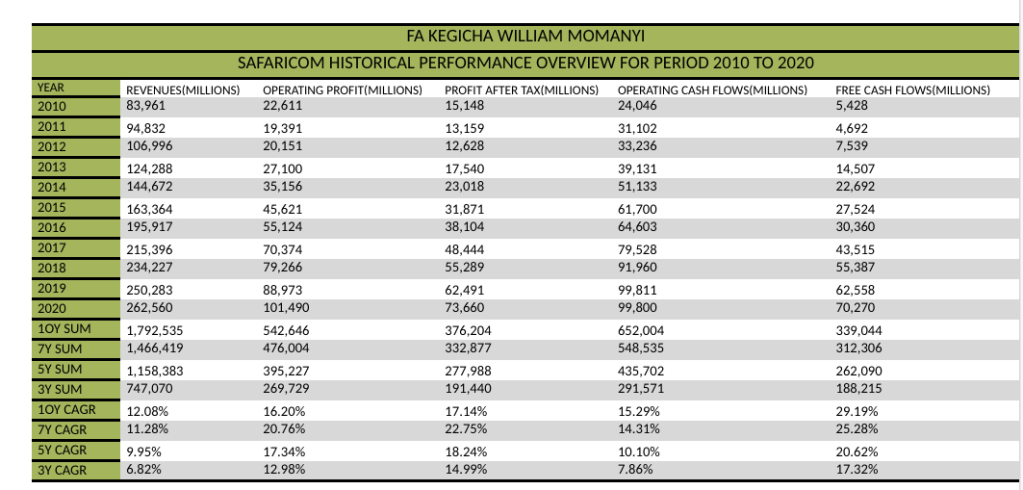

Safaricom PLC has been a fantastic business that has managed to achieve a sales growth of 12% for the period 2010 to 2020 driven majorly by mpesa revenue growth and mobile data growth. Over the last decade, Safaricom revenues have amounted to shs.1.8 trillion.

Safaricom PLC operating profit has amounted to sh. 543billion in the last decade and it has grown by at least 16% in the same time frame. As noted operating profit has grown at a slightly higher rate as compared to revenue growth, implying that some of the growth in operating income is attributable to an improvement in operating efficiency by Safaricom Plc through measures like digitisation of operations.

Profit after tax for telecom titan has amounted to sh.376billion for the last decade and a compound average growth of 17% has been achieved over the same period. Operating cash flow for Safaricom PLC has amounted to sh.652 billion over the last ten years and growth achieved over the same time frame has been 15%. You could like to see this for any good company as this clearly indicates, Safaricom profit after tax is not tied up in working capital items like inventory and receivables. Free cash flows for Safaricom Plc has amounted to sh.339billion for period 2010 to 2020. Free cash flows are important to any serious investor since this is what is used to pay dividends to you as the shareholder.

Items that will drive Safaricom plc growth include digitisation of operations which will help Safaricom cut costs further; offering insurance products via phone by emulating Econet wireless; bridging gap between active voice call and mpesa users; adoption of cashless payments which will drive further growth in Mpesa revenues key catalyst being COVID 19, doubling of Mpesa transaction and wallet limit which we are of the view is here to stay and monetisation of the huge data troves in the hand of Safaricom Plc to be sold to third parties and to come up with new products to better meet the needs of their clients.

I am of the view too that for the next ten years Safaricom should brace for competition from formidable competitors like Microsoft, Amazon and Pay pal. What are your thoughts on the future of Safaricom in the decade 2020 to 2029?