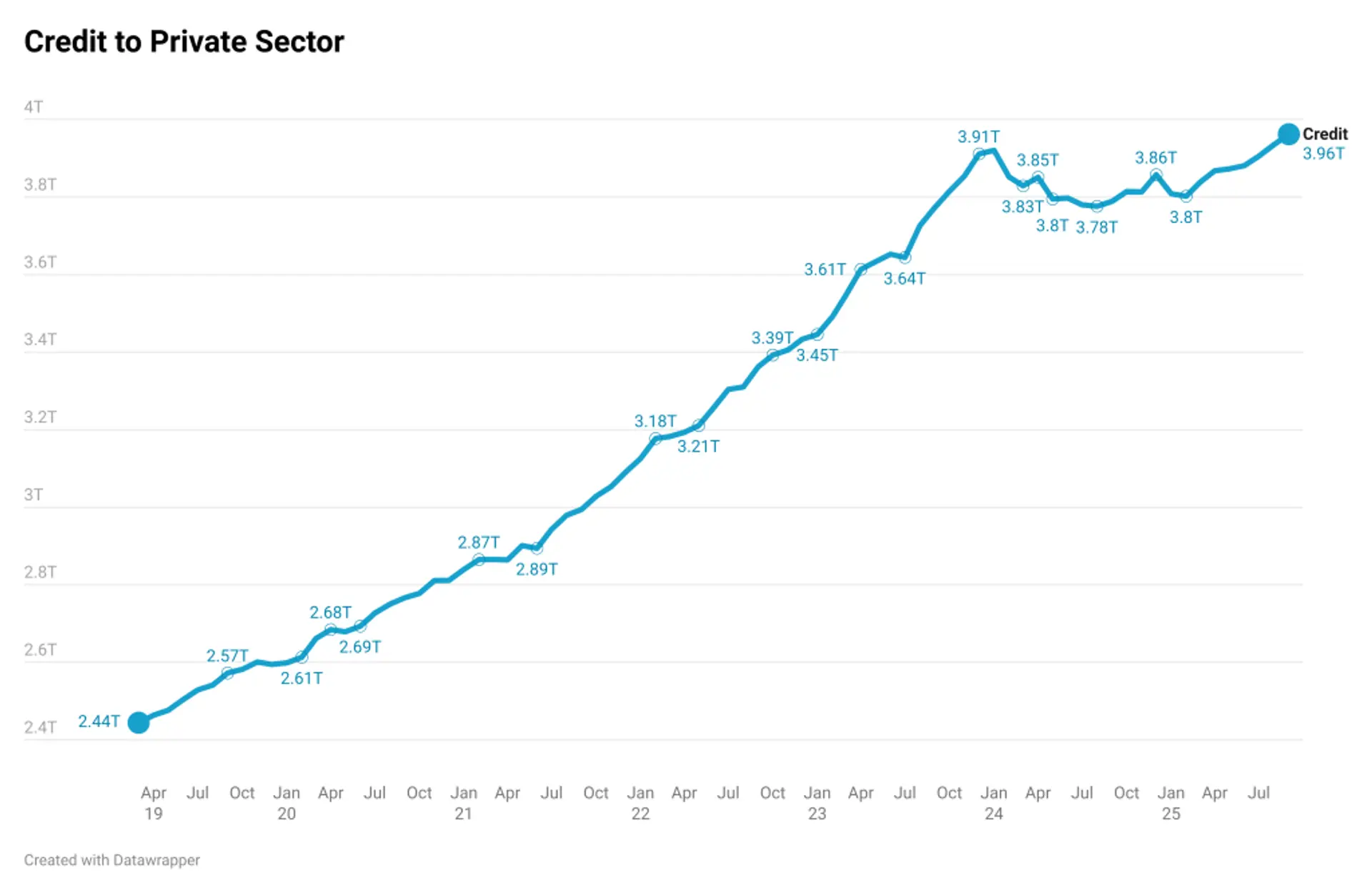

Kenya’s private-sector credit stock rose to an all-time high of KSh 3.96 trillion in September 2025, marking a full recovery from the slowdown seen through 2024.

- •Central Bank of Kenya (CBK) data show lending grew 5.0% year-on-year, up from 3.3% in August and -2.9% in January, reflecting a strong rebound in loan demand across key sectors.

- •The recovery is the first sustained upswing in private credit growth since mid-2022, and follows a period of near-stagnation in 2024, when high interest rates and tight liquidity constrained lending.

- •Private-sector credit stock had dipped to KSh 3.78 trillion by mid-2024 before rebounding sharply as monetary easing filtered through the banking system.

The CBK attributed the improvement to declining lending rates and stronger credit appetite as liquidity conditions eased. Average commercial bank lending rates fell to 15.1% in September from 17.2% in November 2024, following eight consecutive Central Bank Rate cuts — the longest easing streak in Kenya’s monetary on record.

Broad-Based Expansion Across Key Sectors

Sectoral data from the Monetary Policy Committee (MPC) show credit expansion was broad-based. Manufacturing lending rose 11.1% year-on-year, reversing a year of contraction.

Building and construction loans surged 52.9% on renewed project financing, while consumer durables credit climbed 12.2% as households responded to lower borrowing costs. Trade sector credit grew 3.9%, moderating from its June peak of 12.0%.

CBK said the rise in credit largely reflects improved demand for working capital and investment loans as economic activity strengthens.

The MPC noted that continued implementation of the Risk-Based Credit Pricing model, due by March 2026, will further improve transparency in loan pricing and enhance monetary policy transmission.

With credit to the private sector now at a historic high, the CBK said it will monitor developments closely to ensure lending growth remains consistent with price stability and overall macroeconomic balance.