Listed NIC Bank Kenya became the third listed lender to report its financial results for the full year period ended December 2016 with Net Profit dropping by 4.5% to Sh 4.3 Billion while total operating income was up 17.4% from Sh 13.8 Billion to Sh 16.2 Billion.

Despite the tough operating environment (re interest rate cap regime), the bank’s total interest income was up by a an impressive Sh 2 Billion to Sh 19 Billion. Loans and advances to customers accounted for a significant Sh 15 Billion from Sh 13.96 Billion in the previous period. The Bank’s holdings in government securities increased from Sh 2.7 Billion to Sh 3.7 Billion. Net Interest income came in at Sh Sh 12.2 Billion Vs 9.7 Billion recorded in full year 2015. Total Interest expense fell by 6 per cent to Sh Sh 6.86 Billion.

The Bank’s total operating expenses increased by a whopping 36 per cent mainly as a result of increase in loan loss provision by more than half to sh 3.75 Billion vs Sh 1.65 Billion in 2015.

Customer deposits were unchanged at Sh 112 Billion while Earnings Per Share however fell to Sh 6.7 from Sh 7.0.

Despite the fall in profits, NIC Board maintained an interim dividend of Sh 0.25 bringing the total dividend for the whole year at Sh 1.25 per share, unchanged from the previous full year.

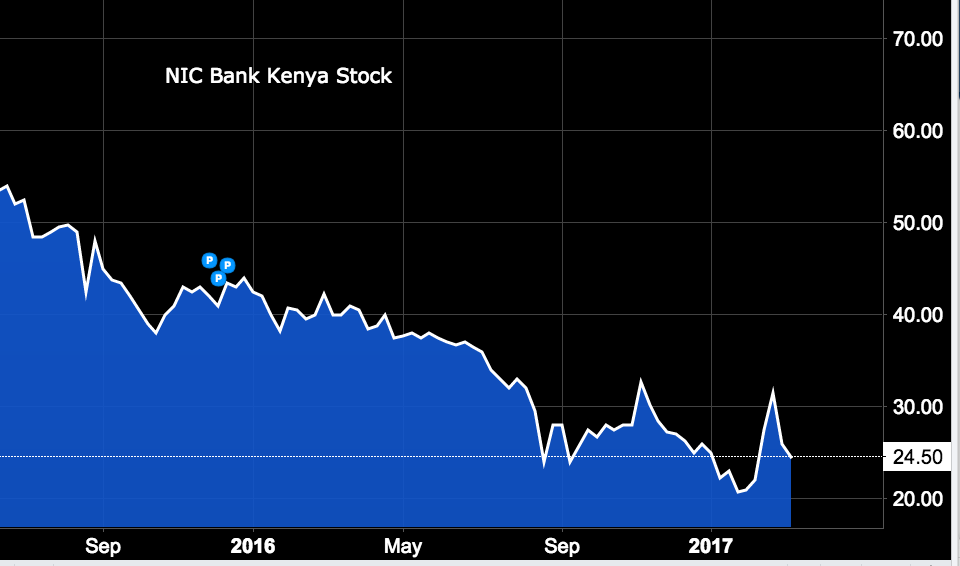

Share Price Performance

The counter on Wednesday’s trading closed at Sh 24.50 as shown in the chart below.