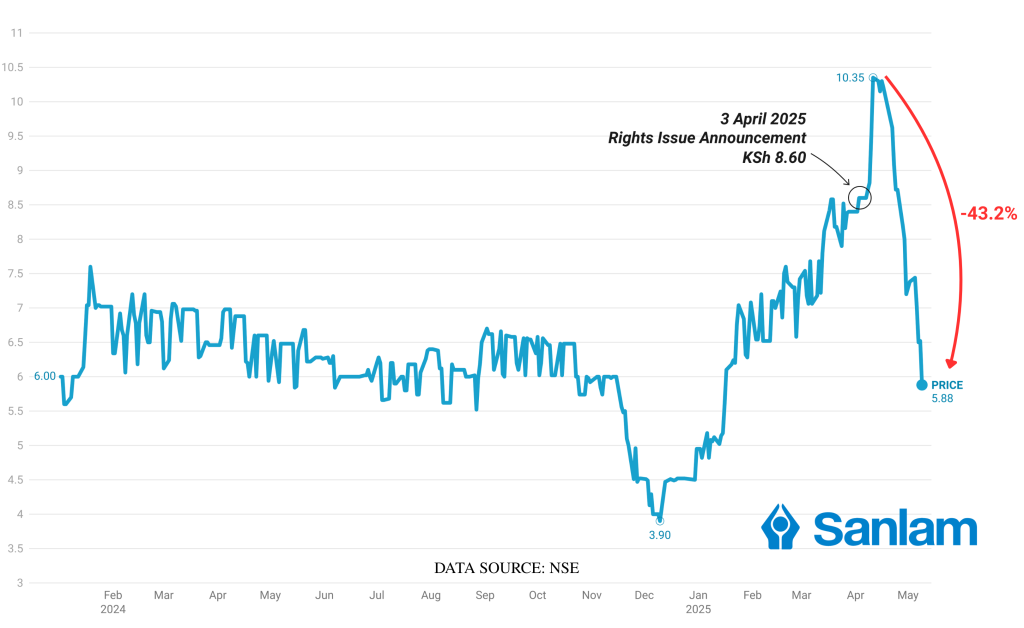

When Sanlam Kenya Plc announced plans for a KSh 2.5 billion rights issue on April 3, 2025, its stock price surged to a post-announcement high of KSh 10.35 — an uncommon reaction to what investors typically view as a dilution event.

- •Just over a month later, the share price has fallen to KSh 5.88, down 43.2%, and inching close to the rights offer price of KSh 5.00.

- •This sharp reversal raises important questions about what drove the rally, what triggered the fall, and what it means for investors ahead of the rights issue closure on May 12, 2025.

- •The transaction aims to raise KSh 2.5 billion to settle a Stanbic Bank loan and strengthen Sanlam’s long-term financial structure.

Initially, the market responded positively to the announcement. Sanlam secured full regulatory clearance — from the Capital Markets Authority (CMA), the Nairobi Securities Exchange (NSE), the Insurance Regulatory Authority (IRA), and the South African Reserve Bank (SARB) — to raise capital through a rights issue.

Sanlam Allianz Africa is underwriting the offer, ensuring that all rights will be absorbed, even if shareholders choose not to participate.

For a company with a modest market capitalization under KSh 1 billion, this announcement sparked a temporary wave of optimism that drove the stock to its highest level in over a year.

The Drop: Dilution Math, Pricing Realities & Market Reassessment

However, the optimism quickly faded. The stock fell from its April 3 high of KSh 10.35 to KSh 5.88 as of Friday, May 9 — a 43% drop that reflects a significant market reassessment. Several factors explain this reversal:

1. Dilution Ahead is Significant

Sanlam has 144 million shares outstanding. To raise KSh 2.5 billion at KSh 5.00 per share, it must issue 500 million new shares, increasing total shares to 644 million.

As a result, any shareholder who does not participate in the rights issue will see their ownership diluted by over 77%.

2. Minimal Discount to Market

With the current share price at KSh 5.88, the offer price of KSh 5.00 reflects only a 15% discount — not attractive enough to prompt aggressive participation, especially as prices continue to decline.

3. TERP Shows Repricing Was Inevitable

The Theoretical Ex-Rights Price (TERP) — calculated by combining current market value with proceeds from the rights issue — stands at approximately KSh 5.20. That’s 50% below the April rally peak, highlighting the disconnection between early market excitement and dilution reality.

4. Low Liquidity Amplifies Volatility

Sanlam is not among the NSE’s most liquid stocks. Small trades can move prices significantly. The rally likely drew in short-term momentum traders, but without sustained buying, the price correction came swiftly.

The sharp rise to KSh 10.35 following the announcement appears to stem more from speculation than fundamental value. Several dynamics contributed to this behavior:

- •Some investors may have misread the rights issue as a growth signal rather than a financial restructuring.

- •Others may have overemphasized regulatory approvals and underwriting commitments as bullish signs.

- •Momentum traders entered early, creating a loop of buying pressure that eventually collapsed.

As more participants recalculated the dilution and valuation implications, sentiment reversed.

Post-Rights Outlook: Higher Market Cap, but Value Depends on Execution

If fully subscribed, the rights issue would raise Sanlam’s market capitalization to approximately KSh 3.35 billion (644 million shares × TERP of KSh 5.20). That reflects a near 4x increase from its pre-announcement valuation.

However, a larger market cap does not automatically increase shareholder value. To justify the new valuation, Sanlam must:

- •Allocate the capital effectively beyond just servicing debt,

- •Drive profitable growth within its core insurance segment,

- •Rebuild investor confidence after the price whiplash.

Sanlam Kenya’s rally and subsequent decline offer a compelling case study in how investor sentiment, market dynamics, and capital structure interact.

As the offer officially closes on Monday, May 12, 2025, attention will shift to:

- •Levels of shareholder participation,

- •Trading behavior once new shares list,

- •Whether Sanlam can convert financial restructuring into long-term performance gains.

However, the closing date is just one chapter. Market participants should watch the remaining key milestones:

| Date | Event Description |

|---|---|

| 21 May 2025 | Final date for payment of irrevocable bank guarantees (IBGs) and letters of undertaking (ILUs) |

| 27 May 2025 | Underwriter (Sanlam Allianz Africa) to subscribe and pay for any untaken rights |

| 29 May 2025 | Announcement of rights issue results |

| 30 May 2025 | Dispatch of share allocation statements and refunds to shareholders |

| 3 June 2025 | Electronic crediting of CDS accounts with new shares |

| 4 June 2025 | Listing and commencement of trading for new shares on the Nairobi Securities Exchange |

These events will mark the conclusion of one of the year’s most significant capital raises on the NSE. They also signal a reset — not just for Sanlam’s financials, but for investor expectations.

Ultimately, rights issues are not only about injecting fresh capital; they are also about redistributing existing value. In illiquid markets like the NSE, timing, communication, and strategy can define the gap between market success and disappointment.