First Published on March 2nd, 2023 by Quinn Mohammed for SureDividend

Real estate and dividend stocks are two of the most popular vehicles for creating passive retirement income.

The downside to owning rental properties is that it is not really passive. Any landlord who has had to call a plumber or an electrician during the middle of the night can attest to this.

For investors looking to capture the returns of the real estate sector while benefiting from the hands-off approach of dividend stocks, real estate investment trusts – or REITs – are a very attractive investment vehicle.

EPR Properties (EPR) is one of the most well-known REITs. EPR reinstated its monthly dividend in the second half of 2021, after suspending it for over a year due to the coronavirus pandemic.

That means EPR rejoined the list of monthly dividend stocks. We’ve compiled a list of 50 monthly dividend stocks, along with important financial metrics like dividend yields and payout ratios, which you can view by clicking on the link below:

This article will analyze the investment prospects of EPR Properties in detail.

Business Overview

EPR Properties is a triple net lease real estate investment trust that focuses on entertainment, recreation, and education properties.

Triple net lease means that the tenant is responsible for paying the three main costs associated with real estate: taxes, insurance, and maintenance. Operating as a triple net lease REIT reduces the operating expenses of EPR Properties.

EPR has identified entertainment, recreation, and education, respectively, as its three large buckets in which it invests. It has then identified attractive sub-segments of those larger segments including movie theaters, ski resorts, and charter schools, as examples.

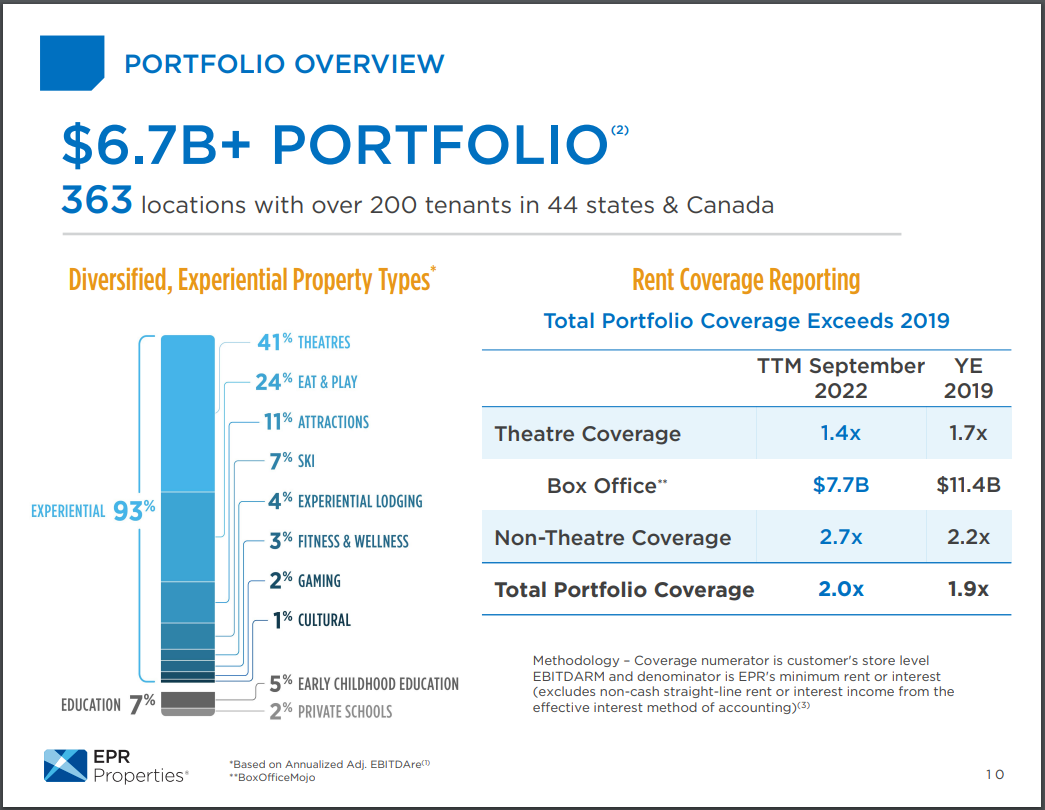

The portfolio includes more than $6.7 billion in investments across 363 locations in 44 states and Canada, including over 200 tenants.

Source: Investor Presentation

EPR is focused in a variety of different metropolitan areas throughout the US and parts of Canada, so it is highly diversified with not only its tenants, but geographically as well.

EPR reported Q4 and FY 2022 results on February 22nd, 2023. The trust reported fourth quarter FFO per share of $1.27, which was $0.09 ahead of expectations. Revenue was $179 million, which was 15% higher year-over-year.

EPR stated that it cannot provide guidance for this year because one of its biggest tenants, Regal, is in bankruptcy procedures. EPR did mention that it had received all planned rent and deferral payments from Regal so far, but also noted the inherent risk for EPR.

Growth Prospects

Prior to 2020, EPR had maintained a track record of steady growth. From 2010 to 2019, EPR compounded its adjusted FFO-per-share by almost 8% per year. The coronavirus pandemic upended virtually all REITs and caused EPR’s FFO-per-share to decline from $5.44 in 2019 to $1.43 in 2020.

Although the company faced major challenges during the pandemic, which showed in the company’s financial results, EPR continues to recover strongly. EPR still has many opportunities to drive its growth. The company’s focus on experiential properties protects the company against e-commerce threats. EPR believes that consumers will still want these experiences and thus its properties will generate strong traffic.

The company believes there’s a strong future growth potential in location-based entertainment. And still, that there are several underpenetrated experiential segments in experiential real estate. The company believes there is a $100 billion+ addressable market opportunity there.

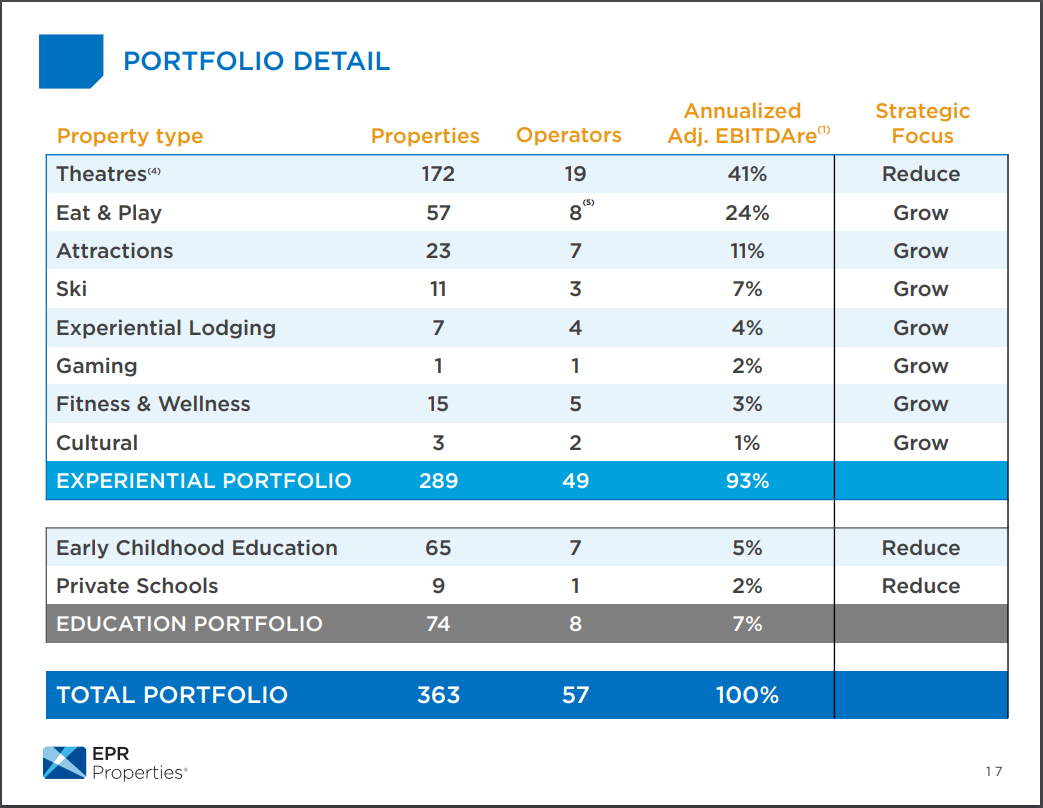

EPR has decided to reduce its education portfolio, while growing most of its property types in its experiential portfolio. EPR will focus on growing all property types in its experiential portfolio, except for theatres. The company wants to reduce its dependence on theatres, which account for 41% of annualized adjusted EBITDAre across 172 properties with 19 operators.

Source: Investor Presentation

Overall, we expect 2% annual FFO-per-share growth over the next five years. EPR’s growth will be fueled by its competitive advantages, which is primarily its portfolio of specialized properties. EPR has methodically identified the most profitable properties through years of experience and focuses its investments in these areas.

Competitive Advantage & Recession Performance

The company’s focus on experiential properties gives it a competitive advantage by protecting it against e-commerce threats. EPR believes that its properties will still generate strong traffic, as consumers will still want those experiences.

The company certainly isn’t immune to recessions, but we see EPR as one of the better-run REITs in our coverage universe due to its business model and advantages. A return to growth should allow the company to slowly raise the dividend over time.

Dividend Analysis

EPR’s dividend history was impressive heading into 2020. The company had increased its annual per-share dividend by roughly 6% per year from 2010-2019. Of course, the pandemic forced the company to suspend its dividend for most of 2020.

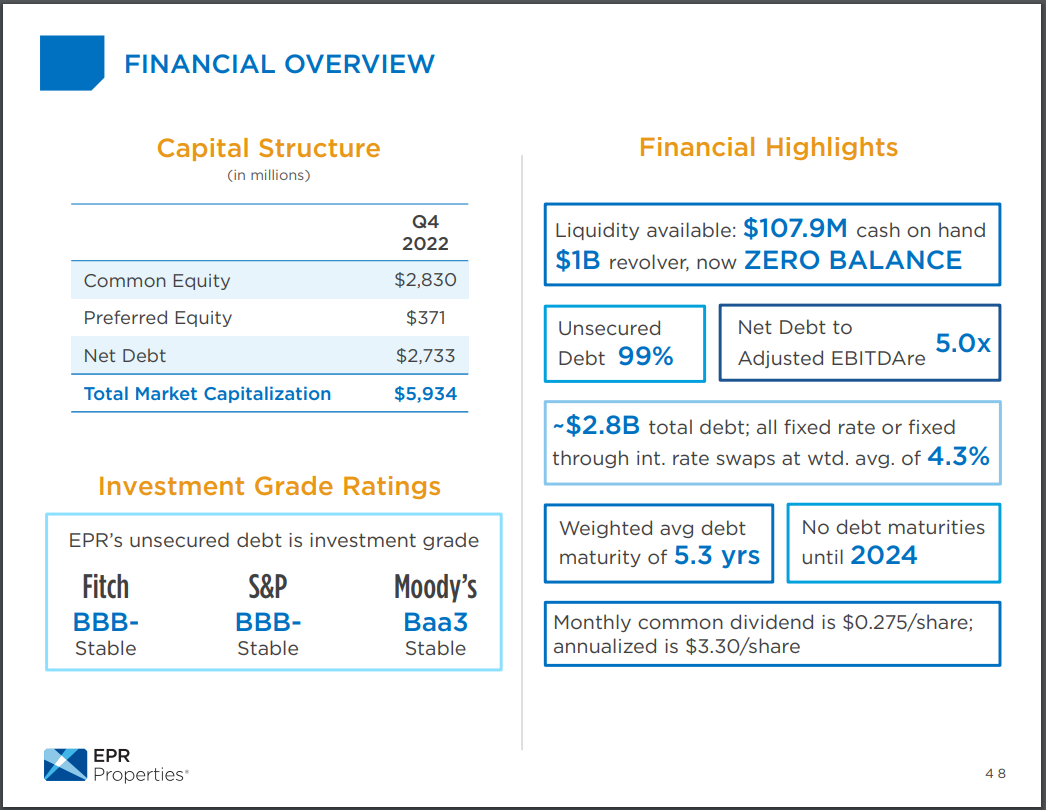

Fortunately, EPR management expects its recovery to continue. This expectation gave management the confidence to increase the monthly dividend 10% to a rate of $0.275 per share in March 2022. This equals an annual dividend of $3.30.

On an annualized basis, the $3.30 per share dividend is still below the pre-COVID payout of $4.59 per share. Still, at a level of $3.30 per share, EPR stock yields 8.1%. Therefore, EPR stock is still attractive for income investors as a high dividend stock.

EPR has a reasonably leveraged capital structure that affords it some flexibility. It has worked to repair its balance sheet in the wake of the pandemic, to further improve its dividend safety and growth potential.

Source: Investor Presentation

EPR’s debt totals about $2.8 billion, with a weighted average debt maturity of 5.3 years and a weighted average interest rate of 4.3%. It has a $1 billion credit revolver that now has a zero balance, giving EPR plenty of liquidity.

All of this supports EPR’s growth plans and by extension, its ability to not only pay its dividend, but also to hopefully raise it over time.

EPR’s dividend appears to be secure, and it is likely the trust will continue to raise it at meaningful rates over time if its FFO continues to recover back to pre-COVID levels. This makes the stock attractive for those seeking current income and dividend growth.

Final Thoughts

EPR Properties looks to be performing very well following the pandemic and continues to recover strongly into 2023.

The REIT has a dominant position in the ownership of movie theaters, recreational facilities, and educational properties.

These are relatively small sub-segments of the real estate industry and give EPR the benefit of being ‘a big fish in a small pond.’

EPR Properties stock has an 8.1% dividend yield and has resumed its monthly dividend payments. As a result, it is once again an appealing stock for income investors looking for high yields and monthly payouts.

Of course, this is dependent on the continued recovery in EPR’s portfolio metrics and financial results. Based on all these factors, EPR Properties appears to be a good choice for income investors, or investors that are looking for some exposure to high-yield REITs.

This article was first published by Quinn Mohammed for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

2 High-Yield Stocks Poised to Outperform the Market

All 110 Baker Brothers Portfolio Stocks | Current 2023 Holdings