Listed media conglomerate Nation Media Group Plc (NMG) has reported a net loss of KSh 254.4 million for the year ended December 31 2024, which is an extension of the KSh 205.7 million loss from the year before.

- •Total turnover dropped 12.5% to KSh 6.23 billion from KSh 7.12 billion in 2023, which the company attributed to a difficult macroeconomic climate characterised by high inflation and muted consumer demand, .

- •The company’s digital business grew by 11% year over year despite the pressure on the top line, as the group added 2.2 million users to its digital audience in 2024, to end the year at 62.4 million users.

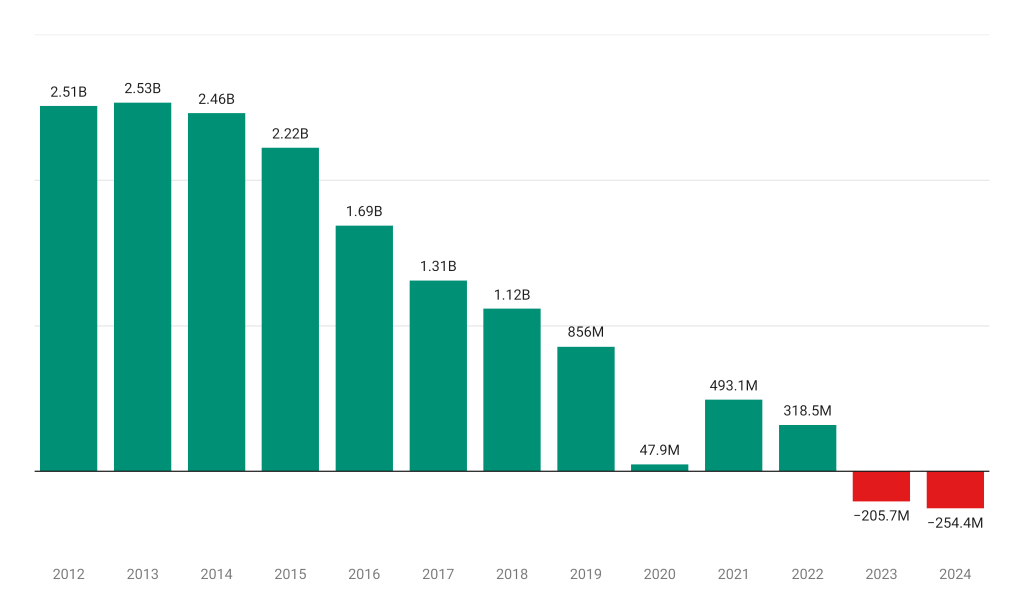

- •From a peak of over KSh 2.5 billion in profits in 2013, the Group’s profit has steadily declined—turning into losses in 2023 and 2024.

As the business increased its digitization efforts and worked to control costs, operating costs decreased by 17.2%. NMG incurred a one-time restructuring charge of KSh 157.8 million in June 2024. Additionally, the cost of sales decreased by 18.9%, which helped maintain margins during the decline in revenue.

“Our transformation strategy is bearing fruit, particularly in digital. The audience growth and stronger monetization are encouraging,” the company said in a statement.

The chart below highlights Nation Media Group’s profitability trajectory over the past 12 years.

This marks the first time NMG has reported consecutive annual losses in more than a decade, underscoring the impact of structural shifts in media consumption and broader economic pressures.

Key Financial Metrics – FY2024

| Metric | 2024 | 2023 | Change |

|---|---|---|---|

| Turnover | KSh 6.23bn | KSh 7.12bn | ↓ 12.5% |

| Net Loss | KSh 254.4m | KSh 205.7m | ↑ 23.6% |

| Digital Revenue Growth | +11% | — | ↑ |

| Operating Costs | ↓ 17.2% | — | ↓ |

| User Base (Digital Reach) | 62.4 million | 60.2 million | ↑ |

Outlook

In order to expand its broadcasting footprint and connect with younger, tech-savvy audiences, Nation Media Group says it will keep implementing its digital-first transformation strategy, giving content, talent, and technology investments top priority. The Group intends to continue operating a profitable print business while reaffirming its dedication to impactful journalism.

The company had KSh 2.38 billion in cash and short-term investments as of December 31, 2024, compared to KSh 2.91 billion in 2023. A KSh 94.4 million share buyback program contributed to the decline in shareholder equity to KSh 7.3 billion.

Due to continued investment requirements and prevailing economic conditions, the Board did not recommend a dividend for the year.