The world’s largest hotel chain, Marriott International has the largest number of pipeline hotels and rooms, according to a recent survey conducted by Lagos-based W Hospitality Group, in association with the Africa Hospitality Investment Forum (AHIF).

The African Hotel Chain Development Pipeline 2024 report shows:

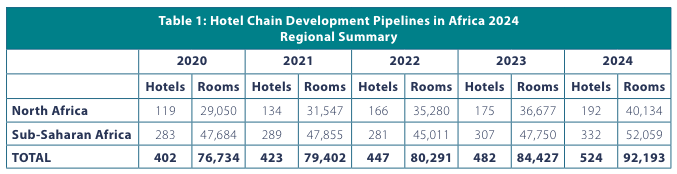

- •As of early 2024 the chains’ development pipelines total a record 524 hotels and resorts with 92,193 rooms, a 9.2 per cent increase from 2023.

- •The hotel chains signed over 100 new deals last year

- •A massive increase in the number of resort projects in the pipeline, and therefore the number of rooms, increasing from 24 per cent of the total last year to 30 per cent in 2024.

“We tracked 29 hotels and resorts with about 3,500 rooms that opened in 2023. That’s 6 per cent of that year’s pipeline, and 21 per cent of the hotels that were scheduled to open last year. The chains project that they will open 139 hotels in 2024, equivalent to almost 27 per cent of the pipeline,” reads the report in part.

The pipeline in sub-Saharan Africa (49 countries, including the Indian Ocean islands) is up 9 per cent on 2023 (measured by rooms), whilst in North Africa (Morocco, Algeria, Tunisia, Libya and Egypt), the total is up by 9.4 per cent.

The hotel chains have deals signed in 41 countries in Africa, with West Africa leading with 14 countries (out of a total of 18), followed by the Southern & Indian Ocean sub-region where there are 11 countries with pipeline development activity. Together, they account for 69 per cent of the total hotels in the survey, and 74 per cent of the rooms.

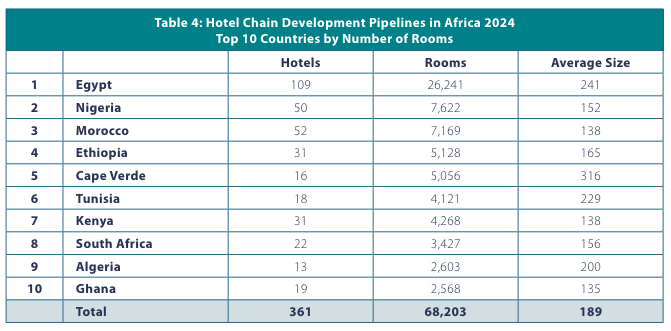

Egypt continue to dominate the African pipeline, with almost 26,250 rooms in 109 hotels this time around, well over three times the number of rooms in second placed Nigeria and third-placed Morocco. With continued signing activity (19 hotels with about 5,200 rooms in 2023), Egypt now accounts for fully 28 per cent of the total pipeline.

Big 5 Players in Hotel Chains

Of the 10 largest hotels in the pipeline, five are in Egypt, four are in Cape Verde, and one is in Tanzania (Zanzibar). The average size of the top 10 hotels is 770 rooms (up from 723 rooms in 2023), compared to an average of 176 rooms for the total pipeline.

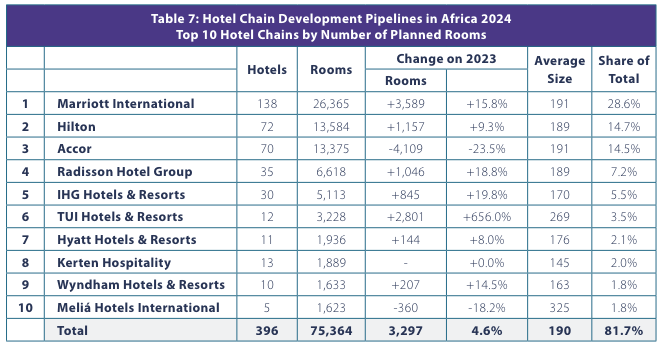

The Big 5 global chains – Marriott International, Hilton, Accor, Radisson Hotel Group and IHG Hotels & Resorts – account for 66% of hotels and 71% of rooms in the entire African pipeline.

Marriott International, the world’s largest hotel chain, remains in the lead for the third consecutive year, with almost twice the number of pipeline hotels and rooms as second placed Hilton, and it has the largest number of rooms added in the year.

Accor opened almost 300 rooms worldwide last year, Hilton’s number was almost 400, and Marriott International achieved almost 560 opening. But of those, only two of Hilton’s total were in Africa, with four for Marriott International and six for Accor. Between the three of them, they opened 73 hotels and resorts (6 per cent of their 2023 achievements) in Africa in five years, split pretty equally between North Africa and sub-Saharan Africa.

In total, the contributors to the survey have 134 hotels and resorts scheduled to open in Africa this year (the number last year was almost the same, at 133), with the top 10 chains accounting for about 72 per cent of that total.

See Also: