TPS Eastern Africa PLC, which operates Serena Hotels, has reinstated its dividend payout after a five-year hiatus, declaring a KSh 0.35 per share dividend for FY2024, matching its last distribution in FY2018.

The group reported a net profit of KSh 1.3 billion in FY2024, a 188% increase from KSh 457 million in 2023. Revenue rose 5% to KSh 10.19 billion, up from KSh 9.68 billion the previous year.

This turnaround was driven by:

- •A KSh 830 million unrealized forex gain due to the Kenya Shilling’s appreciation against the US dollar.

- •A 58% drop in finance costs to KSh 671 million.

- •Steady operations across business units, all of which delivered positive EBITDA.

| Metric | FY2024 | FY2023 (Restated) | % Change |

|---|---|---|---|

| Revenue | KSh 10.19 Billion | KSh 9.68 Billion | ▲ 5.2% |

| EBITDA | KSh 2.45 Billion | KSh 2.53 Billion | ▼ 3.2% |

| Finance Costs | KSh 670.9 Million | KSh 1.59 Billion | ▼ 57.7% |

| Profit Before Tax | KSh 2.00 Billion | KSh 689 Million | ▲ 191% |

| Net Profit After Tax | KSh 1.32 Billion | KSh 458 Million | ▲ 188% |

| Forex Gain (Unrealized) | KSh 830 Million | Not reported | – |

| Proposed Dividend | KSh 0.35/share | Nil | – |

| Total Equity | KSh 11.54 Billion | KSh 10.78 Billion | ▲ 7.1% |

| Net Cash from Operations | KSh 1.76 Billion | KSh 2.24 Billion | ▼ 21.8% |

In the first half of 2024, the Group had recorded a profit after tax of KSh 570 million, a major improvement from a loss of KSh 30.2 million in the same period of 2023. Turnover for the half-year rose 20.4% to KSh 4.5 billion, mainly driven by increased occupancy across leisure, corporate, and MICE (Meetings, Incentives, Conferences and Exhibitions) segments.

Despite the strong interim performance, TPS cautioned against extrapolating the half-year results to a full-year forecast, citing seasonal tourism trends and disruptions from heavy rains, flooding, and political demonstrations in Kenya.

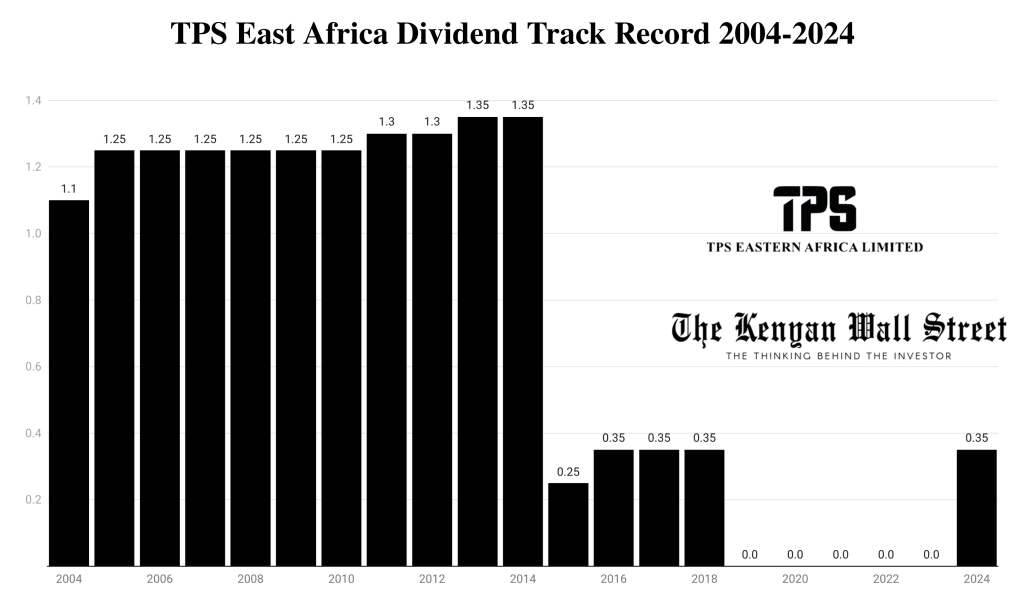

Serena Hotels dividend 2024 marks the first payout by TPS Eastern Africa since FY2018. From FY2004 to FY2018, the Group consistently rewarded shareholders, with annual dividends ranging from KSh 1.10 to a peak of KSh 1.35 per share. However, dividends were suspended for five years starting FY2019 due to profitability challenges and the impact of the COVID-19 pandemic.

Dividend History Snapshot:

“This dividend resumption marks a key milestone in our recovery and reflects confidence in the Group’s sustainable profitability.”

Management

Key Dividend Dates

- •AGM Date: 26 June 2025 (via electronic communication)

- •Book Closure Date: 30 June 2025

- •Payment Date: On or about 30 July 2025

With improved profitability, a leaner balance sheet, and dividend resumption, TPS Eastern Africa is positioned for long-term shareholder value. Investors will be watching as the Group aims to sustain its momentum into 2025. In 2024, TPS invested in tech upgrades, enhanced guest experiences, and sustainability.

The Group paid KSh 2.47 billion in taxes and KSh 330 million in royalties across Kenya, Tanzania, and Uganda.