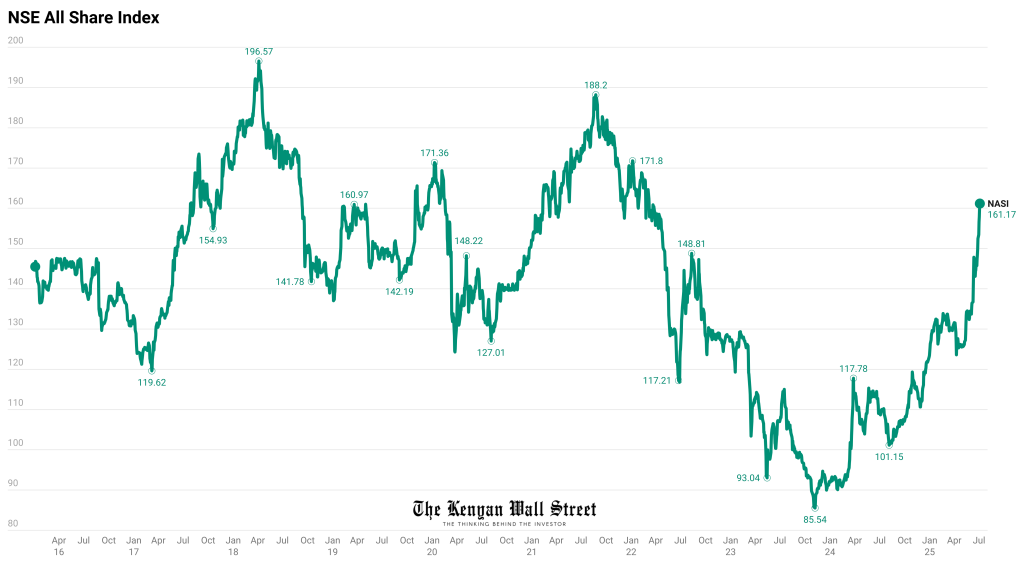

The Nairobi Securities Exchange (NSE) has added over KSh 600 billion in investor wealth in 2025, with the NASI rising +30.5%—continuing an 20-month rally that began in late 2023.

- •Sameer Africa and Kapchorua Tea have dominated market activity in recent days, drawing strong investor interest amid a broader uptrend.

- •The company has emerged as one of the top performers at the NSE in 2025, returning +48.8% over the past week and +82.3% over the past month.

- •The stock rallied to a 10-year high of KSh 5.30, supported by a 461% jump in profit after tax to KSh 259.9 million in FY2024.

Key drivers include:

- •Strong unrealised forex gains

- •Full debt repayment

- •Improved balance sheet and investor sentiment

Sameer recorded price gains in nine of the last ten trading sessions leading to July 4. Although the board did not declare a dividend, the company’s turnaround has attracted significant retail and institutional interest.

| Rank | Company | YTD Return |

|---|---|---|

| 1 | TransCentury (Suspended) | +187.18% |

| 2 | Sameer Africa | +154% |

| 3 | Kenya Power | +139.09% |

| 4 | KenGen | +96.70% |

| 5 | Home Afrika | +81.08% |

Kapchorua Tea: Resilience Rewarded

Kapchorua Tea has also attracted investor interest following the announcement of a KSh 25.00 final dividend and a proposed 1-for-1 bonus share issue.

Key updates:

- •Net profit fell by 55% to KSh 181 million (FY2025)

- •Stock rallied +27.2% last week, hitting a 52-week high of KSh 294.25

Despite a 75% drop in operating profit due to a global tea glut and stronger shilling, the dividend and bonus issue catalyzed investor confidence. Kapchorua’s rally highlights the market’s readiness to back companies reinforcing shareholder value.

Market Momentum Fuels the Surge

The NSE’s strength supports these rallies. In the week ending July 4, indices rose:

- •NSE 25 Share Index surged 198.22 points to 4,107.72.

- •NSE 20 Share Index climbed 106.94 points to 2,503.72.

- •NSE 10 Share Index rose 71.66 points to 1,579.05.

- •All Share Index (NASI) gained 8.72 points to 161.17

YTD Market Performance (as of July 4):

| Index | Jan 2, 2025 | Jul 4, 2025 | Point Change | YTD Return |

|---|---|---|---|---|

| NASI | 123.48 | 161.17 | +37.69 pts | +30.52% |

| NSE 20 | 2,010.65 | 2,503.72 | +493.07 pts | +24.52% |

| NSE 10 | 1,302.31 | 1,579.05 | +276.74 pts | +21.25% |

| NSE 25 | 3,402.80 | 4,107.72 | +704.92 pts | +20.72% |

| Market Cap (KSh B) | 1,939.74 | 2,538.91 | +599.17 B | +30.89% |