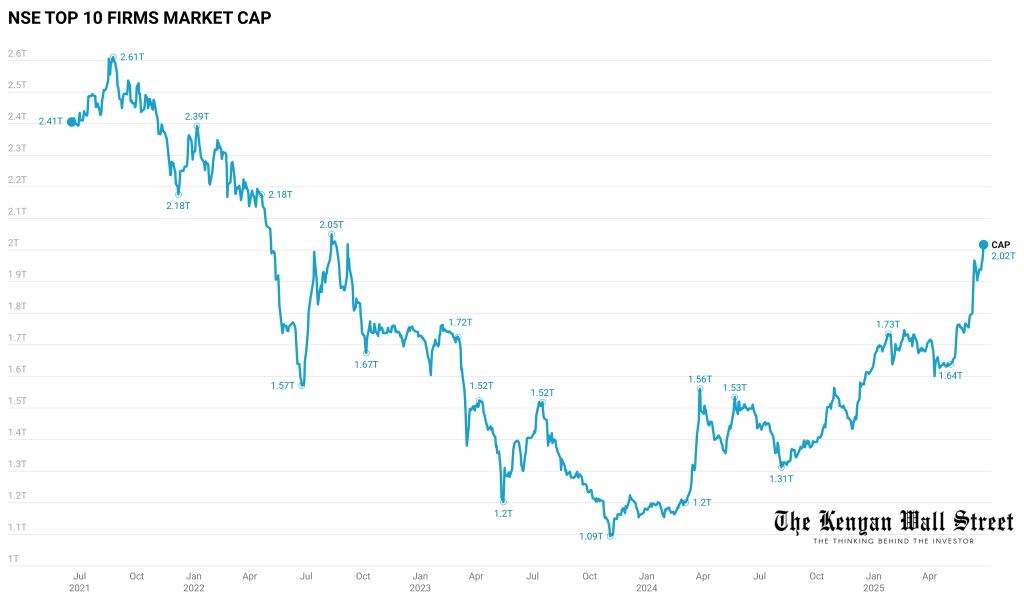

The combined market capitalization of the top 10 listed firms on the Nairobi Securities Exchange (NSE) has surpassed KSh 2 trillion for the first time since September 2022.

- •As of June 27, 2025, these firms accounted for KSh 2.015 trillion, representing 84.2% of the total NSE market cap.

- •Telco giant Safaricom accounts for half of this, while the other nine blue chip stocks maintain strong capital positions ranging between KSh 60 billion and KSh 185 billion.

- •Regulators have highlighted this concentration as a potential risk.

| Company | Last Price | 7D Return | 1Y Return | Market Cap | Industry |

| Safaricom | KES 24.95 | 4.20% | 44.20% | KES 999.6B | Telecom |

| Equity Group | KES 48.85 | 5.90% | 15.60% | KES 184.3B | Banks |

| KCB Group | KSh46.50 | 6.70% | 48.80% | KES 149.4B | Banks |

| EABL | KES 186.00 | 0.50% | 26.70% | KES 146.3B | Manufacturing |

| StanChart | KES 296.50 | 4.80% | 52.80% | KES 112.0B | Banks |

| Absa | KES 18.95 | 1.60% | 35.40% | KES 102.9B | Banks |

| Co-op Bank | KES 17.35 | 4.20% | 36.60% | KES 101.8B | Banks |

| NCBA | KES 58.75 | 4.90% | 42.90% | KES 96.8B | Banks |

| Stanbic | KES 161.50 | 0.80% | 41.40% | KES 63.8B | Banks |

| I&M Group | KES 35.55 | 3.60% | 65.00% | KES 58.8B | Banks |

| TOTAL | KES 2015.7B | 84.2% |

Safaricom Plc, the largest company on the NSE, closed at KSh 25.00 per share. This pushed its valuation above KSh 1 trillion for the first time since December 2022.

KCB Group also extended its lead over East African Breweries Ltd (EABL), with a market cap of KSh 149.4 billion compared to EABL’s KSh 146.3 billion.

Is It a Sign of Strength or a Concentration Concern?

The renewed growth of these counters suggests rising investor confidence. Foreign institutions have also shown renewed interest. But the concentration of market value in a few firms remains a concern for analysts and regulators alike. Heavy reliance on a few large-cap stocks means that movements in companies like Safaricom and KCB can disproportionately affect the entire market.

This pattern is not new. The only other time in the last five years when the top 10 companies made up more than 89% of the total market cap was in June 2021. At the time, Safaricom alone was worth more than KSh 1.6 trillion. By contrast, on November 3, 2023, the top 10 had fallen to a combined value of just KSh 1.094 trillion.

Despite efforts to attract new listings, the NSE has seen few IPOs in recent years. This has left most investor capital concentrated in a handful of familiar counters.

To address this, the Capital Markets Authority (CMA) and NSE have introduced reforms. These include easing listing requirements, offering incentives for small and mid-sized firms, and revising index methodologies to reflect a broader market picture.

As the top 10 regain their commanding position, the key question remains: will this rally lead to deeper, more diverse participation—or reinforce the current concentration trend?