Norway’s sovereign wealth fund is one of the largest in the world and is managed by the asset management unit of the Norwegian Central Bank i.e. Norges Bank Investment Management. They actively deploy capital around the world with an aim in achieving the highest return possible in order to safeguard and build financial wealth for future generations.

The fund’s asset allocation is:

- Equities 62.5%

- Fixed Income 34.3%

- Real Estate 3.2%

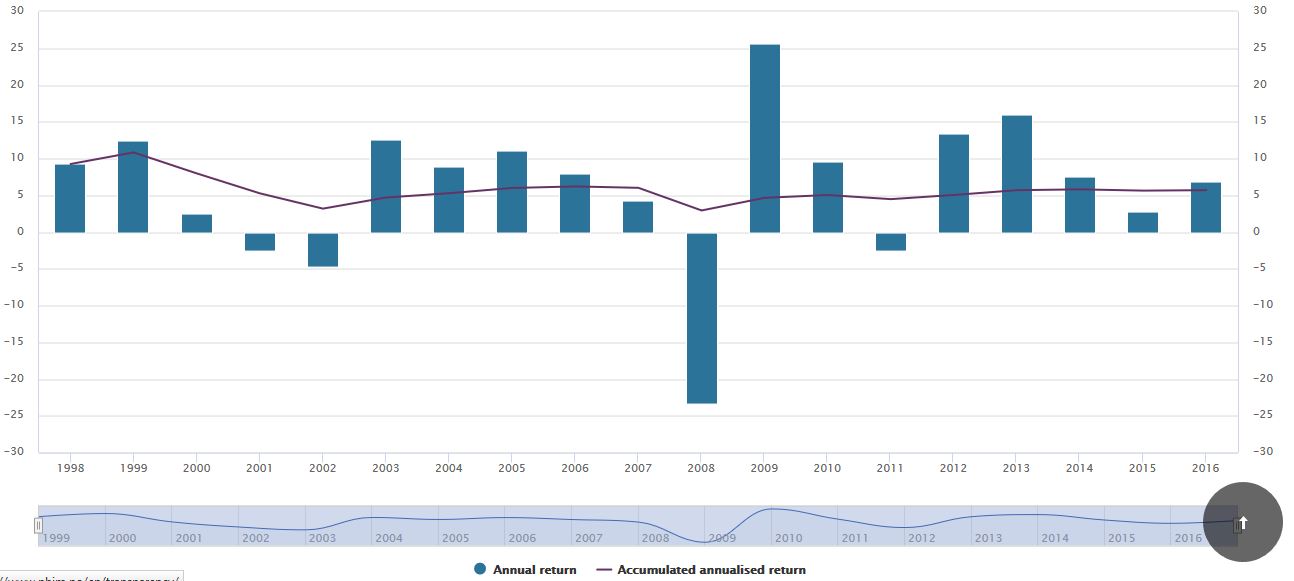

The fund has managed to generate an annual return of 5.7 percent since 1998 (formation of Norges Bank Investment Management) to the end of 2016, measured in the fund’s currency basket. After management costs and inflation, the return was 3.8 percent. The return in dollars was 5.8 percent.

The funds equity investments are spread across the world, the largest geographic exposure is to Europe and North America, followed by developed markets in Asia and Oceania and emerging markets.

The fund’s largest holdings are in:

- Nestle

- Royal Dutch Shell

- Apple

- Alphabet

- Microsoft

- Roche Holding

- Novartis

Note the fund has a set a limit of 10% ownership on any given listed company they invest in mandated by the Ministry of Finance.

The fund uses the FTSE Global All Cap Index as a benchmark, they employ an active investment strategy in order to beat the return on this benchmark.

Norges Bank has also various equity investments in Africa specifically in:

- Botswana

- Egypt

- Ghana

- Kenya

- Mauritius

- Morocco

- Nigeria

- South Africa

- Tanzania

- Tunisia

- Uganda

The fund has debt investments only in two countries in Africa i.e Tunisia and South Africa. They do not have any real estate investments in Africa.

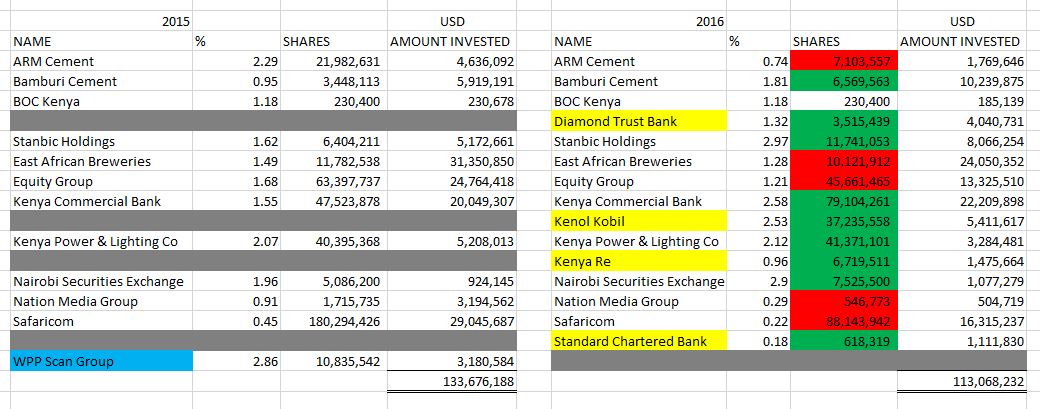

Coming down to Kenya the company had 12 equity investments as at the end of 2015. In their latest holdings report they have increased their equity investments to 15 companies as at the end of 2016.

During 2016 the fund reduced their holdings in ARM Cement, East African Breweries, Equity Group, Nation Media Group and Safaricom. They sold out their entire 2.86% stake in WPP Scan group.

Norges Bank made four additions in 2016 i.e.

- Diamond Trust Bank – 1.32% ownership

- Kenol Kobil – 2.53% ownership

- Kenya Reinsurance Corporation – 0.96% ownership

- Standard Chartered Bank of Kenya – 0.18% ownership

Kenol Kobil’s share price performance was one of the best on the NSE in 2016

Norges Bank employs an aspect of responsibility investing in their investment process and excludes companies in their investment universe that engage in:

- Production of coal or coal based energy

- Production of cluster ammunitions

- Production of nuclear weapons

- Production of tobacco

- Serious violation of human rights

- Severe environmental damage

- Gross corruption

- Serious violations of individuals’ rights in situations of war and conflict

- Other particularly serious violations of fundamental ethical norms

RELATED;

Kenyan Stocks among Franklin Templeton Top Holdings in latest fillings

Largest Sovereign Wealth Fund’s Investment Journey in Kenya

Source: (Norges Bank Investment Management, Kenyan Wall Street, FT)