For the first time since self-listing in September 2014, the Nairobi Securities Exchange became the first listed company to issue a profit warning for full year 2016 saying it expects its net profit to fall by more than Sh 76 Million (25%).

Despite increased volume of traded units at the bourse as at september 2016 compared to the same period last year, the exchange says the announcement is based on the projections for the remainder of the year due to decline in equity market prices considering the fact that 53% of its revenues come from trading activities.

In its half year of 2016 numbers, after tax profit fell by a massive 54% to Ksh 82 Million compared to Ksh 178.6 Million reported in a similar period in 2015. The exchange cited challenges witnessed in the global markets with reduced equity trading volumes from foreigners and other market participants.

READ; NSE Kenya Half Year Net Profit Plunges By 54%

In the full year ended December 2015, Profit After Tax fell by 4.5% to Ksh 305.6 Million versus Ksh 320 Million posted a year earlier.

“The Board of Directors of the Company hereby informs its shareholders and the general public that based on the projections for the remainder of the year, the Company is expected to record a decline of more than 25% in the net profit attributable to the shareholders of the Company for the financial year ended 31 December 2016, as compared to that for the same period ending 31 December 2015. This has taken cognizance of the decline in equity market prices, with trading revenues accounting for 53% of the Company’s revenues stream.” Said NSE in a statement.

Market Outlook

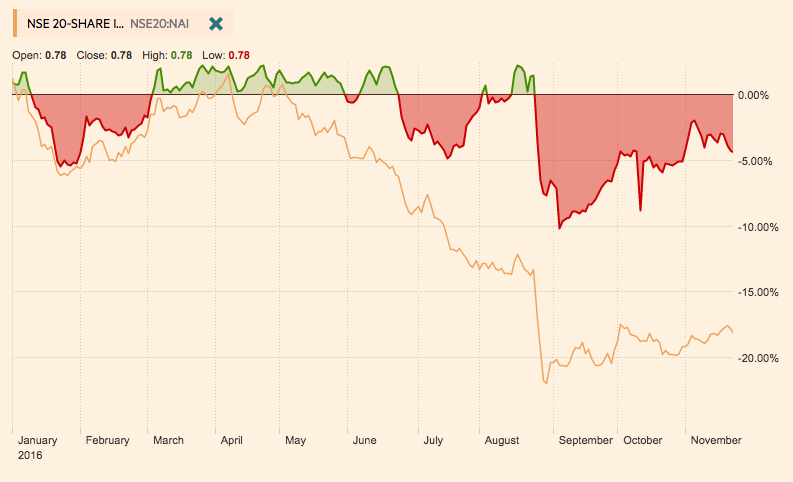

Despite improvement in volumes, the NSE All Share Index is down by nearly 7% (Year To Date) to 138.01 as of early trading on Wednesday. On the other hand, the benchmark NSE 20 index is down by 16% since the beginning of the year as shown below.

According to Sterling Capital, foreign investors have continues to sustain the market though focusing on five companies in three sectors; telecommunication, banking and manufacturing as local investors stay away from the bear market. Year to date, only four counters have seen a positive price growth.

NSE Ltd Counter

The NSE Ltd Counter on Wednesday’s trading dropped by 3.64% to an all-time low of Sh 14.55. The counter has lost 40.61% since the year began.