Over time, banks have collected tremendous amounts of data from their customers, including spending habits, income, demographics, etc., and they are currently sitting on a data treasure trove. Despite having all this data, there has been little innovation in the space on how to serve consumers better.

On the other hand, Fintech companies have proliferated the Sub-Saharan Africa (SSA) market and caused a lot of disruption more so in the payments and credit space. As a matter of fact, open banking/finance on the continent stemmed from two major pain points:

i. Payment startups faced numerous challenges when they sought to integrate directly with banks and;

ii. Credit/lending startups had a hard time ascertaining borrower creditworthiness given the shallow credit profiles on the continent.

?How challenges in the payments landscape influenced open banking

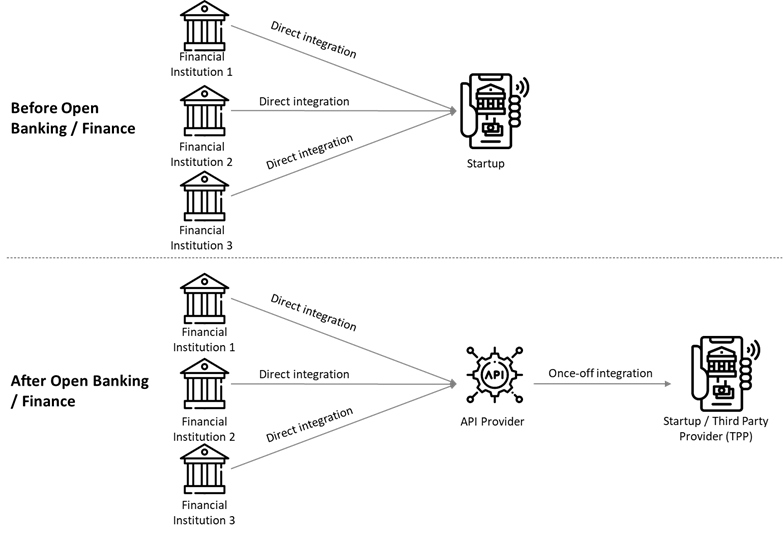

Before the rise of open banking, if a payment processing company wanted to accept a direct payment from a financial institution such as a bank or mobile money wallet, it would have to integrate directly with card payment processors and mobile money wallets.

Note, the earlier forms of integrations mainly solved for card payments; that is, they did not allow for card-not-present situations. Therefore, if a payment processing company wanted to accept a direct bank payment, it would take tremendous time and effort to integrate with all the banks directly. This slow and lengthy integration process resulted in the formation of other companies that sought to supplement the services offered by payment processors, such as open banking/finance companies, which have helped the payment processors by not having to build entire integration stacks.

?How challenges in the credit/lending landscape influenced open banking

Similarly, Fintechs offering credit often face challenges in assessing the borrower’s creditworthiness and collecting loan repayments. With the rise of open banking, these Fintechs could access borrowers’ financial accounts and collect payments more seamlessly.

?The state of open banking and open finance on the continent

With this context in mind, let us delve deeper into the current and potential use cases.

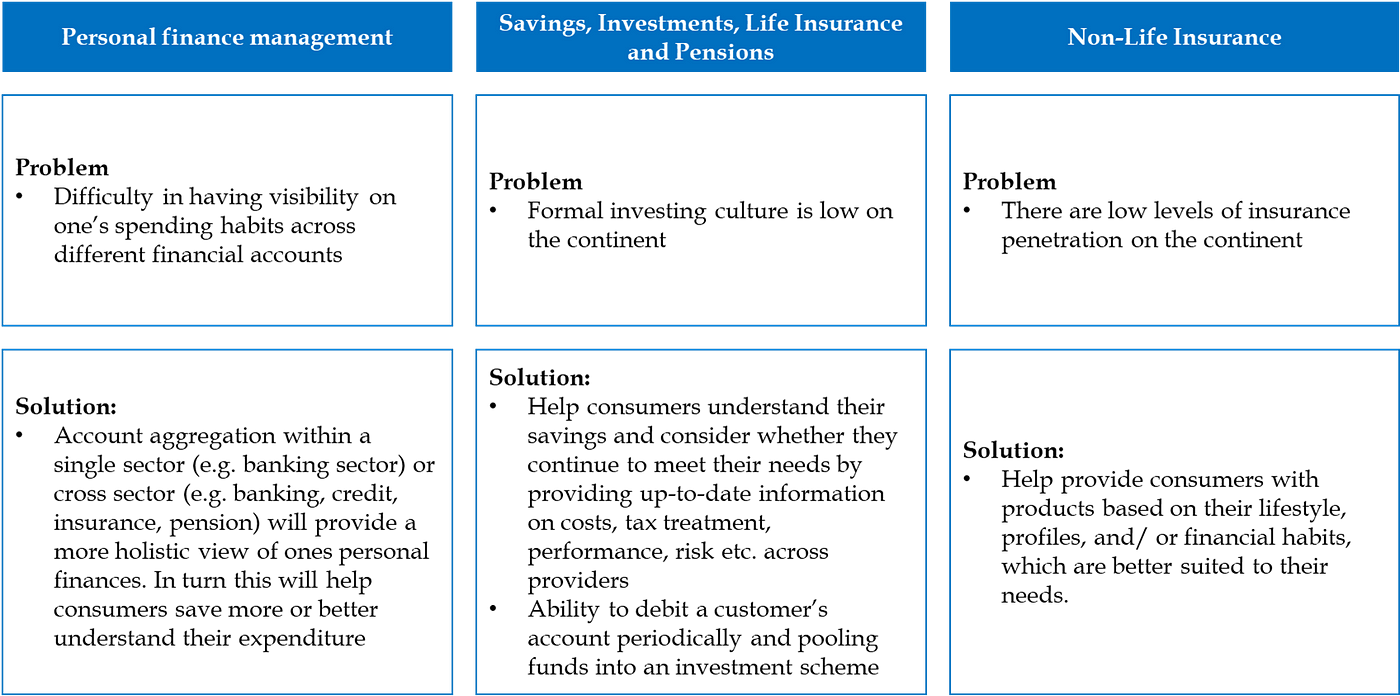

Current use cases

Future use cases

From the images above, we see that the businesses and customer experience have improved over time as new value has been created and there exists the potential for new use cases such as personal finance management and investments exists.

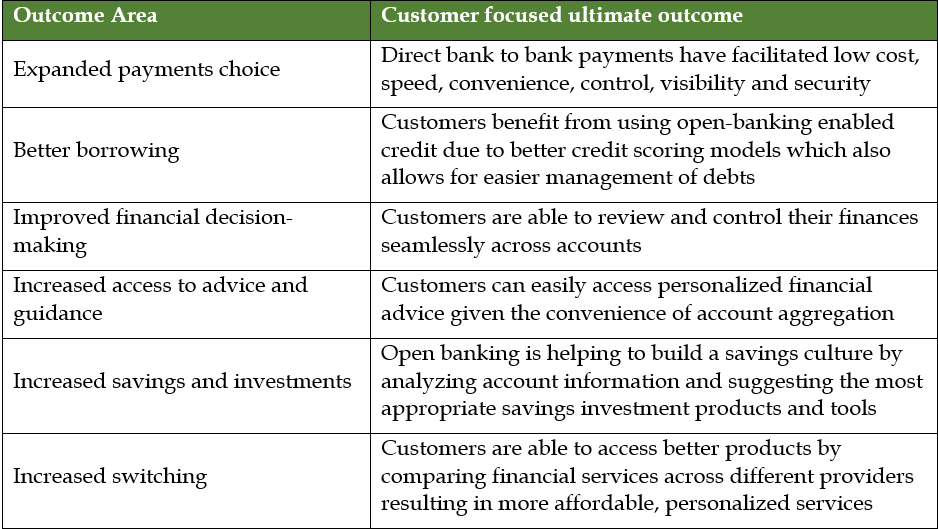

In summary, the table below depicts the intended outcomes of open banking.

⚖Regulatory Landscape Review

With the rise of open banking/finance, there has been increasing attention from regulators on the continent. For this article, I shall compare and contrast the regulatory landscape in Nigeria, South Africa, and Kenya.

Nigeria

Nigeria is currently at the forefront of regulatory reforms and will become Africa’s open banking pioneer. In 2018, the Open Technology Foundation (OTF), a not-for-profit organization driving the development and adoption of Open Banking standards in Nigeria, was formed. The primary objectives of the OTF are to:

i. Analyze the need of the industry for common API standards among banks and other financial institutions

ii. Develop the common API standards

iii. Provide a sandbox and other testing tools for certification

iv. Promote the adoption of Open Banking standards with stakeholders across Nigeria

v. Enable further innovation in the financial services industry

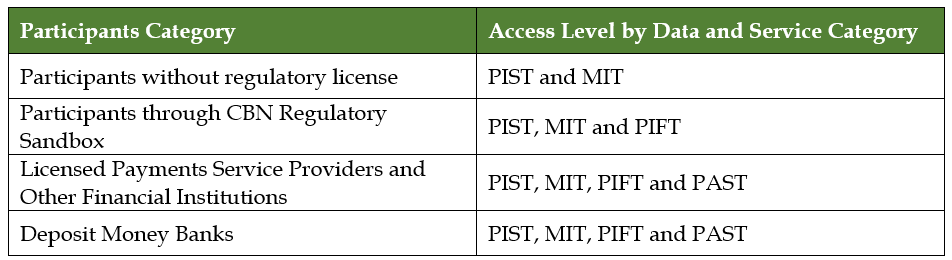

Following this, the Central Bank of Nigeria (CBN) has taken it further by issuing a regulatory framework for open banking in Nigeria. The framework establishes principles for data sharing across the banking and payments ecosystem, which will promote innovation, broaden the range of financial products and services, and deepen financial inclusion by providing guiding principles for API specifications.

The objectives of the framework are as follows:

i. To provide an enabling regulatory environment for innovative and customer-centric financial services through the safe utilization and exchange of data and services

ii. To define risk-based data access levels and service categorizations toward effective management of risk in the operation of open API

iii. To outline baseline requirements and standards for the exchange of data and services among participants in the financial services sector

iv. To provide risk management guidance for operators in the financial services space for leveraging data and APIs in the provision of financial services

v. To promote competition in banking and other financial services and enhance access to financial services

South Africa

As open banking/finance increasingly gains momentum, various South African regulators and policymakers have taken strides to understand the potential benefits and risks of open finance in the country and are working towards establishing appropriate regulatory frameworks.

· The South African Reserve Bank’s National Payment System Department (NPSD) published a consultation paper on open-banking activities in the national payment system in November 2020, which aims to develop a policy position on open banking with a focus on payments.

· The Financial Sector Conduct Authority (FSCA) published a consultation and research paper on regulating open finance in December 2020. Some aspects of this regulatory framework include how the customer is treated from consent, to how customer data is handled across the data management chain.

· The Intergovernmental Fintech Working Group (IFWG) established the Open Finance Integration Working Group (OPI WG) in late 2020 to serve as a platform for South African regulators and policymakers to draw on each other’s perspectives on open finance, over and above the positions put forward from a payments or conduct perspective.

Despite the lack of a unifying regulatory framework in the country, some banks have adopted open APIs.

Kenya

Having observed the growing integration of banks and other financial institutions with innovators in the financial services industry across the globe, the Central Bank of Kenya (CBK) released a draft document outlining the bank’s 5-year plan (2021–2025). This plan seeks to establish a regulatory landscape that embraces innovation, with open banking being one of the key focus areas.

Currently, the lack of open and secure APIs means that larger players maintain their market position, stifling innovation and healthy competition. In Kenya, this is particularly challenging because mobile money wallets also represent a considerable share of the store of value. Banks, as well as mobile payment service providers, are yet to fully open up access to their APIs, which has limited innovation and the ability of new products to be rolled out. The CBK will work to standardize open and secure APIs by defining industry-wide standards for effective API development. In turn, this will allow customers to easily permission their data for use by TPPs.

In conclusion, I believe that regulators across the continent should enforce a mandatory open finance regime to promote collaboration between incumbents and TPPs. Otherwise, incumbents will have no incentive to share the consumer data leading to fewer innovations in the market and high barriers to entry.

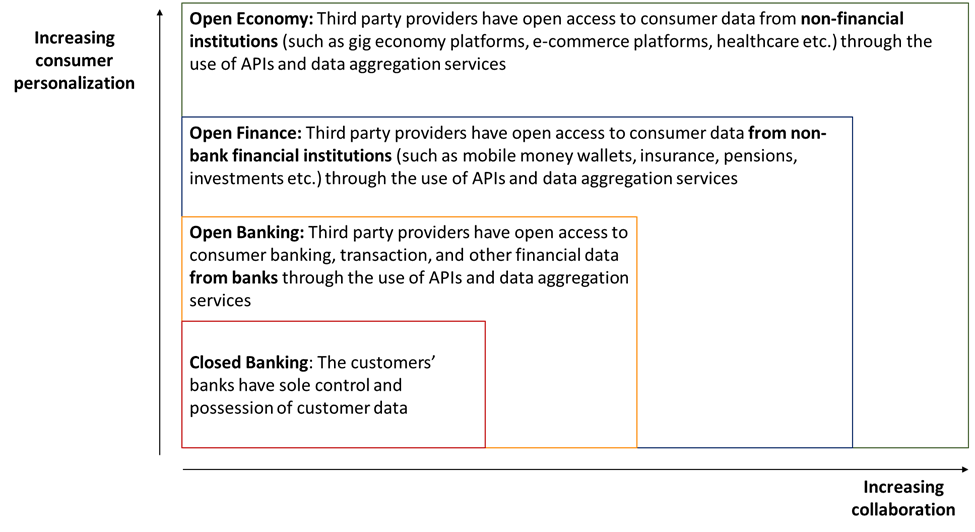

?Looking ahead: the move from open banking/finance to an open economy

With the information revolution underway and the rise of digital technology, data is king. There will be a gradual shift in the economy whereby data sharing will include data from gig platforms, e-commerce platforms, healthcare providers, and any other platform that holds large amounts of consumer data.

To illustrate this point, I will consider the healthcare sector and look into Swift MediSpark, a healthcare startup.

MediSpark started off as an EMR company that created software for hospitals to manage their data. As they built this solution, they faced a lot of challenges when it came to integrating their software with various players in the ecosystem. This led the founders to pivot the company and focus on building an ecosystem of APIs for Africa’s healthcare system.

The firm then set out to do the following:

i. Connect healthcare providers to insurers to facilitate more accurate claim submissions against patient data and allow for faster payments

ii. Connect healthcare providers to researchers to allow for more clinical trials and drug development research

iii. Connect healthcare providers to patients to smoothen out the healthcare process from medical bill financing to medication refills to virtual consultations

iv. Connect healthcare providers to Fintechs, which can provide a layer of products such as payments and financing services for the consumer

v. Connect healthcare providers to other providers for referral services and health record sharing regardless of what Electronic Medical Record (EMR) tool they use.

However, after building this solution for a while, the founders decided to pivot once more and offer BNPL services for healthcare services not catered to by insurance firms such as in vitro fertilization (IVF). The main reasons for doing so were as follows:

i. The firm faced a hard time monetizing this data. This is because there are not a lot of players building in the healthcare space to require those integrations and those that are building are not entirely willing to pay for the data. (For a firm to buy data they must be extremely large and the data must be very bespoke — this is why they pivoted from selling data to building a product off of the data)

ii. The insurance penetration rate on the continent is very low and consequently insurance firms do not process a large number of claims. This implies that insurers do not see the value of buying extra sets of data to improve their actuary models as they can adequately price products based on their own in-house data. In order for companies such as MediSpark to succeed in this space, the insurance sector has to mature significantly.

Nevertheless, the company will continue to partner and integrate to various healthcare players and build out its data as it awaits for the market to mature.

Another example of open economy innovation can be witnessed in Ethiopia. MasterCard, Gavi, the Ethiopia Ministry of Health and JSI, recently announced a partnership to implement the MasterCard Wellness Pass solution within Ethiopia’s health information system, to bring efficiency to healthcare tracking and offline portability of health records in the most marginalized communities. With time, this data will allow financial providers such as insurance firms to provide more personalized insurance that are accurately priced.

Note that the healthcare industry is just one sector that can benefit from an open economy and the possibilities are endless. As seen in the case of MediSpark, for an open economy to succeed the entire ecosystem must be relatively mature.

In conclusion, it will therefore take considerable time and effort for other sectors to catch up to the Fintech sector. Nevertheless, we expect increased access to consumer data to power hyper-personalized, contextual, predictive, and pre-emptive financial experiences across numerous fields.

Related:

Kenya’s Central Bank Gears Up For Open Banking in New 5-Year Strategy