The National Assembly’s Finance and Planning Committee has proposed to extend the period that commercial banks will raise their core capital to at least KSh 10 billion from three to eight years.

- •The Kenya Bankers Association (KBA) lobbied for the extension of the period of compliance to this requirement, which was initially set at 3 years.

- •The Business Laws (Amendment) Bill, 2024, required banks to increase their core capital from at least KSh 1 billion to at least KSh 10 billion to strengthen the banking sector.

- •The lenders argued that the timeframe was too short and many banks would not be able to achieve the core capital and operate effectively.

“The committee noted that 3 years, as proposed in the bill, is too short a time for the banks to restructure and achieve the KSh 10 billion core capital. The committee is proposing a phased-up approach of a maximum 8 years to achieve the set target of core capital,” the committee said.

The KSh 1 billion requirement was set in 2012. The finance committee noted that despite the exponential growth of banking assets, liabilities, the number of depositors and borrowers – the threshold was not scaled up.

“The low capital base, which supports a significant asset base of the banking sector, makes it more susceptible to bank failure. The current minimum core capital can no longer support the sector’s current and expected growth trajectory,” the committee added.

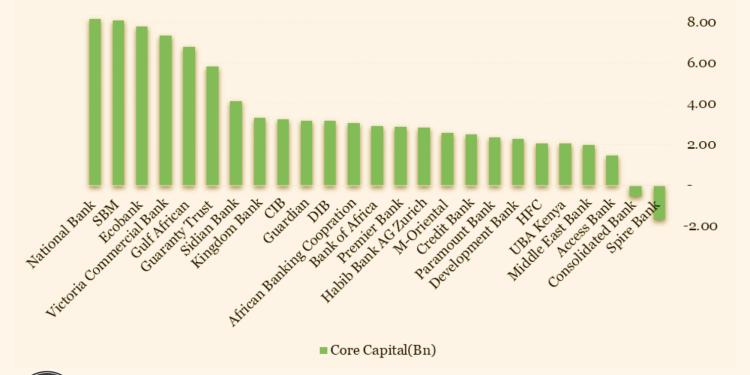

Commercial banks were also expected to attain a core capital requirement of KSh 3 billion by the end of 2025. According to data from CBK, only 24 out of 38 licensed banks were poised to cross the core capital threshold of KSh 10 billion if the time lapsed this year. This means that smaller banks, most of which are subsidiaries of larger banks, would be on the edge.

The proposal could lead banks to tap into alternative funding and possibly merge with others. Subsidiaries such as Kingdom Bank (Co-operative Bank subsidiary), SBM Bank, and CIB Kenya, would need substantial capital injections to survive the cut.

Some lobbyists pleaded for the reduction of the core capital requirement, citing that bigger banks – which control 80% of the sector – will also consolidate their market presence leaving smaller banks to fold. This could potentially limit competition in the banking industry.

The move is intended to match similar decisions made by the Bank of Uganda and the Bank of Tanzania. Banks are required to maintain 10.5% core capital to total risk-weighted assets, and 14.5% total capital to risk-weighted assets.

In June this year, the Treasury said that the tenfold increase in the requirement was meant to enable banks absorb shocks and finance large scale projects while ensuring sufficient capital buffers.