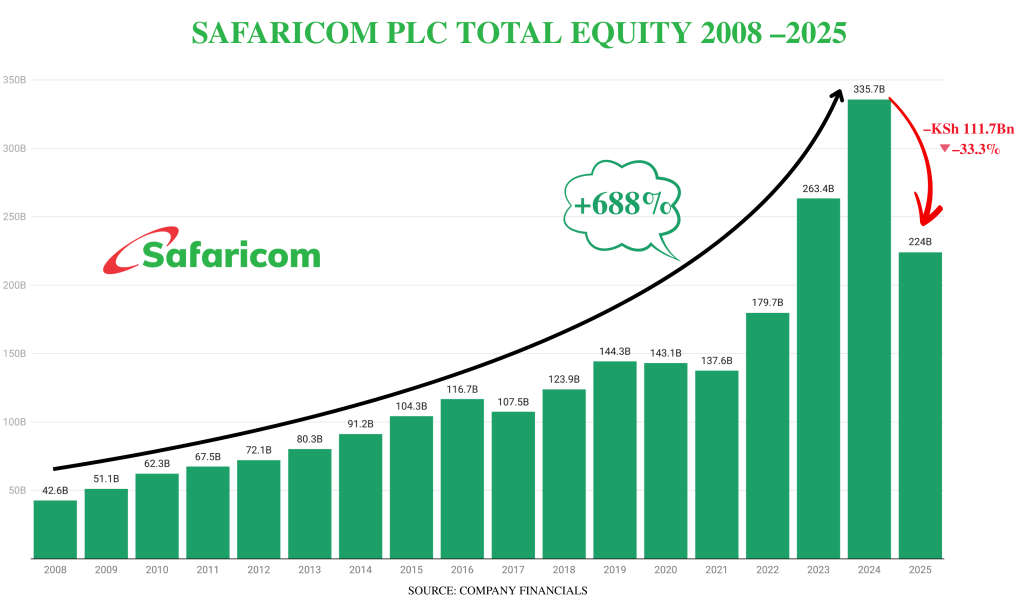

Safaricom PLC has posted a net profit of KSh 69.8 billion and maintained a KSh 48.08B dividend, but its total equity fell by KSh 111.7B (–33.3%), from KSh 335.7B in FY2024 to KSh 224.0B in FY2025, the biggest drop in its history.

The core Kenyan business showed healthy growth across key revenue streams:

- •Net income (Kenya only): KSh 95.5B (+12.7%)

- •Group Profit After Tax: KSh 45.76B

- •Profit Attributable to Shareholders: KSh 69.8B

- •M-PESA revenue: KSh 161.1B (+15.2%)

- •Mobile data revenue: KSh 72.9B (+15.2%)

Why Did Equity Fall So Hard?

The answer lies in a KSh 153.8B foreign exchange translation loss from Safaricom Telecommunications Ethiopia (STE). This is a consolidated subsidiary. According to international accounting standards (IAS 21 and IAS 29), the group must translate the value of foreign assets and reserves into Kenya shillings.

Between April 2024 and March 2025, the Ethiopian Birr weakened from 2.2 to 0.98 per KSh. As a result, the value of STE’s assets in Kenyan shillings dropped significantly.

This loss did not affect cash or operating profit. Instead, it flowed through Other Comprehensive Income (OCI) into the Foreign Currency Translation Reserve (FCTR). This directly reduced shareholder equity.

Example: If Safaricom held 1B birr in assets, that was worth KSh 1B at a 2.2:1 rate. After devaluation to 0.98, the same assets would be worth under KSh 500M — a KSh 500M equity write-down.

Safaricom’s 17-Year Equity Journey

Safaricom’s total equity grew from KSh 42.6B in 2008 to a peak of KSh 335.7B in 2024 — an increase of 688%. FY2025 erased years of accumulated gains in a single fiscal period.

Implications for Investors

- •Profits remained strong: The KSh 69.8B PAT supports dividend continuity and reinvestment.

- •Equity perception hit: Book value dropped by one-third, which may concern value investors.

- •FX exposure is real: Ethiopia’s devaluation affected more than revenue — it revalued the balance sheet.

Safaricom’s FY2025’s results highlight the inherent currency risks in regional expansion carries currency risk, and magnify macroeconomic volatility.