A new report on the Kenyan startup ecosystem has been released, presenting findings from a research project that was funded by the UK in collaboration with Kenyatta University, Maitri Capital, and other partners. The research provides a comprehensive overview of the Kenyan start-up ecosystem, including its strengths, weaknesses, opportunities, and risks. The report aims to go beyond funding and investment and offer background context on the ecosystem and the various stakeholders that contribute to its growth.

According to the report, Kenya’s startup ecosystem has achieved significant progress, including increased funding and the introduction of supportive policies and regulations. However, the lack of accurate and quality data on the development and dynamics of the ecosystem is a significant barrier to effective startup and innovation policy and program design.

To address this issue, Maitri Capital and Kenyatta university conducted a research study to improve understanding of the Kenyan startup ecosystem and how historical lessons can be applied to new initiatives and policy decisions. The research was based on existing datasets and data-driven studies, as well as input from government and private stakeholders. The research covered all 47 counties in Kenya and considered the contributions of major players, including start-ups, investors, donors, universities, hubs, accelerators, incubators, and government agencies.

The research presents an opportunity to reflect on the potential long-term impacts of the Kenyan tech startup ecosystem while highlighting the country’s investment climate and offers recommendations on how to improve it and support the expansion of the start-up ecosystem.

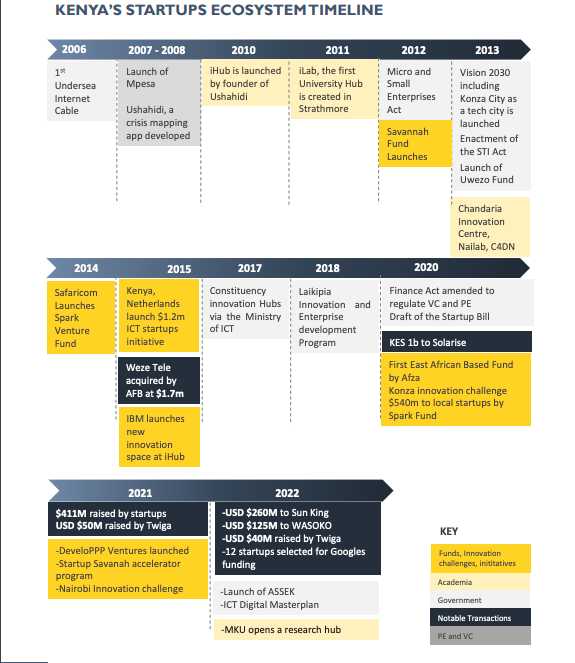

Kenya’s Startup Ecosystem Timeline

Kenya’s startup ecosystem is relatively young but is ranked as the third-best in Africa and first in East Africa, with over 1000 startups in different sectors. The ecosystem’s growth can be traced back to 2006 when an underwater internet cable was deployed, resulting in a surge in connectivity and the establishment of some of the first startups. The usage of mobile phones and the internet also grew, leading to the formation of Mpesa, which was later adopted by Safaricom.

The creation of iHub, one of Kenya’s first tech hub in 2008 provided an environment for businesses to incubate and thrive. The Kenyan government also initiated Tandaa Grants to encourage entrepreneurs, with 45 startups or enterprises funded between 2010 and 2012. The ecosystem has attracted a growing number of investors globally due to its large population with access to technology and the increasing number of support organizations. Despite economic obstacles such as inflation, devaluation, and a global slowdown, the ecosystem has shown resilience and strong year-on-year growth, with heightened private investment and notable public raises from larger pan-African companies.

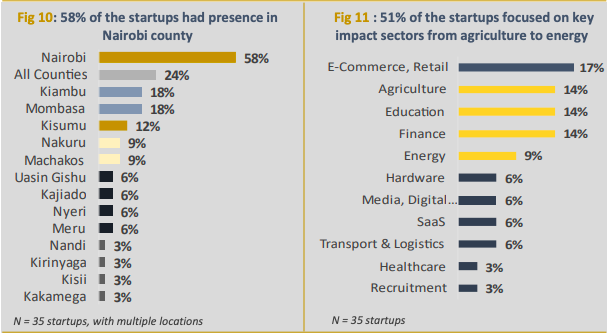

At the same time, the research indicates that 58% of the startups in Kenya have a presence in Nairobi and have been expanding to the parts of the country. Despite 53% of the startups operating in Kenya, there is growing interest to expand to other East African countries as well as West Africa.

Difficulty in Funding

Out of all the startups that took the survey, 91% have tried to raise money from investors. Only 6% of the startups are using their own money, and 3% did not answer. Out of the 33 startups that tried to raise money, 97% were able to get some through different ways, like loans, investments, and grants. Only two startups either got bought or merged with another company.

Raising money from investors is tough for most startups. The survey showed that 97% of startups found it hard to get money, while only 3% found it easy. Most startups (65%) are trying to get investments in exchange for part ownership of the company. Some (15%) are looking for a mix of loans and investments, and others (12%) just want loans. A few (8%) are looking for grants or safe notes.

Maitri Capital’s View on the Kenyan Startup ecosystem

“Kenya’s startup ecosystem has come a long way in the last decade, with real growth beginning in 2016 and amplifying in 2020-2022. The combination of a vibrant economy, Kenyans’ willingness to try new and better solutions, resilience during difficult times like Covid19, and a rapidly growing talent pool within the Kenyan startup ecosystem make it one of the most attractive on the continent, if not globally. This is evidenced by founders moving to Kenya to start their businesses and global investors looking to invest in the country. More work, however, is required to engage local business leaders, the corporate community, Universities and the Government to participate through investment, mentorship, partnerships, a favorable tax environment for Kenyan startups to progress further.” says Poonam Vora, Cofounder of Maitri Capital Ltd.

The report, titled “Understanding the Kenyan Start-up Ecosystem,” is an essential resource for anyone interested in the Kenyan start-up ecosystem. The UK, through the East Africa Research and Innovation Hub, Kenyatta University, and Maitri Capital, are committed to working with all stakeholders to support the expansion and development of the start-up ecosystem in Kenya to help the nation’s economy expand and create jobs.

ALSO READ; What is a venture holding company? Revolutionizing the landscape of venture investment in Africa