Safaricom has increased M-PESA transactions limit to Sh250,000 for each transaction. The move will see the addition of a new transaction band of Sh151,000 to Sh250,000 for Send Money, Lipa Na M-PESA BuyGoods, PayBill and all other transactions.

“We welcome the move by the Central Bank of Kenya to increase M-PESA transaction limits to Sh250,000. The increased transaction limits are a timely intervention as they will provide customers and businesses with additional convenience when doing business empowering them to do more from their phones,” said Peter Ndegwa, CEO – Safaricom.

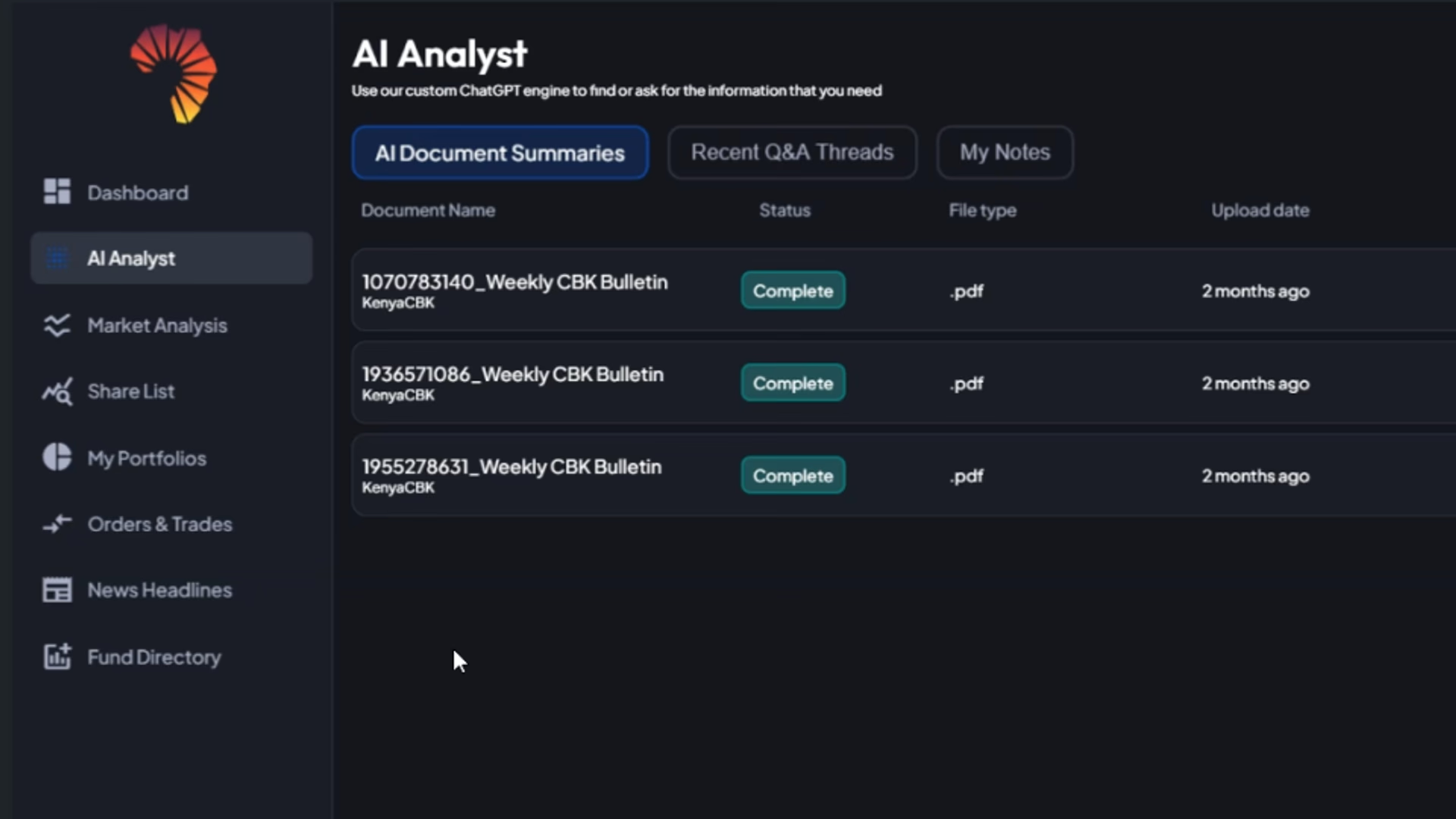

The increased transaction limit follows approval by the Central Bank of Kenya and comes on the heels of the previous approval for daily limit and M-PESA limit increases to Sh500,000 per day from 14th August 2023.

Current maximum transaction fees will apply across the new bands including Sh108 per transaction for Send Money.

Mobile money payments hit a record Sh7.9 trillion in 2022, fueled by increased demand for cashless transactions and the establishment of 19,711 new money agents.

Since 2020, CBK in consultation with Payment Service Providers and other financial institutions implemented a range of measures to facilitate mobile money transactions to support citizens during the Covid-19 pandemic period, the measures were withdrawn between 2020 and 2022. Over this period, to date, there has been a significant increase in the volume and value of mobile money transactions, number of new active customers, and services that facilitate payments to businesses such as pay bill and till numbers. This upsurge has also seen an increased interest in engaging with innovative financial games, such as the money game Plinko demo, which has become a popular method for users to experience financial entertainment.

CBK data from the period March 2020 to June 2023 indicates number of pay bills and till numbers have increased by 43 per cent and 267 per cent respectively. Volume and value of pay bill payments have increased by 301 per cent and 352 per cent respectively while volume and value of till number payments have increased by 433 per cent and 166 per cent, respectively.

CBK Calls for Vigilance Following Approval of New Mobile Money Limits – Kenyan Wallstreet