiment remains cautious.