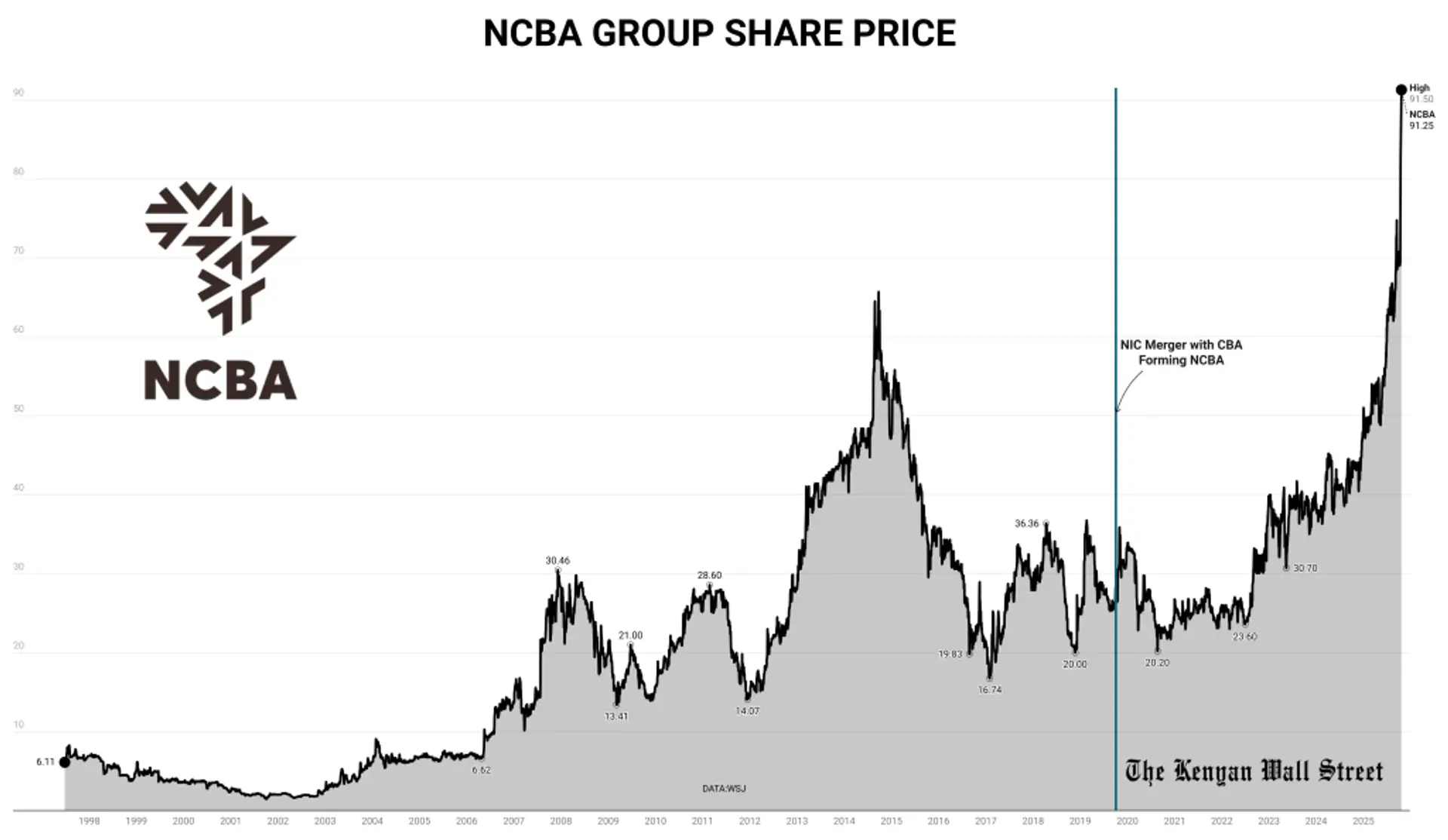

NCBA Group’s share price has been on a record-breaking run since October 14, rising to an unprecedented KSh 91.50 on Tuesday and pushing its market value past KSh 150 billion amid ongoing Stanbic Kenya buyout speculation.

- •The lender’s share price rose 9.6% in the latest session to close at KSh 91.25, its highest level since the NIC–CBA merger in 2019.

- •The stock has rallied 21.2% in four trading sessions since Bloomberg reported that Standard Bank Group’s Kenyan subsidiary, Stanbic Bank Kenya, is in advanced talks to acquire NCBA.

- •The rally has lifted NCBA’s market capitalization by about KSh 26 billion to the KSh 150 billion mark, placing it as Kenya’s third-most valuable bank after Equity Group and KCB Group, and fifth overall on the Nairobi Securities Exchange.

| Date | Close (KSh) | Daily Change | % Change | Volume |

|---|---|---|---|---|

| Oct 14 2025 | 75.25 | +5.75 | +8.27 % | 341,475 |

| Oct 15 2025 | 81.25 | +6.00 | +7.97 % | 592,261 |

| Oct 16 2025 | 83.25 | +2.00 | +2.46 % | 270,305 |

| Oct 21 2025 | 91.25 | +8.00 | +9.61 % | 308,387 |

NCBA shares have gained 89.3% year-to-date, making it the second-best-performing banking stock on the NSE after HF Group, which is up 127%.

NCBA’s half-year 2025 profit rose 12.6% to KSh 11.1 billion, supported by loan growth and improved operating efficiency. The group’s performance has reinforced investor confidence during the current rally, with trading volumes doubling their three-month average.

Neither NCBA nor Stanbic Kenya has issued a statement on the reported talks. If confirmed, the transaction would create Kenya’s third-largest lender by assets and expand Standard Bank’s retail presence in East Africa.

Over the past twelve months, NCBA shares have traded between KSh 43.30 and KSh 91.50, underscoring the scale of the recent rally that has taken the lender to uncharted valuation levels.