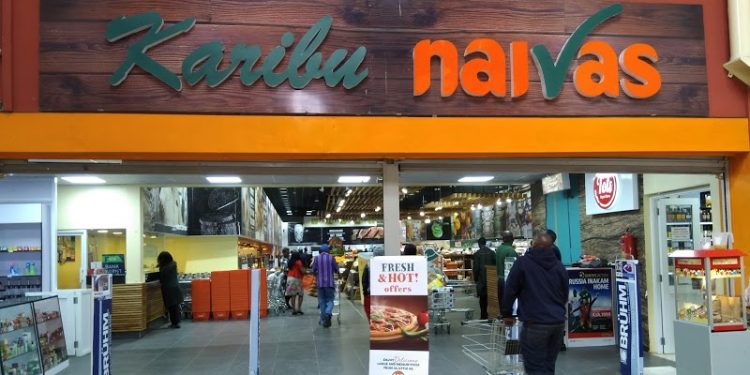

Amethis Finance, a French private equity fund has announced plans to acquire a 30% percent stake in Naivas Supermarkets.

However, the companies have not disclosed how much the PE firm will inject into the retail chain.

Business Daily reports that back in 2017, Amethis announced that it was seeking KSh36 billion for investment in 11 countries including Kenya. By July last year, the firm had raised KSh42 billion.

The capital boost into Naivas will help the retailer survive in the highly competitive market, with new entrants such as Carrefour and Shoprite, and Sokoni Retail which recently acquired Tumaini and Quick Mart stores.

Other Kenyan firms in which Amethis has previously invested in are Ramco Plexus in 2014, KenAfric in 2016 and Chase Bank Kenya in 2013.

Amethis is an investment fund manager dedicated to the African continent, with an investment capacity exceeding €725 million. It brings growth capital to promising midcap champions in diverse sectors throughout the African continent.

See Also: