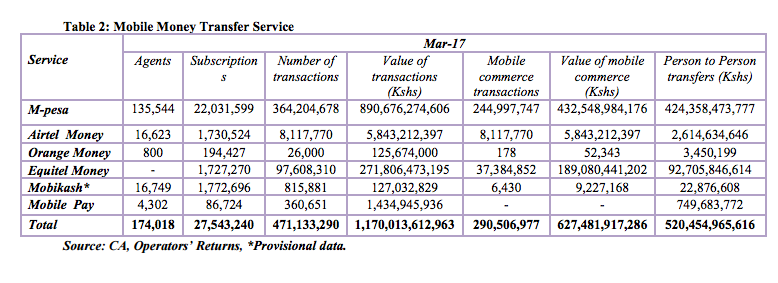

In the first three months of the year, the number of mobile money subscriptions stood at 27.5 million whereas the number of active mobile money transfer agents was at 174,018 according to the CAK sector statistics report. The volume of transactions on these channels was recorded at 471.1 million with 1.1 trillion Kenya Shillings moved over the period.

Overall, M-Pesa accounted for 76% (890 Billion) of the Sh 1.1 trillion while Equitel was second at 23% or Sh 271.8 Billion.

In addition, payments for goods and services through the mobile money transfer platforms hit Sh627.4 billion in the first three months of the year, demonstrating a higher appetite for the service as an alternative to hard cash and card payment.

Safaricom’s M-Pesa accounted for Sh 432.5 Billion of the Sh 627 billion transacted in the form of form of payment for goods and services. Equitel was second with Sh 189 Billion having been transacted on the platform in the form of mobile commerce payments.

There was a total of 290.5 million transactions on the payment of goods and services.

Over the period under review, the person-to-person money transfers amounted to Sh 520.4 billion.

According to the report, the number of active mobile money transfer agents was registered at 174,018 up from 161,583 in the previous quarter. Safaricom had the highest number accounting for 78% (135,544) of the total number of agents.

Of the 27.5 million mobile money users, 80% (22M) of them were subscribed to Safaricom’s M-Pesa platform, Mobikash 6.4% (1.8M) Airtel Money 6.3% (1.7M), Equitel 6.2% (1.73M) while Orange Money had 0.7% (194,000) of the market share.

According to the report, the growth in online shopping could fuel the volume of parcels sent in the near future and the relative ease of shopping online will open up opportunities to buy and sell from people and companies in other countries.