NIC bank net earnings for the third quarter of the year slightly dipped by 1.3% to Sh 3.3 Billion as total Interest income fell by 8.4% to Sh13.5 Billion.

Net interest income was down 14.5% to Sh 8 Billion as non-interest income grew 2.9% to Sh 3.2 Billion. Loans and advances to customers grew by 7.3% to Sh 118.6 Billion while provision for the loans declined by 32.9% to Sh 2.1 Billion.

Total interest expense was up marginally by 2.3% to Sh 5.5 Billon. Total operating expense was up 2.8% to Sh 6.8 Billion.

Pre tax profit declined by 7.3% to Sh 4.4 Billion from Sh 4.7 Billon in the same period last year. Earnings Per Share (EPS) declined by 1.3% to Sh 5.19 per share.

The bank increased its investment in securities by 50% to Sh 51.8 Billion. Customer deposits were up 21.3% to Sh 131.4 Billion.

Gross Non Performing Loans (NPLs) increased by 3.2% to Sh 14.7 Billion.

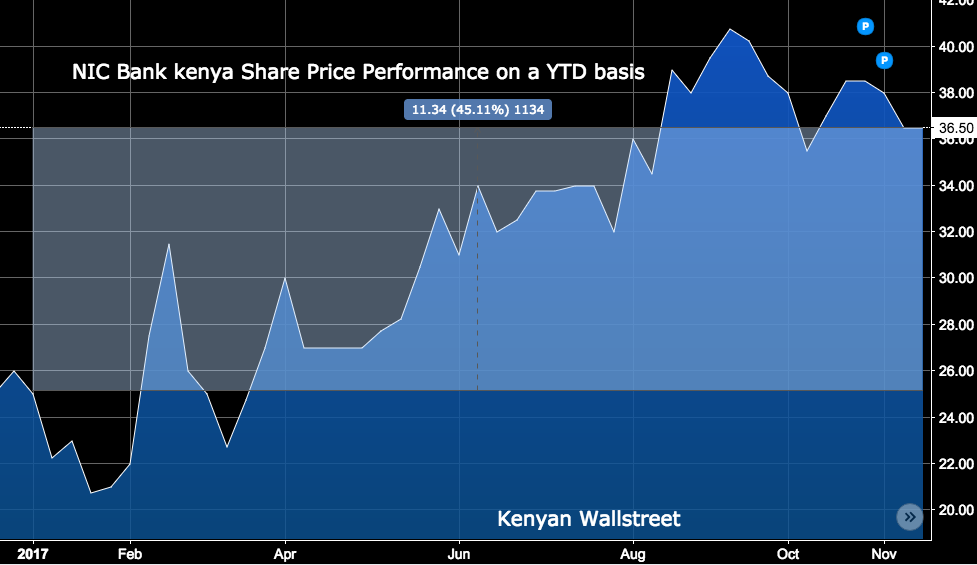

Share Price

On a Year To Date basis, NIC Bank Share Price is up by approximately 45%.