The Nairobi Securities Exchange (NSE) is currently navigating a defining moment, poised between a future of democratized capital markets and the entrenched resistance of traditional stockbrokers.

- •NSE’s ambitious 2025-2029 strategy, spearheaded by CEO Frank Mwiti, aims to attract 9 million new retail investors by allowing everyday Kenyans to build wealth through direct trading access, diversified products, and an expanded agency network.

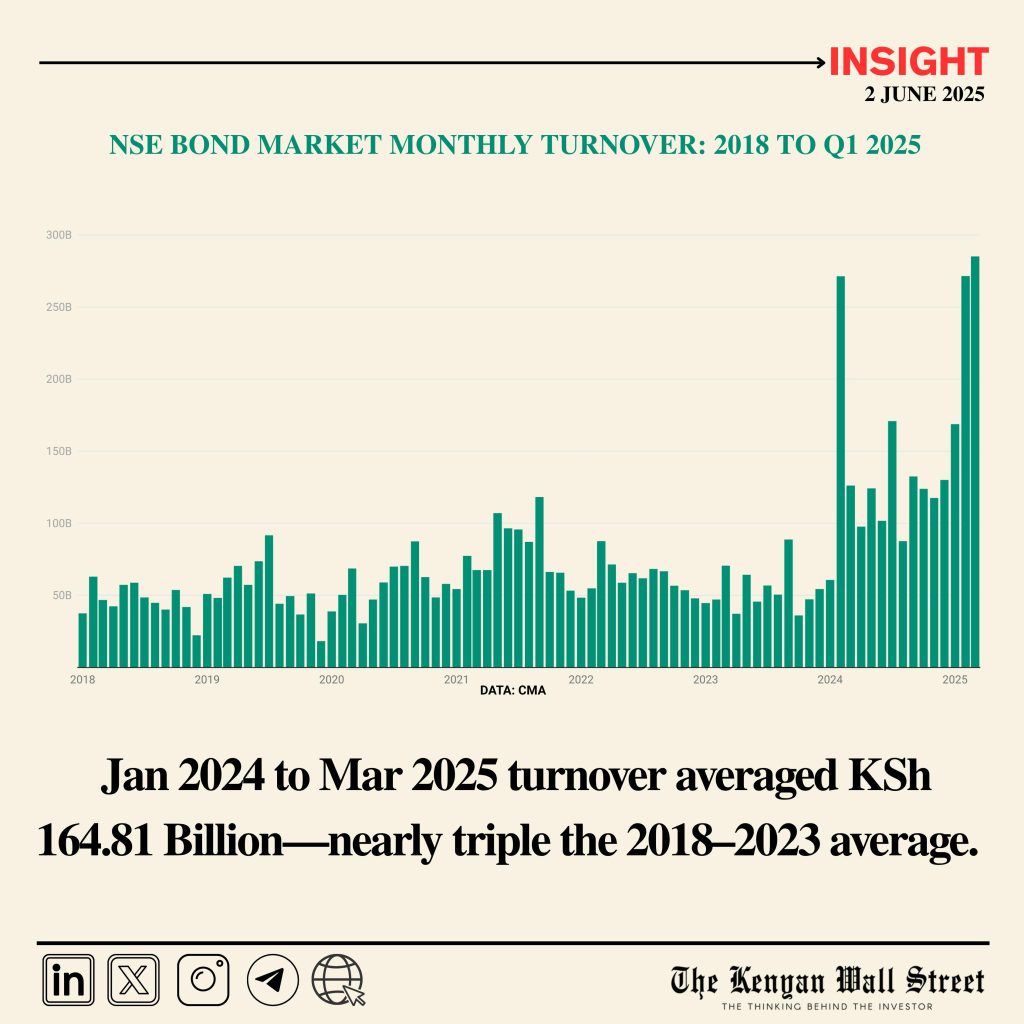

- •2024 performance saw profit after tax surge by over 500% and bond market turnover hit a record KSh 1.7 trillion mark for the first time.

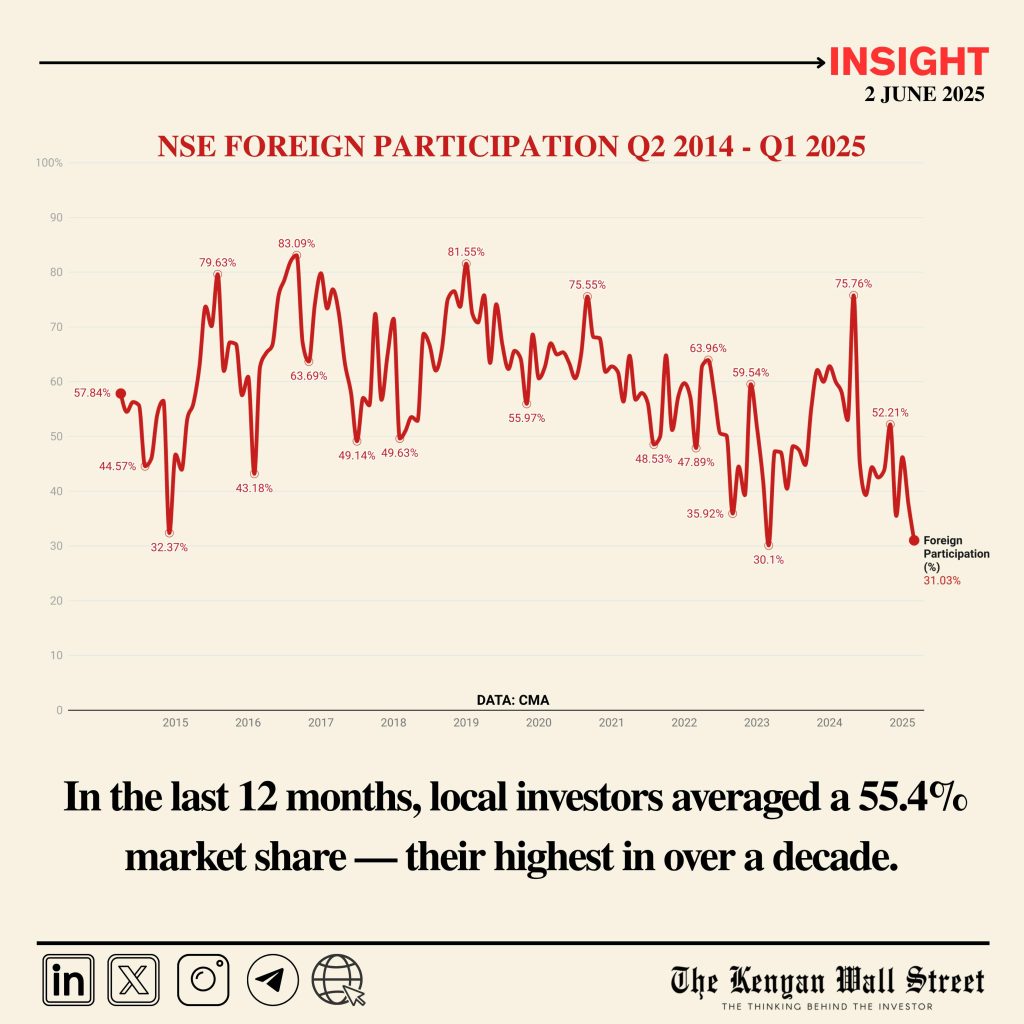

- •However, the strategy faces significant backlash from stockbrokers-who are also minority shareholders and stand to benefit from a more active and profitable NSE- as they view Direct Market Access as a threat to their traditional business model, drawing parallels to the initial banking opposition faced by M-Pesa, or the financial inclusion that has given Kenyans access to formal banking.

Can Mwiti’s Vision Overcome Broker Resistance for an M-Pesa Moment?

The Nairobi Securities Exchange (NSE) has begun a plan to propel Kenya’s capital markets into a new era of growth and accessibility.

This strategy, championed by CEO Frank Mwiti, is anchored on revitalizing markets, optimizing operational effectiveness, and leveraging technology.

A key objective is to attract an impressive 9 million active retail investors, both domestically and from the diaspora, signaling a deliberate move to broaden the investor base and expand the overall market size.

However, this strategic pivot has been met with resistance from traditional stockbrokers, represented by the Kenya Association of Stock Brokers and Investment Banks (KASIB). KASIB, whose members collectively hold approximately 20% of the NSE’s shareholding , has vehemently opposed the introduction of Direct Market Access (DMA).

DMA allows clients to place buy or sell orders directly into the NSE trade matching system for automatic execution, bypassing direct intervention by the broker. Brokers view DMA as a direct threat to their traditional intermediation role and their commission-based revenue model, fearing disintermediation and a fundamental shift in the value chain.

The NSE’s Direct Market Access (DMA) Guidelines were formally approved by the Capital Markets Authority (CMA) in October 2019. These comprehensive guidelines clearly stipulate the involvement and responsibilities of licensed Trading Participants (brokers) in facilitating DMA.

Ideally, the NSE’s plans to promote DMA do not imply bypassing brokers entirely; rather, they envision an enhanced framework where brokers play a key role in enabling clients to directly input orders into the trading system, while still maintaining their critical oversight and regulatory responsibilities.

This framework ensures that while investors gain more direct control, the necessary professional and regulatory safeguards remain in place.

The exchange reported exceptionally strong results for the year ended December 31, 2024, with profit after tax soaring by over 500% to KSh 116.3 million, compared to KSh 18.4 million in 2023.

The bond market achieved a historic milestone, crossing the KSh 1 trillion mark in cumulative turnover for the first time ever, closing the year at KSh 1.7 trillion while market capitalization surged to KSh 1.9 trillion from KSh 1.4 trillion, and the NSE was recognized as the best-performing market in Africa in dollar returns by MSCI.

This strong performance provides the financial stability and market confidence necessary to undertake such significant reforms. The impressive growth in 2024 are not just numbers; they represent a vibrant resurgence driven by strategic reforms.

To halt this progress would be to deny millions of Kenyans the opportunity for wealth creation and to relegate the NSE to a peripheral role in a rapidly evolving global financial ecosystem.

RELATED;

Kenya’s Stock Market Outperforms African Peers in Dollar Returns

Kenya’s Secondary Bond Market Surges 95% in Q1, On Track for Another Record Year

“Our Share Price is Undervalued by 50%” -Safaricom CEO

Beyond business model concerns, KASIB has leveled serious accusations against NSE’s Chief Executive Officer, Frank Mwiti. They accuse him of “poor leadership, withholding information from the board, and failing to seek their approval on material decisions,” citing “irregularities” and an “unprocedural annual general meeting”.

The plan to introduce direct market access to investors was specifically cited as an action the board was reportedly unaware of. These accusations culminated in a formal call for a vote of no confidence in the CEO. KASIB has also expressed concerns that the NSE appears to be engaging in trading and advisory activities beyond its licensing mandate, creating a conflict of interest.

This standoff draws a compelling parallel to Kenya’s “M-Pesa moment.” When Safaricom launched M-Pesa in March 2007, it faced intense opposition from Kenyan commercial banks. Banks argued that M-Pesa was engaging in “banking business” without the appropriate license, violating the Banking Act, and publicly grumbled about an “uneven playing field,” even alleging it was a “pyramid scheme”.

Despite pressure from the Ministry of Finance and bank CEOs to audit or halt M-Pesa, the Central Bank of Kenya (CBK) conducted a thorough review and issued a “Letter of No Objection,” allowing the service to proceed.

M-Pesa subsequently experienced explosive growth, transforming Kenya’s financial landscape. Within three years of its launch, 90% of Kenyan adults were using the platform. By 2024, M-Pesa boasted 34 million customers in Kenya and 51 million across eight African markets, processing over 180 million transactions daily.

Eventually, the initial banking opposition gave way to integration, with banks finding ways to leverage the mobile money ecosystem for their own benefit.

If the current opposition from stockbrokers succeeds in stifling the NSE’s momentum, Kenya’s capital markets risk returning to the “old page”—a landscape characterized by limited retail participation, stagnant growth, and a failure to fully harness the nation’s economic potential.

RELATED;

Kenya’s Stock Market Adds KSh 113Bn in 5 Days as Safaricom Sparks Rally

Nairobi Securities Exchange Gains KSh 420bn in Investor Wealth in 2024