MTN Group has posted a half-year 2024 loss, weighed down by devaluation of the Nigerian naira and operational challenges in Sudan.

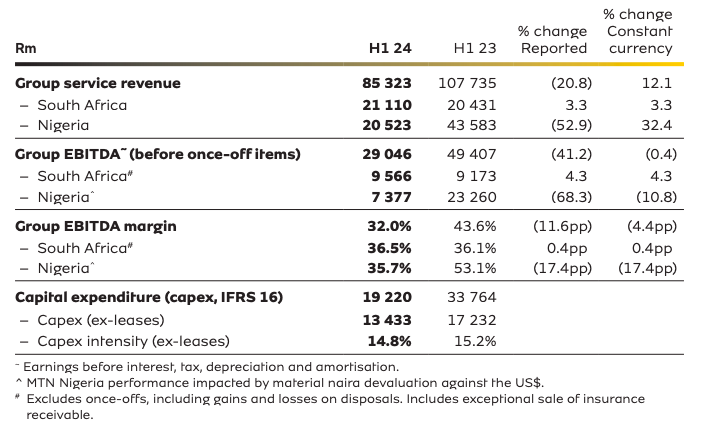

- •The telecommunications group’s service revenue fell to 85.32 billion South African rand ($4.78 billion) from 107.735 billion rand for the same period a year earlier.

- •Earnings before interest, taxes, depreciation, amortization before once-off items declined to 29.05 billion South African rand from 49.41 billion rand.

- •The Ebitda margin fell to 32% from 43.6% due to cost pressure from challenging conditions.

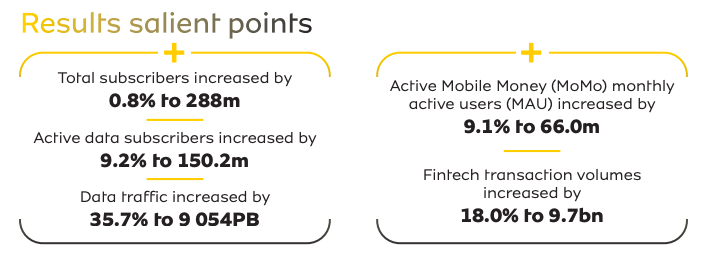

At the end of the period, MTN’s total subscriber numbers were up 0.8% to 288 million.

The operator with 288 million customers across 18 markets in Africa reported a headline loss of 256 cents per share in the six-month period ended June 30, compared with restated headline earnings from a year earlier at 260 cents a share.

“Although the underlying commercial momentum and strategy execution were solid in the period, macro headwinds impacted operating results,” Group CEO Ralph Mupita said in a statement.

“The further devaluation in the naira against the U.S. dollar, the translation impact on reporting currency (rands) of the naira and the ongoing conflict in Sudan had the most significant impact on reported results.”

MTN’s service revenue from South Africa surpassed that of MTN Nigeria its biggest market by revenue, growing marginally by 3.3% to 21.1 billion rand, while Nigeria tumbled by 52.9% to 20.5 billion rand.

MTN said the board anticipates paying a minimum ordinary final dividend of 330 cents per share for 2024 financial year.

See Also: