In December 2015, Vodafone launched its mobile money scheme M-Pesa in Ghana under the brand ‘Vodafone Cash’, since its launch the service has attracted about 280,ooo users as of September, according to Vodafone Ghana.

Ghana was the 11th country to receive the M-Pesa service after Kenya, Tanzania, South Africa(Failed), Democratic Republic of Congo, India, Mozambique, Egypt, Lesotho, Albania and Romania. Vodafone had an aim to bring a cash transfer service to the unbanked 15 Million people in the country.

According to statistics from Vodafone Group, over 5 billion transactions were carried out in the six months to September 2016 with more than 27 million active customers globally.

In India, there are now over one million active users of Mpesa where Vodafone was also granted approval by the Reserve Bank of India to establish a payments bank.

The mobile payment service has been successful in other developing countries such as Kenya, Tanzania and India, where many customers use the scheme as a secure alternative to cash.

Michael Joseph, who is the former CEO of Safaricom and is currently Vodafone’s director of mobile money, says customers valued the freedom, peace of mind, security and convenience offered by the mobile payments service.

Credit Suisse “East Africa now accounts for 80% of the global mobile- money transactions”

In Ghana, Vodafone also uses the service to pay interest to customers as a result of guidelines issued to mobile money providers by the Bank of Ghana. So far, Vodafone has paid approximately $116,000 as interest to its customers across Ghana by the end of September 2016.

According to a US-based Consultative Group to Assist the Poor (CGAP), a global partnership of organisations that seek to advance financial inclusion, Ghana’s move to allow mobile phone customers to earn interest on their mobile money wallets follows Tanzania’s move and other nations that have embraced mobile money could follow.

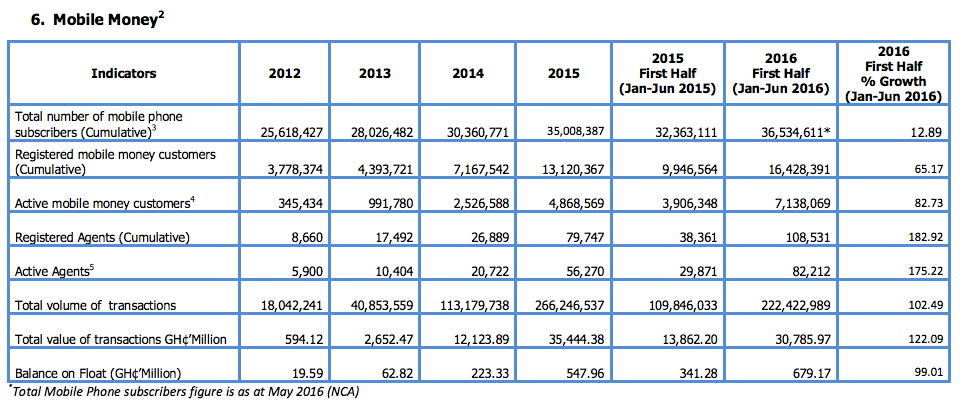

Ghana Mobile Payment stats – (Central Bank of Ghana)