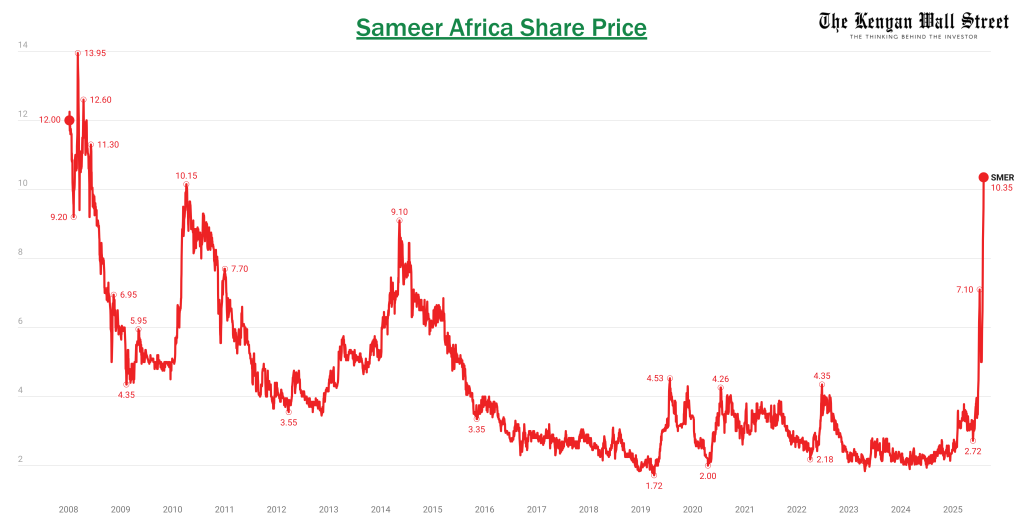

Listed on the Nairobi Securities Exchange, Sameer Africa—formerly a tyre manufacturer and now an industrial landlord—has delivered one of the strongest rallies on the bourse in 2025.

- •Its share price has surged from KSh 2.43 at the end of December 2024 to KSh 10.35 on August 5, representing a year-to-date gain of +326%.

- •This has lifted the company’s market valuation from KSh 675.54 million to KSh 2.88 billion, likely driven by investor optimism over its leaner, debt-free structure and full transition into industrial real estate.

- •The rally gained momentum in late June, when Sameer shares broke above KSh 3.50, and is now trading above KSh 10 for the first time since April 2010.

As of August 5, it is the best performing stock on the Nairobi Securities Exchange in 2025. It leads the market ahead of a suspended TransCentury at +187%, Kenya Power at +134%, and KenGen, which rounds out the triple-digit gainers with a +100% return year-to-date.

The stock has risen 234% over the past three months, including +46.2% in the past week alone. Sameer is now the 30th most traded stock on the NSE over the past quarter.

3 months period to August 5, 2025, Sameer Africa traded 2.76 million shares, with a total turnover of KSh 17 million. The highest daily volume was 309,200 shares on July 31.

Financial Drivers

The stock surge followed Sameer’s FY2024 results released in April, which marked a sharp turnaround for the company. Net profit rose more than fivefold to KSh 259.9 million, up from KSh 46.3 million in 2023. This was driven by a KSh 83.6 million unrealised forex gain and the complete elimination of interest expenses after fully repaying more than KSh 500 million in debt.

Revenue remained flat at KSh 389.5 million, but the company kept margins up by focusing on its rental business and reducing overheads. Operating profit declined 14% to KSh 198.1 million, mainly due to one-off costs related to a subsidiary.

The balance sheet improved sharply. Shareholders’ equity rose 56% to KSh 735.6 million, and total liabilities fell 22% to KSh 786 million. Sameer closed the year debt-free with a leaner structure and stronger profitability.

| Key Financial Highlights – FY2024 | Amount (KSh) | YoY Change |

|---|---|---|

| Profit After Tax | 259.9 million | +461% |

| Revenue | 389.5 million | -0.3% |

| Operating Profit | 198.1 million | -14% |

| Forex Gain (Unrealised) | 83.6 million | — |

| Shareholders’ Equity | 735.6 million | +56% |

| Total Liabilities | 786.0 million | -22% |

Business Model Shift

In 2012, Sameer Africa was still operating as a tyre manufacturer, generating over KSh 4.08 billion in total revenue. About 87% of that came from its now-defunct tyre production line. Fast forward to 2024, the company’s revenue dropped to KSh 388.6 million, but nearly all of it—99.7%—came from rental income, a stable source built on its expanding real estate portfolio.

The shift was not only sectoral but structural: Sameer moved from a high-volume, low-margin manufacturing business to a leaner model based on real estate returns. Its property holdings now exceed 750,000 square feet in Nairobi, anchored by assets like Sameer Business Park and Rivaan Centre.

Despite a 90% reduction in total revenue over the 12-year period, the company’s 2024 net profit surpassed its 2012 level, highlighting the profitability and financial efficiency of its new model. The strategic pivot allowed Sameer to offload the cost-heavy manufacturing segment while doubling down on high-occupancy commercial property, positioning it as a resilient income-generating business.

While Sameer’s strategic shift has delivered clear financial gains, the company remains highly reliant on rental income, making it vulnerable to market shocks in the property sector. The company is seeking to grow its rental portfolio, including plans to lease out space in a new warehouse under its Infill Project, though progress has been delayed.

Sameer Africa’s pivot from tyre manufacturing to real estate is now one of the most successful turnarounds on the Nairobi Securities Exchange. With a quadrupled market cap, restored profitability, and a simplified operating model, the company has regained investor confidence. The challenge ahead lies in sustaining growth and building revenue diversity without compromising its new structure.