Safaricom’s share price jumped by 6.1% on Tuesday, June 10, closing at KSh 22.60, marking the stock’s best daily performance since December 10, 2024, when it gained 6.34%.

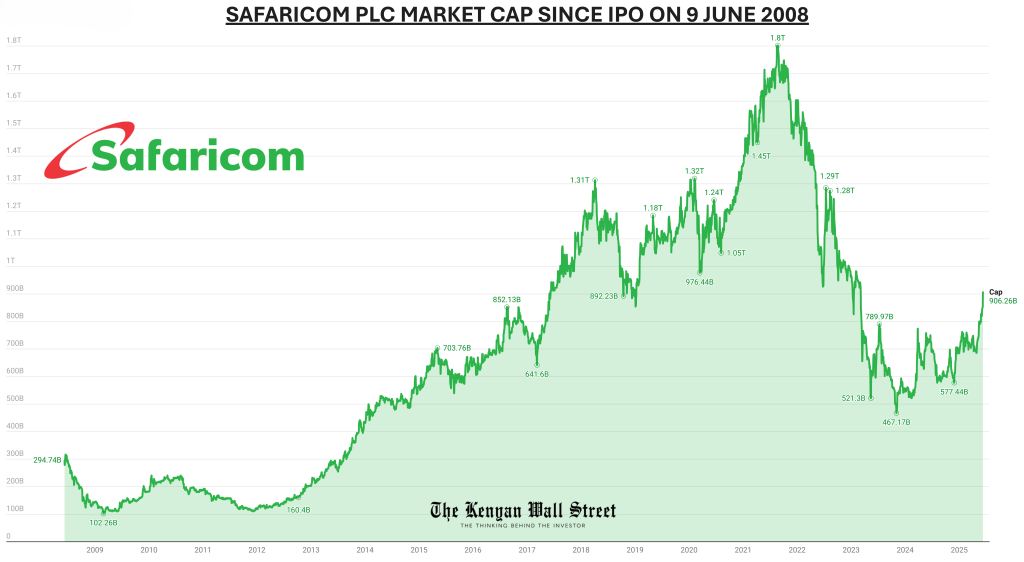

- •Renewed investor confidence boosted Safaricom’s market capitalization to KSh 906 billion (over USD 7 billion), its highest level since March 2023.

- •Year-to-date, Safaricom’s share price is up 32.55%, underscoring its key role in driving the market.

- •With yields on short-term securities falling into single digits and the Central Bank of Kenya (CBK) cutting its policy rate on Tuesday, investors may continue to pile into the equities market.

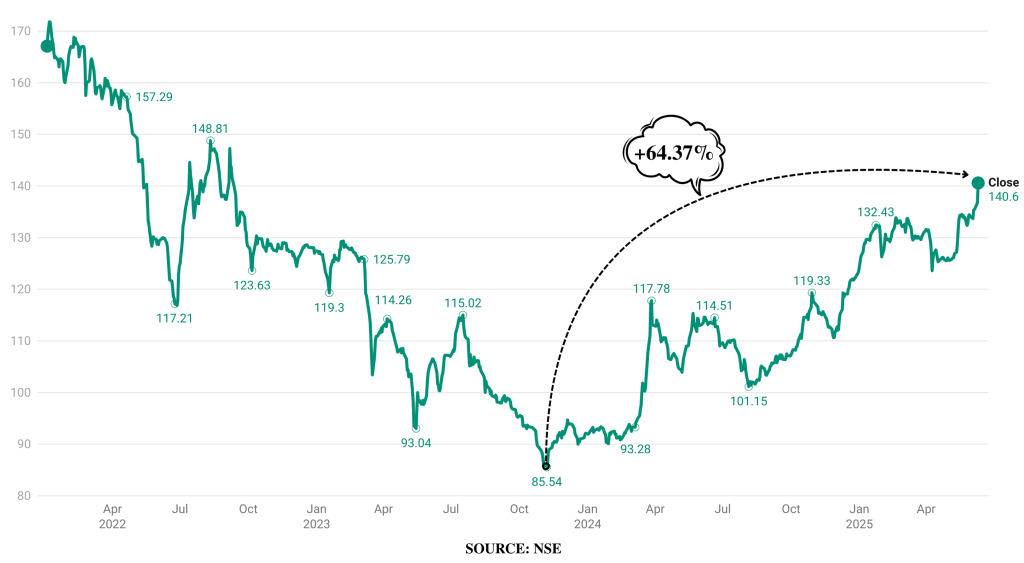

The positive sentiment extended to the broader market, largely driven by Safaricom’s outsized influence on the index. The NSE All Share Index (NASI) climbed 2.82% on Tuesday, closing above 140 points for the first time since September 9, 2022. This surge increased the total market capitalization to KSh 2.211 trillion, up from KSh 2.151 trillion in the previous trading session.

Since hitting a low of 85.54 points in October 2023, the NASI has added KSh 861 billion in wealth to its investors. Year-to-date, the NASI is up 13.86%, reflecting a sustained recovery and growing investor confidence.

Safaricom’s Consistent Impact on the NSE

This is not the first time Safaricom has ignited a market rally in recent weeks. Just a month ago, the telco’s FY2025 earnings release triggered a strong performance in the stock. That rally lifted the NSE All Share Index by 5.7% over just five trading days, adding KSh 113 billion to market capitalization and pushing investor wealth above KSh 2 trillion.

During that period, Safaricom’s robust financials reassured investors, despite forex pressures from its Ethiopian operations. The company’s steady M-PESA growth and resilient Kenyan business underpinned confidence. Safaricom also recorded foreign inflows, reversing earlier outflows, which underscored renewed interest in blue-chip stocks.

Tuesday’s surge underscores Safaricom’s continued influence on the Nairobi Securities Exchange. As the NASI extends its gains, the focus now shifts to whether the index can hold above the key 140-point level, potentially paving the way for a sustained mid-year rally.