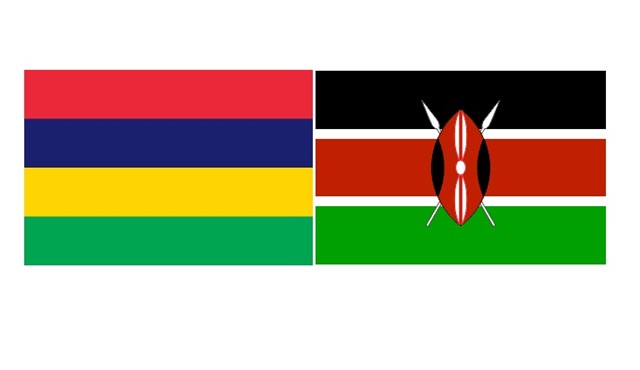

The High Court has invalidated a tax charter, The Kenya-Mauritius Double-Taxation Agreement which was signed between the two countries in 2012 to enable companies registered in both countries to enjoy lower taxes and pay taxes in only one legal jurisdiction.

In his ruling, Justice Weldon Korir nullified the agreement citing that due process was not followed and that the agreement ceased to effect according to the Kenyan law.

“The government failed or neglected to subject the Kenya-Mauritius Double Taxation Avoidance Agreement to the due ratification process in line with the Treaty-making and Ratification Act 2012.

“It was not shown that the legal notice No 59 of 2014 was laid before Parliament and this court has to declare that the said legal notice ceased to affect and became void by section 11 (4) of the Statutory Instruments Act, 2013,” part of the ruling stated.

Tax Justice Network, Africa, had filed a petition in Parliament claiming that the charter had dire consequences to Kenya’s revenue base by providing an avenue for companies to take the profits to Mauritius and evade paying taxes in Kenya.

Companies registered in either country to report their profits in Mauritius to enjoy the lower rate.

The NGO also claims that the deal was unconstitutional since Parliament did not ratify it.

Related;

Kenya Ranks Top Tax Haven in Africa- Financial Secrecy Index 2018

Nairobi International Financial Centre: Africa’s Newest Tax Haven