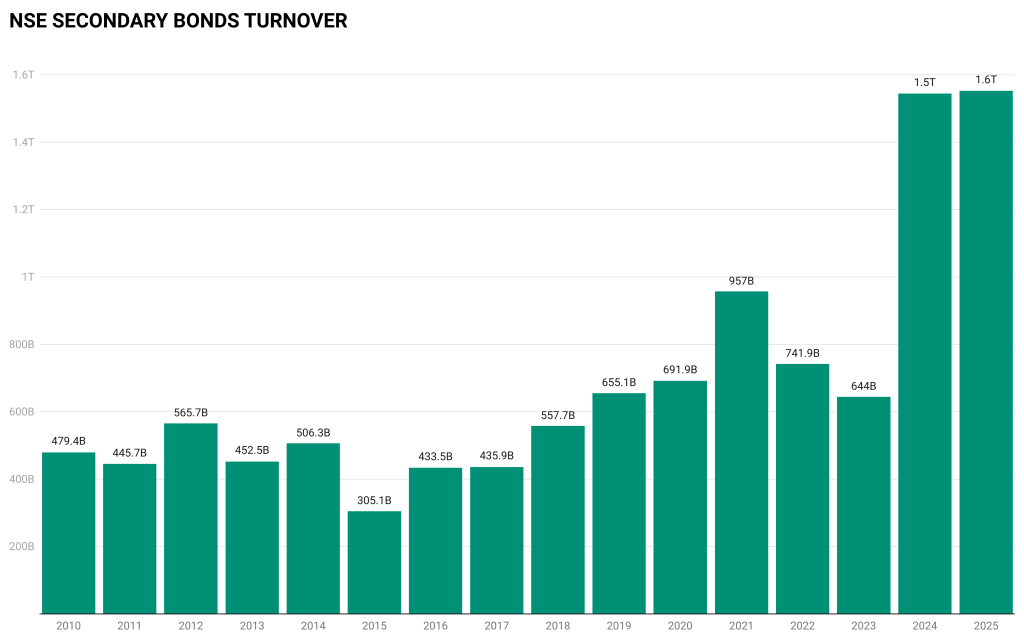

The Nairobi Securities Exchange (NSE) secondary bond market has set a new benchmark in 2025, with turnover reaching KSh 1.552 trillion as of 21st July—surpassing the previous full-year record of KSh 1.544 trillion set in 2024.

- •This marks an unprecedented surge in fixed-income trading activity, with five months still remaining in the year.

- •While turnover remained relatively stable between 2011 and 2020, averaging below KSh 700 billion per year, the market began to accelerate post-2020, hitting KSh 957 billion in 2021 and KSh 1.54 trillion in 2024.

- •The first seven months of 2025 alone have already eclipsed all prior years, putting the market on track for a potential KSh 2.6 trillion turnover if current trends persist.

** 2025 is up to 21 July

What’s Driving the Record Turnover?

1. Retail Investor Surge and Digital Platforms:

- •Retail investors—including self-help groups, Saccos, private companies, and individuals—now hold KSh 801.8 billion in government securities, up from KSh 385.8 billion just two years ago. In addition, the rollout of CBK’s Dhow CSD digital trading platform has made bonds more accessible, thereby fueling demand.

2. Secondary Market Premiums:

- •Because falling interest rates on new bond issues have increased price premiums on older bonds issued in 2023 and 2024, which carry higher coupons or fixed rates, holders are cashing in. This is driving trading volumes higher.

3. Focused Trading on High-Yield Bonds:

- •Much of the activity has centered on the 8.5-year tax-free infrastructure bond (IFB) issued in February 2024 (coupon: 18.46%), now trading at a 22% premium. Similarly, 17-year, 7-year, and 6.5-year IFBs issued in 2023 (coupons: 14.4–17.9%) have attracted significant interest.

4. Price-Yield Dynamics:

- •As yields fall on new issuances, existing high-coupon bonds become more valuable. This pushes more trading into the secondary market as investors seek out higher returns. New investors are less likely to take up primary issues when they can access higher-yielding securities on the secondary market.

With an average monthly turnover of over KSh 221 billion so far, the NSE is on pace to close the year well above KSh 2.5 trillion in bonds turnover. Moreover, market watchers expect the heightened demand for government securities to persist, especially if interest rates on new issues remain subdued.