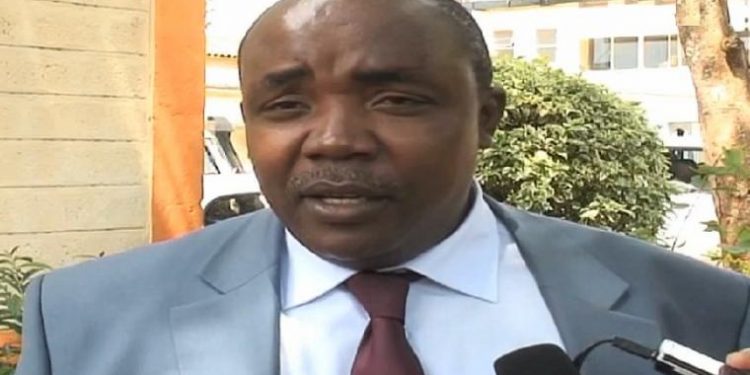

Jude Njomo, the Member of Parliament representing Kiambu Constituency proposed The Banking Amendment Bill of 2019 which seeks to punish borrowers who take on loans beyond the set lending rate.

The Central Bank Base Rate as per the September 2016 Banking Amendment Act stands at 9 percent, where banks can exercise a 4 point limit above the base rate.

The proposed bill, if passed into law, will punish both lenders and borrowers for none compliance with Section 64 of the Central Bank Act. Borrowers who pay interest beyond the capped rate will be liable to a fine of Shs. 1 Million or one-year imprisonment upon conviction. Currently, the law only punishes Banks and CEOs, a move which in the opinion of Hon. Njomo is discriminatory.

The Bill also undertakes to fix loopholes in the Banking Amendment Act of 2016 such as the vague definitions of critical terms like “credit facility” and “Central Bank Rate”, which exposed the law to instances of misinterpretations and misuse.

The sponsor of the bill replaces the term “credit facility” with “loan” and explains Central Bank Rate to refer to Section 64 of the Central Bank Act; a 9% base rate and a 4% limit above the base rate.

Nevertheless, there are still various concerns towards the Central Banking Rate. While the reason behind regulating interest rates was to boost access to loans and prevent financial institutions from making abnormal profits from oblivious customers. The outcome seems counterproductive. The Central Bank Rate (CBR) restricted lending to low-income citizens as banks sought lending-averse policies, carefully avoiding lending to “risky customers”. In some instance, some financial institutions opted to exit the market altogether. Gray areas in the CBR left room for the growth of unregulated lenders, offering loans to citizens at unorthodox rates. The result of it all was a slow growth in lending. Is it time Parliamentarians reconsidered the lending rate cap?