Safaricom’s M-PESA now commands 99.6 percent of the total value of all mobile money deposits. This is from the latest data by the Communications Authority for the period between October and December 2019.

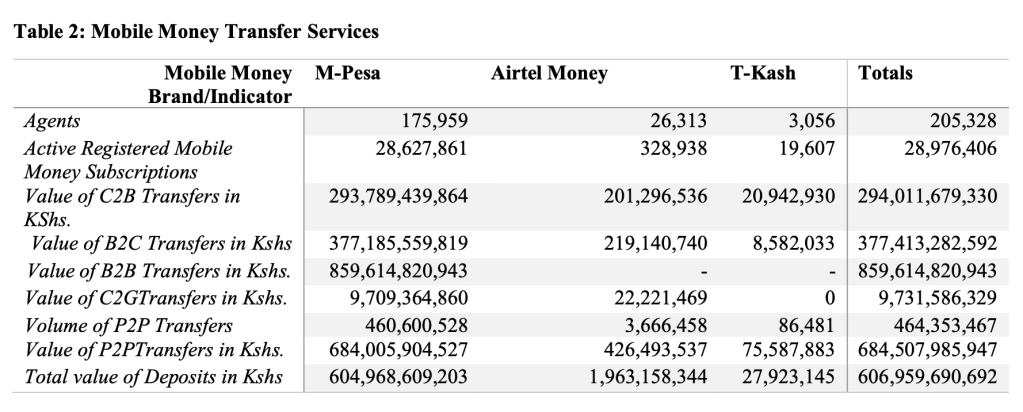

In the three months to December 2019, M-PESA deposits amounted to KSh 604.9 billion, compared to KSh 1.9 billion deposits in Airtel Money and only KSh 27.9 million in T-Kash.

It is worth noting that the authority recently removed Equitel, by Equity Bank, from the category of mobile money services. This now leaves Safaricom’s MPESA, Airtel Money and Telkom’s T-KASH as the only mobile money service providers in the country.

In terms of active mobile money subscriptions, Safaricom leads with 28.6 million (98.8 per cent) followed by Airtel Money with 328, 938 (0.5 percent) and T-Kash 19,607 subscriptions are good for 0.07 percent market share.

Recommended Read: Equitel Dropped from Mobile Money Category

Total number of active mobile money subscriptions stood at 28.9 million during the period, while the number of active mobile money agents stood at 205,328.

Furthermore, the report reveals that Person to Person transfers accounted for KSh 606 billion, while business to business transactions (both B2B and C2B) accounted for KSh 1.15 trillion for the quarter.

Mobile Subscriptions keep growing

The number of active mobile subscriptions grew by 2.4% to reach 54.5 million as at 31st December 2019 up from 53.2 million subscriptions in September 2019.

Safaricom, however, recorded a decline in market share by 0.1 percent to stand at 64.8 percent. Airtel, on the other hand, gained 1.3 percent to reach a market share of 25.9 percent. Both Telkom Kenya and Equitel lost 0.5 percent to record market shares of 6.2 and 3.1 percent respectively.

Related:

Mpesa Tripple Pay of Accessibility, Simplicity and Convenience