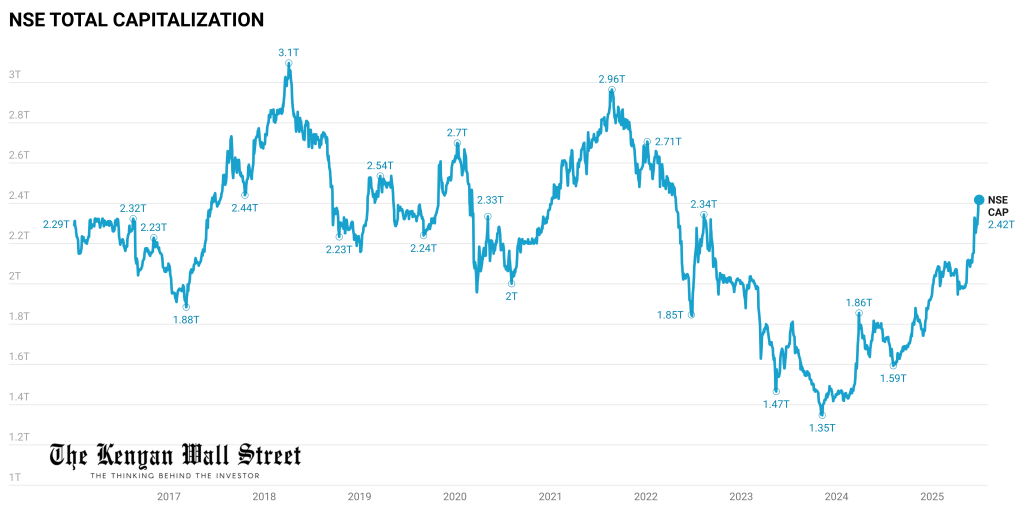

East and Central Africa’s leading exchange, the Nairobi Securities Exchange (NSE), has delivered a commanding performance in the first half of 2025—adding KSh 477 billion in investor wealth and closing June at KSh 2.417 trillion, its highest level since mid-2022.

- •This surge extends a rally that began in November 2023, when market capitalization bottomed at KSh 1.35 trillion, before gaining KSh 1.067 trillion in the 18 months since.

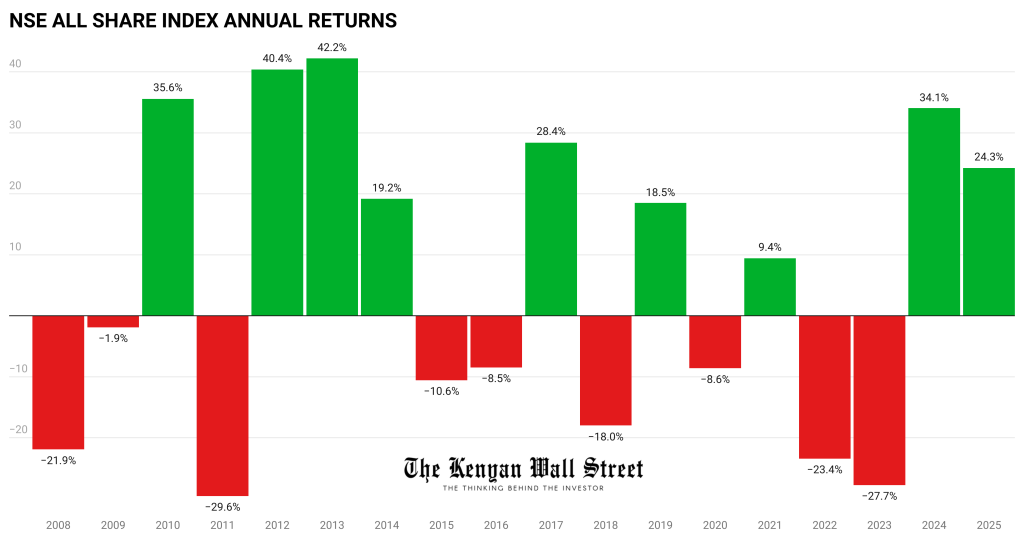

- •All major indices have recorded robust gains, led by the NSE All Share Index (NASI), which climbed 24.25%.

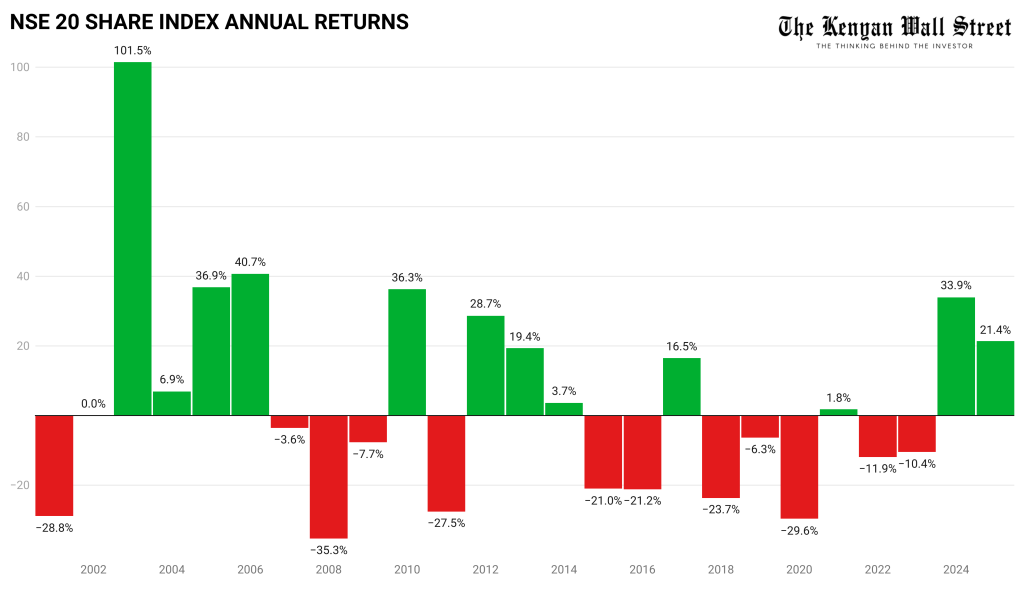

- •The NSE 20 Share Index rose 21.37%, delivering its second consecutive year of 20%+ returns—a streak last seen in 2005–2006.

The NASI has also extended its momentum from a 34.06% gain in 2024, reminiscent of the 2012–2013 bull cycle.

| Index | Jan 2, 2025 | June 30, 2025 | H1 Change (%) |

|---|---|---|---|

| NASI | 123.48 | 153.43 | +24.25% |

| NSE 20 | 2,010.65 | 2,440.26 | +21.37% |

| NSE 10 | 1,302.31 | 1,516.93 | +16.48% |

| NSE 25 | 3,402.80 | 3,938.28 | +15.74% |

Top Gainers: Power and Infrastructure Stocks Shine

Energy stocks—led by Kenya Power (+139.09%) and KenGen (+104.95%)—have powered the market’s ascent. Their rally has been driven by stronger earnings, policy reforms, and renewed investor interest in infrastructure-linked plays.

| Rank | Company | YTD Gain (%) |

| 1 | Kenya Power (KPLC) | +139.09% |

| 2 | KenGen | +104.95% |

| 3 | Sameer Africa | +84.36% |

| 4 | Home Afrika | +83.78% |

| 5 | Trans Century † | +82.05% |

† Note: Trading in Trans Century shares has been suspended indefinitely by the NSE

On the downside, lagging counters such as Eveready East Africa (-22.6%), Africa Mega Agricorp (-20.0%), and Bamburi Cement (-14.2%) illustrate the rally’s uneven breadth across the bourse.

Sectoral Leaders and Laggards

Energy (+67.0%), investment (+56.9%), and insurance (+43.1%) were the best-performing sectors, supported by price momentum in utilities, diversified holdings, and re-rated financials. In contrast, agriculture (-3.6%) and automobiles (-7.7%) continued to underperform due to structural and profitability headwinds.

| Sector | YTD Change (%) |

| Energy and Petroleum | +67.0% |

| Investment | +56.9% |

| Insurance | +43.1% |

| Telecommunication | +46.6% |

| Agricultural | -3.6% |

The total market cap has expanded by KSh 1.067 trillion since the November 2023 bottom, culminating in an 18-month rally that marks one of the strongest in over a decade.

- •As of June 2025, the Top 10 firms account for over KSh 2 trillion in combined value—a level not seen since September 2022.

- •Safaricom also reclaimed the KSh 1 trillion mark, signaling renewed institutional interest despite FX pressures from its Ethiopia expansion.

Buoyed by earnings growth, macroeconomic stabilization, and robust local demand, the NSE enters the second half of 2025 with bullish tailwinds. However, risks remain—from global monetary policy shifts to domestic corporate earnings volatility.

Still, the first half of 2025 confirms a clear trend: Kenya’s capital markets are firmly in bull territory, with investor confidence on the rise.