This NSE Market Recap shows a strong rebound, with the NASI jumping +5.83% to 134.27, the highest since September 2022. Market cap crossed KSh 2.1T, backed by KSh 246.14M in foreign net inflows — the first since early April.

| Top Gainers | % Gain | Top Losers | % Loss |

|---|---|---|---|

| 🟢 Sanlam Kenya | ▲ +26.87% | 🔴 Unga Group | ▼ –8.75% |

| 🟢 Nation Media Group | ▲ +21.46% | 🔴 ScanGroup | ▼ –6.96% |

| 🟢 Longhorn Publishers | ▲ +19.17% | 🔴 TP Serena | ▼ –6.54% |

| Indicator | Previous Week | Current Week | WoW % Change |

|---|---|---|---|

| NSE 20 | 2,109.29 | 2,195.93 | +4.11% |

| NSE 25 | 3,395.77 | 3,587.30 | +5.64% |

| NASI | 126.87 | 134.27 | +5.83% |

| NSE 10 | 1,285.49 | 1,369.91 | +6.57% |

| Market Cap (KSh Bn) | 1,994.14 | 2,112.06 | +5.91% |

| Volume (Mn Shares) | 100.34 | 162.73 | +62.18% |

| Equity Turnover (KSh Mn) | 1,790 | 3,247 | +81.47% |

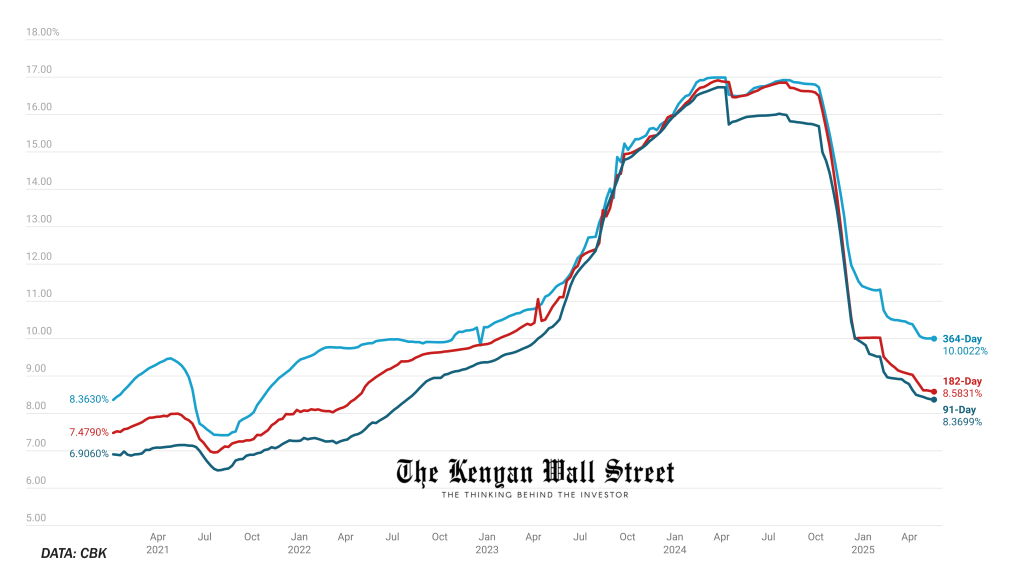

The T-Bills auction saw strong demand, with KSh 37.41B bid against KSh 24B on offer — an oversubscription of 155%. The 364-day paper drew the bulk of interest, taking in KSh 24.02B.

Yields remained steady:

- •91-day – 8.37%

- •182-day – 8.58%

- •364-day – 10.00%

The 364-day yield has now held just above 10% for months — last dipping below that mark on December 19, 2022, highlighting sustained high borrowing costs. The next auction is set for May 23, 2025.

Earnings Watch

Several financial institutions reported Q1 results during the week:

- •Co-operative Bank posted a KSh 6.93 billion net profit in Q1 2025, up +5.3% YoY, buoyed by a 21.7% rise in net interest income.

- •Sidian Bank delivered a surprise with a +250% jump in profit to KSh 556.9 million, driven by strong interest and non-interest income growth.

- •TPS Serena Hotels declared its first dividend since 2018, after posting a KSh 1.3 billion FY2024 net profit, boosted by forex gains and revenue growth.

- •Airtel Africa reported $994 million in mobile money revenue, closing in on the $1B milestone despite currency depreciation in key markets like Nigeria and Zambia.

Several listed companies hit significant historical price levels:

- •NSE PLC closed at KSh 7.50 (May 15) — its highest since October 26, 2022

- •Sasini fell to KSh 14.00 (May 12) — a 10-year low, last seen on March 27, 2015

- •Williamson Tea touched KSh 200.00 intraday (May 16) — the lowest since December 19, 2023

- •Nairobi Business Ventures (NBV) dropped to KSh 1.76, falling below its pre-October 2020 suspension level

Listed advertising conglomerate WPP Scangroup issued a material announcement that its flagship agency, Ogilvy Africa, had lost Airtel Africa as a client.

Key Corporate Events – Week of May 20, 2025

| Date | Company(s) | Event |

| May 20 | Equity, Absa, Co-op | Q1 Results & Briefings |

| May 21 | KCB, StanChart | Q1 Results |

| NSE, Family Bank | AGMs + Dividend Book Closure (NSE) | |

| May 22 | NCBA, KCB, Absa, I&M | Q1 Results, AGMs, Dividend Payments |

| May 23 | Equity, BAT, DTB, Liberty, Limuru Tea | Dividend Book Closures + AGMs |