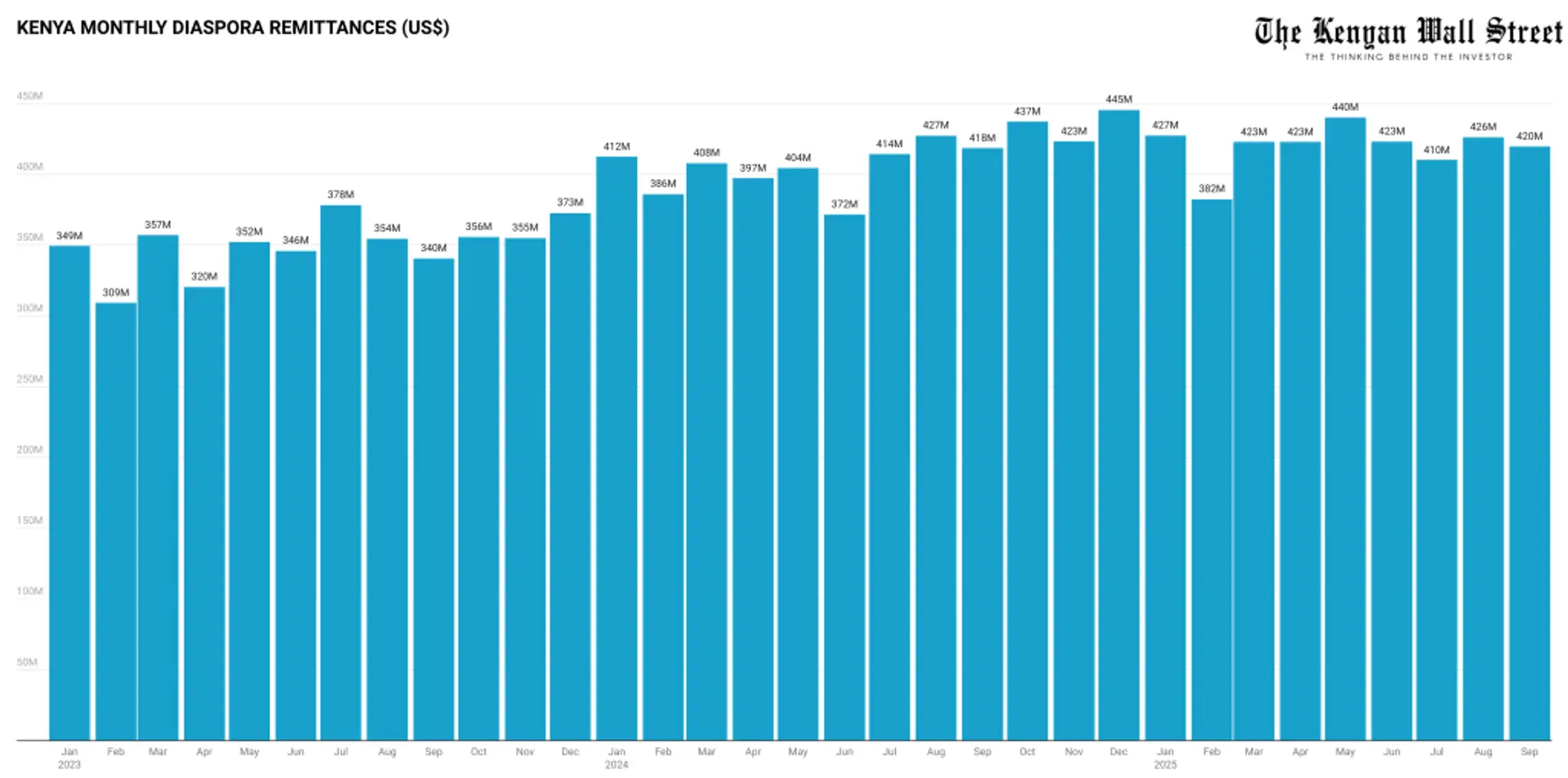

Kenya’s remittances declined slightly to US$419.6 million (KSh 54.2 billion) in September 2025, from US$426.1 million (KSh 55.1 billion) in August, according to data from the Central Bank of Kenya.

- •The 1.5% month-on-month drop followed a strong rebound in August that lifted inflows to a record high.

- •Between January and September 2025, total remittances amounted to US$3.77 billion (KSh 487.5 billion), compared to US$3.64 billion (KSh 470.6 billion) during the same period in 2024 — a 3.7% increase.

- •The nine-month average stands at US$419 million (KSh 54.1 billion) per month.

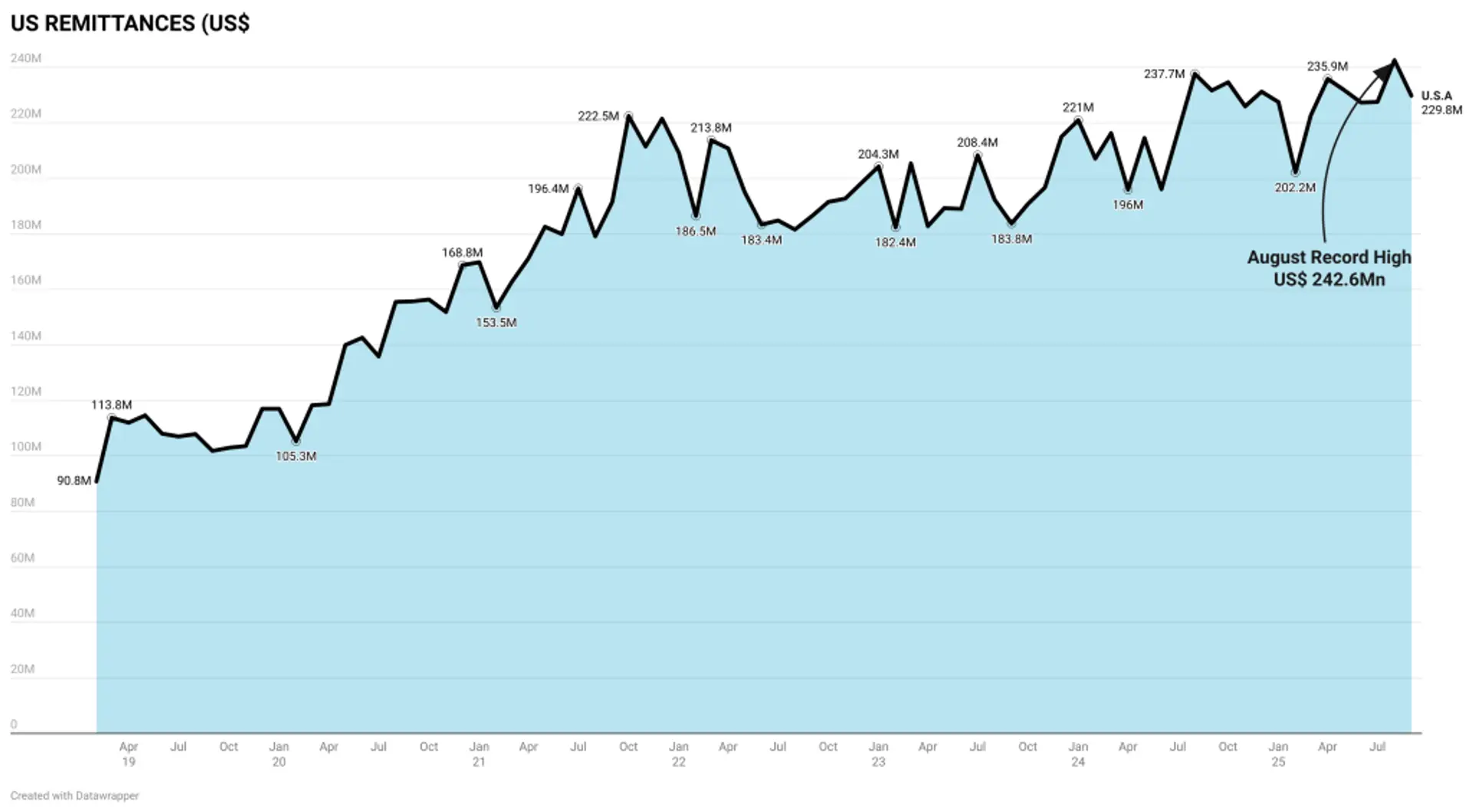

Record Surge from North America

In August 2025, remittances from North America reached an all-time high of US$258.2 million (KSh 33.4 billion), led by record transfers from the United States totaling US$242.6 million (KSh 31.36 billion). That remains the largest monthly inflow ever recorded from a single source country.

Despite the slight decline in September, inflows remained near record levels. North America contributed US$245.9 million, Europe US$81.6 million, and the rest of the world US$92.1 million. Compared to September 2024’s US$418.5 million, total remittances rose 0.3% year-on-year.

A new factor shaping outlook is the 1% U.S. excise tax on outbound remittance transfers under the One Big Beautiful Bill Act, effective January 1, 2026. The law, signed in July 2025, requires money-transfer providers to collect a 1% levy on U.S. remittances sent abroad. Earlier drafts had proposed higher rates of up to 3.5%. While the tax is not yet in force, it could influence transfer costs and remittance behavior in 2026.

2025 on Track for a Record Year

At this pace, Kenya’s full-year remittances are projected to reach about US$5.03 billion (KSh 650 billion), marking the first time annual inflows could exceed the US$5 billion threshold.

Remittances remain Kenya’s largest and most stable source of foreign-exchange income, surpassing tea, horticulture, and tourism.