1 million customers unsubscribed from Safaricom’s Fuliza overdraft service in 2023, according to the company’s latest financial results.

- •The service’s customer numbers reduced from 8.1 million to 7.1 million, marking a 13.2% contraction.

- •It led to reductions in average ticket size- which are down by 14.6% to KShs. 254.4 per person, and revenues, which dropped by 28.4% to KShs 3.9bn.

- •Other lenders on the platform faired better, although their customer numbers and revenues are much smaller than Fuliza’s, but their average loan sizes are much higher.

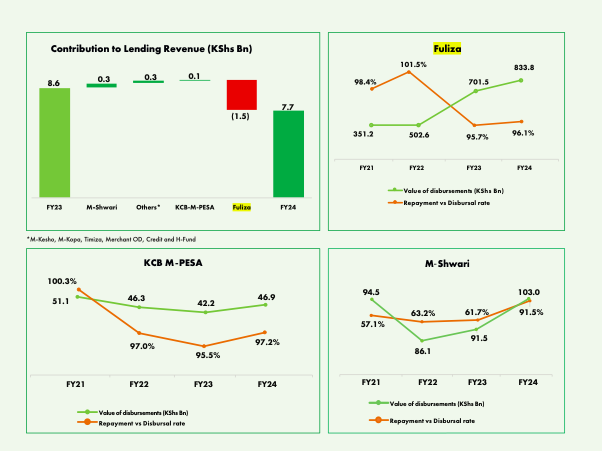

KCB Mpesa’s revenues grew by 15.4% to KShs. 700 million, while its customers grew by 8.9% to 4million. Its average loan size is now Ksh 5,928, and the service has the highest repayment rate at 97.2% in 2023.

MShwari’s revenue grew by 12.4% and its customers by 22.3% to KShs. 2.3billion and 6.5 million customers respectively. MShwari also had the highest increase in repayment rates, which rose from 61.7% to 91.5%, while its average loan size rose from KSh 7, 793 to KShs. 10, 126.

Fuliza in the Credit Market

Fuliza’s revenue drop is the first since the company launched the service in 2019. A report by the Competition Authority of Kenya (CAK) in February showed that the overdraft product rapid expansion had caused some market fragmentation, especially for small ticket sizes.

A big part of its initial exponential growth was due to timing, with disbursements surpassing Kshs. 1bn daily during the pandemic. In September 2022, Safaricom and its banking partners-NCBA and KCB- reduced the cost of overdraft fees on the service which included a zero-cost period for the first three days for small ticket sizes. The reductions, meant to ease the cost of credit which accrues daily on the service, led to a dip in revenues.

Despite the contraction in major indicators in 2023, Fuliza is still the biggest credit provider in the MPESA ecosystem. It disbursed Kshs. 833.8bn in 2023, an 18.9% rise from 2022.